In the vast machinery of modern capitalism, where fortunes rise and fall like tides, Realty Income (O) stands as a peculiar anomaly-a beacon for those who toil in the shadow of uncertainty. It has branded itself “The Monthly Dividend Company,” an audacious claim that speaks both to its ambition and its promise to investors. This is no mere slogan; it is a lifeline thrown to those who depend on steady income streams, whether they are retired workers or weary savers seeking solace from the chaos of markets. But let us not mistake this for charity-it is strategy, cold and calculated, designed to endure through storms both economic and existential.

A Yield That Speaks Louder Than Words

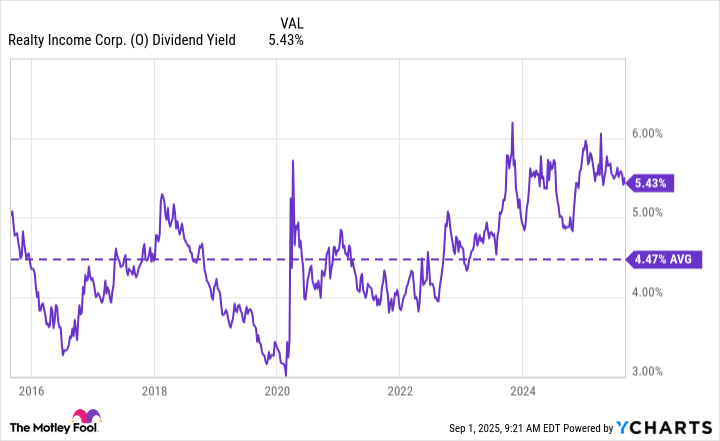

The first thing one notices about Realty Income is its dividend yield, currently hovering around 5.5%. To the untrained eye, this number might seem abstract, but to the laborer counting pennies at month’s end, it is sustenance. Compare this to the meager 1.2% offered by the S&P 500 index (^GSPC), which feels more like crumbs swept off the table of prosperity. Even within the realm of real estate investment trusts (REITs), where yields average 3.9%, Realty Income towers above its peers. And when viewed against its own historical average of 4.5% over the past decade, the current yield gleams like a rare gem amid rubble.

For the working class investor-who views stocks not as speculative toys but as tools for survival-this is no trivial matter. A high yield is not just a number; it is a promise kept, a light burning against the encroaching darkness of inflation and stagnation.

A Legacy of Reliability

But what good is a high yield if it collapses under pressure? Realty Income has proven itself resilient, weathering decades of turmoil with the stoic determination of a factory worker clocking endless shifts. For thirty years, it has raised its annual dividend, a feat matched by few. Within this broader streak lies another: 111 consecutive quarterly hikes. Imagine that-a company increasing its payout every three months, without fail, while empires crumble and industries vanish overnight.

True, the growth rate is modest, averaging 4.2% annually over three decades. Yet even this modesty carries dignity, outpacing inflation and ensuring that the buying power of its dividends does not erode over time. In a world where promises are broken as easily as glass, Realty Income’s consistency offers something rare: trust.

Expanding Horizons Amidst Uncertainty

Size, however, brings challenges. With over 15,600 properties in its portfolio, Realty Income dwarfs its competitors in the net lease REIT space. Such scale demands innovation, lest stagnation set in. Here, the company reveals its pragmatic soul. It ventures into new territories-not recklessly, but with measured steps. Europe, for instance, has become fertile ground for expansion, where the net lease model remains nascent. Meanwhile, it diversifies into emerging sectors like casinos and data centers, ventures once foreign to its traditional domain.

Yet perhaps most intriguing is its foray into debt investments and asset management services aimed at institutional clients. These moves are not grand gestures meant to dazzle shareholders; they are practical solutions born of necessity. Like a farmer planting multiple crops to hedge against famine, Realty Income spreads its efforts wide, ensuring that its foundation remains strong enough to support its ever-growing dividend obligations.

The Forgotten Detail: Monthly Payments

And then there is the final touch, often overlooked yet profoundly significant-the monthly dividend payments. Most corporations distribute their dividends quarterly, forcing retirees to stretch their budgets thin across uneven intervals. Realty Income, however, understands the rhythm of life. Its monthly checks mimic the regularity of a paycheck, offering a semblance of normalcy in an otherwise unpredictable existence. For those living paycheck to paycheck in retirement, this small act of consideration can mean everything.

A Beacon in Turbulent Times

So, why should one consider Realty Income today? Because it represents stability in a world teetering on the edge of disorder. Its generous yield, unbroken record of reliability, and proactive approach to growth make it a worthy ally for anyone navigating the treacherous waters of modern finance. Add to this the convenience of monthly payments, and you have a company that respects not only the numbers but also the lives behind them.

For the weary worker, the cautious saver, or the retiree clinging to dignity, Realty Income is more than a stock-it is a testament to endurance, a reminder that even in the harshest systems, resilience can carve paths toward security 🌟.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-06 10:15