As a seasoned analyst with over two decades of market experience under my belt, I can confidently say that Raydium’s meteoric rise this year has been nothing short of spectacular. The platform’s dominance in the Solana ecosystem is reminiscent of the dot-com boom, where one company could skyrocket while the rest struggled to keep up.

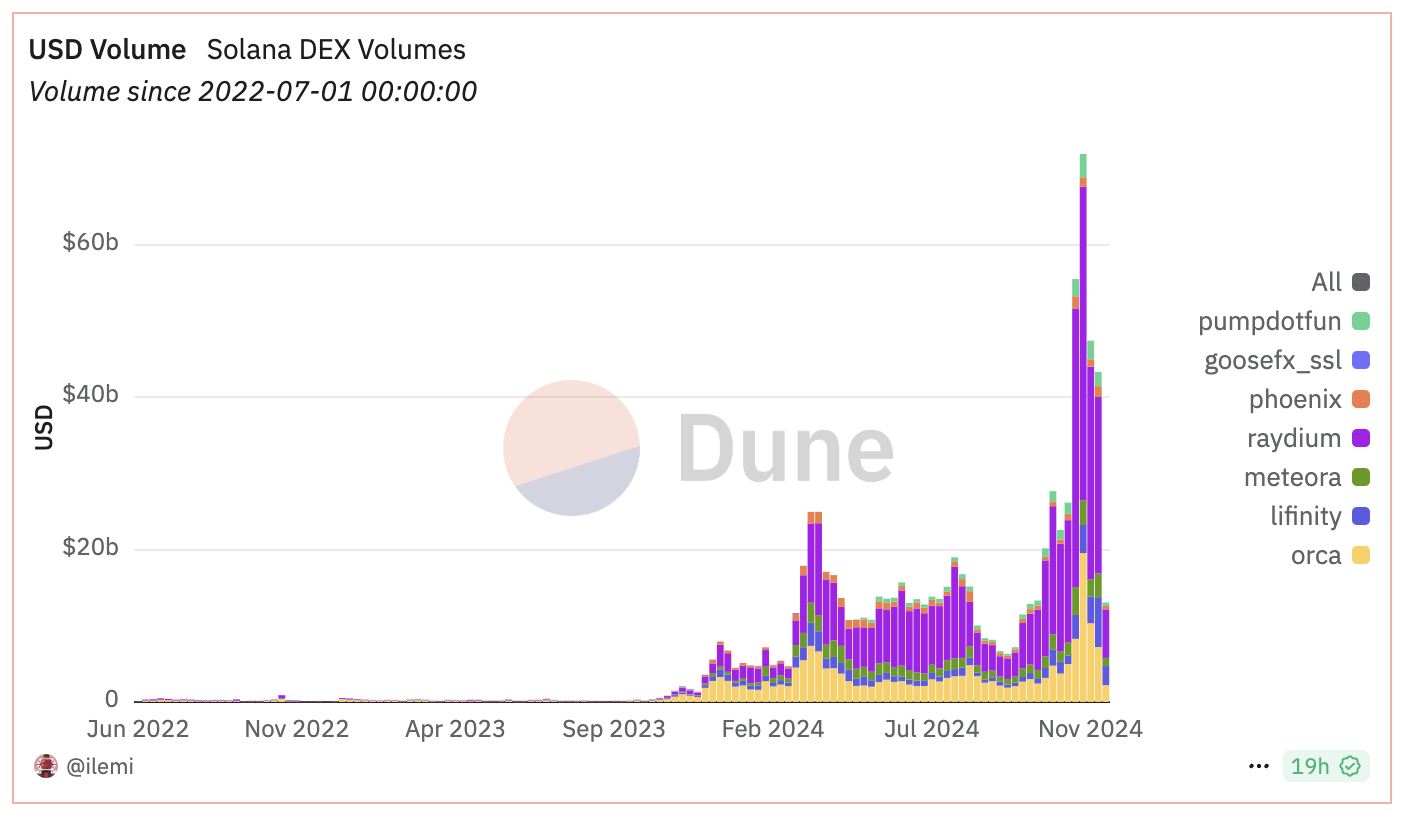

2024 has been a remarkable year for Raydium’s native token, RAY, as it experienced a significant increase of 665.45%. This impressive surge has solidified its position among the top-performing cryptocurrencies. The platform’s recent success is evident in its overtaking of Uniswap in terms of monthly DEX volumes. This growth can be attributed to a substantial $23 billion increase, which occurred within just one week.

In the Solana blockchain environment, Raydium maintains its advantage as a leading decentralized exchange, profiting from its market dominance and increasing popularity.

Raydium Is Now One of the Most Profitable Businesses In Crypto

Raydium has firmly established itself as the dominant Decentralized Exchange (DEX) within the Solana network. In a span of just one week, from December 2 to December 9, it processed a remarkable trading volume of approximately $23 billion. This figure outstrips the collective volumes handled by its nearest competitors, including Orca, Pumpfun, Meteora, and Lifinity.

Approximately half of all decentralized exchange (DEX) trading volumes on the Solana network are currently handled by Raydium, a significant portion that stems from the popularity of meme coins.

For the last month, Raydium has accumulated a staggering $226 million in fees, outpacing well-known platforms such as Jito, Uniswap, Circle, and even Solana. Remarkably, it trails only Ethereum and Tether in this regard.

As Solana’s ecosystem expands substantially, Raydium, being the leading application within it, enjoys a favorable wind of growth that may boost its value.

RAY RSI Is Reaching Overbought Levels

In just under two days, the Raydium Relative Strength Index (RSI) saw a swift escalation, surging from 26 to 70. This substantial spike suggests robust purchasing activity fueled by the recent price upswing.

At these current RSI levels, it suggests that RAY is transitioning from an oversold state towards being overbought, which typically reflects increased investor attention and desire for the stock.

The Relative Strength Index (RSI) is a tool that assesses the pace and intensity of price fluctuations, ranging between 0 and 100. Readings below 30 may hint at an oversold state, frequently followed by a recovery, while readings above 70 might indicate overbought conditions, potentially suggesting an impending correction.

At present, Ray’s Relative Strength Index (RSI) stands at 69, which is nearly reaching the overbought zone. Once the RSI exceeds 70, it might suggest more upward momentum to come before a possible correction or downturn happens.

Raydium Price Prediction: Will It Rise Back to $6 In December?

As a crypto investor, I’ve been closely watching the Raydium Exponential Moving Averages (EMAs). Intriguingly, these technical indicators have shown a change in momentum just two days ago. The shortest-term EMA dipped below the longest-term EMA, forming what’s known as a death cross. This bearish signal suggests that the short-term trend might be heading downward compared to the long-term trend. It’s important for me to keep an eye on this development and adjust my investment strategy accordingly.

Conversely, the price of Raydium started to rebound quickly, and the short-term moving average (EMA) now sits above the long-term one, suggesting a bullish reversal. This shift has been accompanied by a 20% price surge within the past 24 hours, underscoring the robustness of the current market trend.

If the bullish trend continues strongly, the price of RAY might reach its nearest resistance levels at around $5.9 and possibly $6.25. Overcoming these barriers could trigger a further increase towards $6.46, suggesting a potential 14% growth. This surge could be particularly significant if meme coins manage to maintain their popularity and emerge as a dominant theme in the crypto market.

If the present strength weakens, there’s a possibility that RAY may need to re-evaluate its support at $5.19. If it can’t sustain itself at this level, it might lead to a decrease in price towards $4.67.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-12 03:08