Ray Dalio, the founder, chief investment officer mentor, and member of the Bridgewater Associates board, is also identified by these roles. Dalio is renowned for his principle-based investing strategy that prioritizes examining historical economic trends to minimize risks. His expertise in data analysis and profound grasp of macroeconomic influences have significantly contributed to Bridgewater’s enduring prosperity. Additionally, Dalio penned the book “Principles: Life and Work,” where he reveals his exclusive management ideologies and insights on constructing a thriving organization.

In his introduction, Dalio explains that good money serves two essential functions: it acts as an effective medium for trading goods and services, and it preserves wealth over time. He highlights the dollar, euro, yen, and Chinese renminbi as the most widely used currencies globally. Importantly, he points out that these currencies are debt-backed, meaning that when you possess them, you’re essentially holding promises to receive money in the future.

Yet, Dalio warns that if there’s a high risk of debts not getting repaid or getting repaid with worthless currency, both the debt and the money lose appeal. He explains that when a government is burdened with excessive debt, its central bank might resort to printing more money, resulting in inflation and a devalued currency.

Instead of relying on debt for monetary value as with debt-backed currencies, Dalio advocates for gold as an alternative form of non-debt money. He views it similar to cash, but unlike cash and bonds, gold is not subjected to the risks of default or inflation that can devalue them. Dalio emphasizes that gold holds value due to the risks of debt defaults and inflation. Moreover, central banks hold gold as the third most common reserve currency, more than the yen and renminbi.

Dalio recognizes the classification of cryptocurrencies as a type of non-debt money. Some individuals may draw comparisons between cryptocurrencies and commodities like gems and art based on their non-debt status, transportability, and widespread acceptance as valuable assets for wealth preservation.

In good economic conditions as described by Dalio, it’s wise to invest in debt assets and other financial instruments. But when governments encounter financial difficulties, leading to excessive borrowing and money printing, causing inflation, Dalio recommends owning gold. This is the primary reason why gold acts as a diversifier in investment portfolios, including Dalio’s own.

In a footnote, Dalio makes it clear that he’s expressing his perspectives on investments without offering personalized advice. He emphasizes that he doesn’t endorse purchasing gold based on his statements. Instead, through his communications, Dalio aims to elucidate market mechanisms, highlight crucial insights, and propose strategic investment approaches.

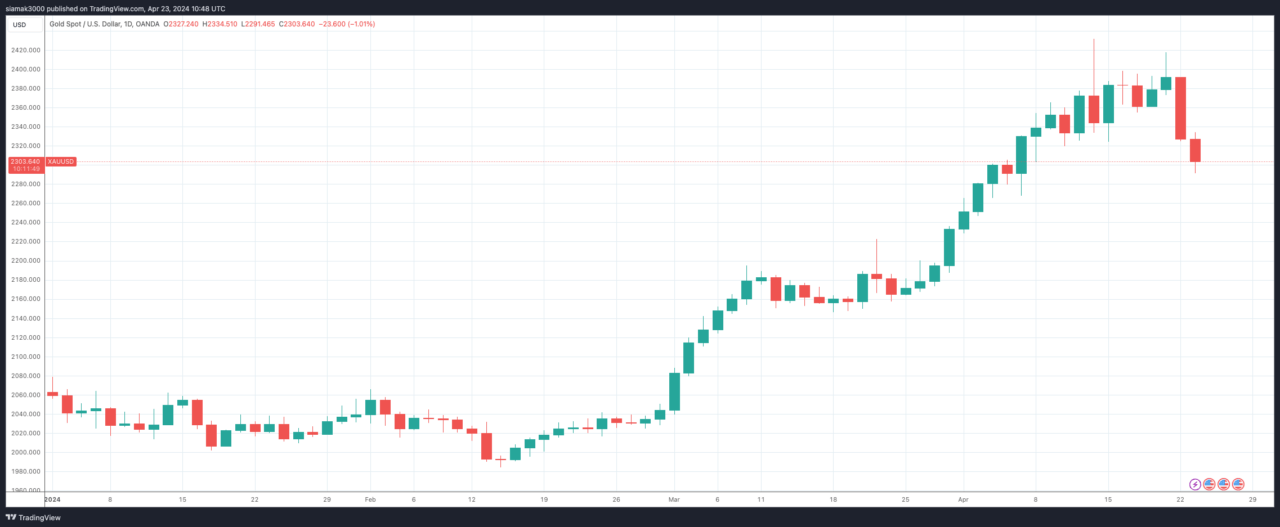

As I pen this down (10:45 a.m. UTC on April 23), gold is being sold for $2,303.21 per ounce, representing a 1.3% decrease in value compared to today’s opening prices.

Read More

2024-04-23 13:57