People talk about rare earth minerals like they’re something new. They aren’t. They’re just… inconveniently distributed. And now, suddenly, important. So it goes.

If you asked the average American to name a company digging up these little bits of the planet, MP Materials (MP +1.77%) would probably come to mind. They’ve got the publicity. A $400 million deal with the Department of Defense tends to do that for you. Perfectly reasonable. But there’s another one, USA Rare Earth (USAR +9.07%), and they’re aiming for a slightly different niche. A niche, you understand, is just a comfortable place to be ignored.

Both companies, naturally, want to build a domestic supply. The idea is to make magnets. Good magnets. The kind that make electric motors hum and smartphones think. A worthy goal, really. Though history suggests that “domestic” is often a temporary condition. Everything flows, doesn’t it?

MP Materials mostly deals in the lighter stuff. USA Rare Earth, however, has a deposit in Texas – the Round Top deposit – that’s richer in the heavier elements. Dysprosium, terbium. These aren’t household names, but they’re crucial for high-performance magnets. The kind that, let’s say, might be useful if you were building something that needed a strong magnetic field. Or, you know, just wanted a really good refrigerator magnet. It’s all relative.

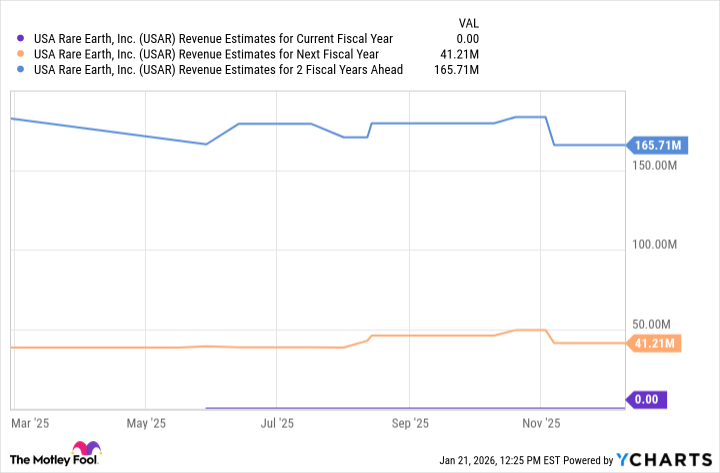

Here’s where things get interesting. USA Rare Earth isn’t exactly producing anything yet. It’s a pre-revenue company. A dream, mostly, wrapped in geological surveys and engineering plans. They predict a magnet factory by 2026. Mining at Round Top? 2028, if everything goes according to plan. And plans, as anyone who’s lived a little while knows, rarely do.

The stock market, of course, doesn’t wait for mines to be dug or magnets to be wound. The market cap is already around $2.5 billion. For a company with no revenue. It’s a bit like betting on a horse that hasn’t been born yet. Still, if they can actually pull this off – build a mine-to-magnet supply chain – that valuation might not seem so outlandish. It’s a gamble, certainly. Most things are.

A thousand dollars invested today? Risky. Very risky. But then, so is relying on foreign suppliers for critical materials. The U.S. needs these magnets. They’re in everything from electric vehicles to wind turbines. So, USA Rare Earth is well-positioned, if it can scale. A big “if,” naturally. But then, what isn’t?

The story of USA Rare Earth is, at its core, a very old story. A story about hope, and ambition, and the relentless pursuit of something valuable. A story about turning dirt into dreams. So it goes. And whether those dreams will actually materialize? Well, that remains to be seen. It usually does.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Top 15 Movie Cougars

2026-01-25 17:52