It is a truth universally acknowledged, that a company in possession of a steadily increasing dividend, must be the object of some interest to those engaged in the more rational pursuits of investment. Such is the case with Quebecor, a Canadian enterprise engaged in telecommunications and media, which has, since the year 2016, demonstrated a most commendable consistency in augmenting its distributions to shareholders. From a modest beginning of 0.0175 Canadian dollars per share, the quarterly payout has ascended to the present sum of CA$0.35. A fortunate investor, possessing the foresight to commit CA$1,000 to this company in 2016, would now find themselves in receipt of an annual yield of no less than 17% upon the original sum – a circumstance which, while gratifying, is, alas, past.

Whether such prosperity may continue is, of course, the question which now engages our attention. There are, however, reasons to believe that this Montreal-based company, with a current valuation of CA$11.8 billion, may yet maintain a similar pace of growth over the next decade. Indeed, should my estimations prove correct, an investor acquiring shares at the present moment might anticipate a yield of approximately 55.7% upon the original cost by the year 2036. Such a prospect, while perhaps appearing fantastical to some, is not entirely devoid of plausibility.

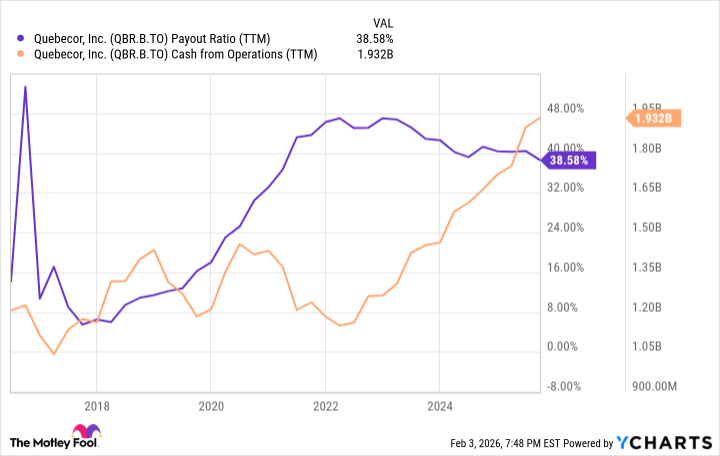

One must always, in assessing the future prospects of a company, consider the matter of its payout ratio – that is, the proportion of net income devoted to the payment of dividends. A lower ratio affords management greater latitude in continuing, or even accelerating, such distributions. A company already expending the entirety of its earnings upon dividends, possesses little room for maneuver, whilst one which could readily double its payout without undue strain, is in a far more enviable position.

In the case of Quebecor, the payout ratio has, commendably, diminished over the past four years, coinciding with a notable increase in cash flow from operating activities, which, in 2022, surpassed even the most optimistic predictions. This is a circumstance which ought to reassure even the most cautious of investors, for it indicates that the company is generating a surplus of cash from its core business operations – a most desirable quality.

The consistent generation of cash, unencumbered by extraneous factors such as stock offerings or accounting adjustments, is a testament to the company’s underlying strength. It suggests a business capable of not only meeting its current obligations but also investing in future growth. Since 2016, Quebecor has, on average, increased its dividend by 40% per annum. There has been, it is true, a slight deceleration since 2020, with an overall increase of 75% – a circumstance which, however, is partly attributable to the company’s decision to repurchase its own shares, to the tune of CA$179 million over the past twelve months.

This expenditure on share repurchases, amounting to nearly as much as the CA$216 million distributed in dividends last year, suggests a certain ambivalence on the part of management. Were they to curtail these repurchases, they could conceivably double the dividend payout without incurring debt or compromising future investments. It is a course of action which, given the company’s history, appears not improbable. The current valuation, with a price-to-earnings ratio of just 14 – a mere fraction of the broader S&P 500 – might, however, tempt management to continue acquiring shares, a strategy which, while understandable, may not be the most advantageous for those seeking a steady stream of income. Prudence, it would seem, would dictate that investors consider following suit – acquiring shares whilst the price remains, as it were, a most reasonable bargain.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-07 23:12