The market’s a fickle lover. One month, QuantumScape’s stock lay cold, drifting toward oblivion like a corpse in a river. Then, out of nowhere, it caught fire. A 200% surge in 30 days. Wild, yeah? But markets don’t gamble on hope—they bet on math. And this time, the math wore a lab coat.

QuantumScape’s breakthrough? A production process 25 times faster. Not a tweak. A gut punch to the old ways. The kind of edge that makes engineers whisper, “Now we might just make it.” But hope’s a fickle currency. The euphoria’s half-unraveled already. Investors remembered what they forgot: prototypes don’t pay bills. Not yet. Still, this pullback? A door left ajar. A second chance for the bold.

What’s QuantumScape?

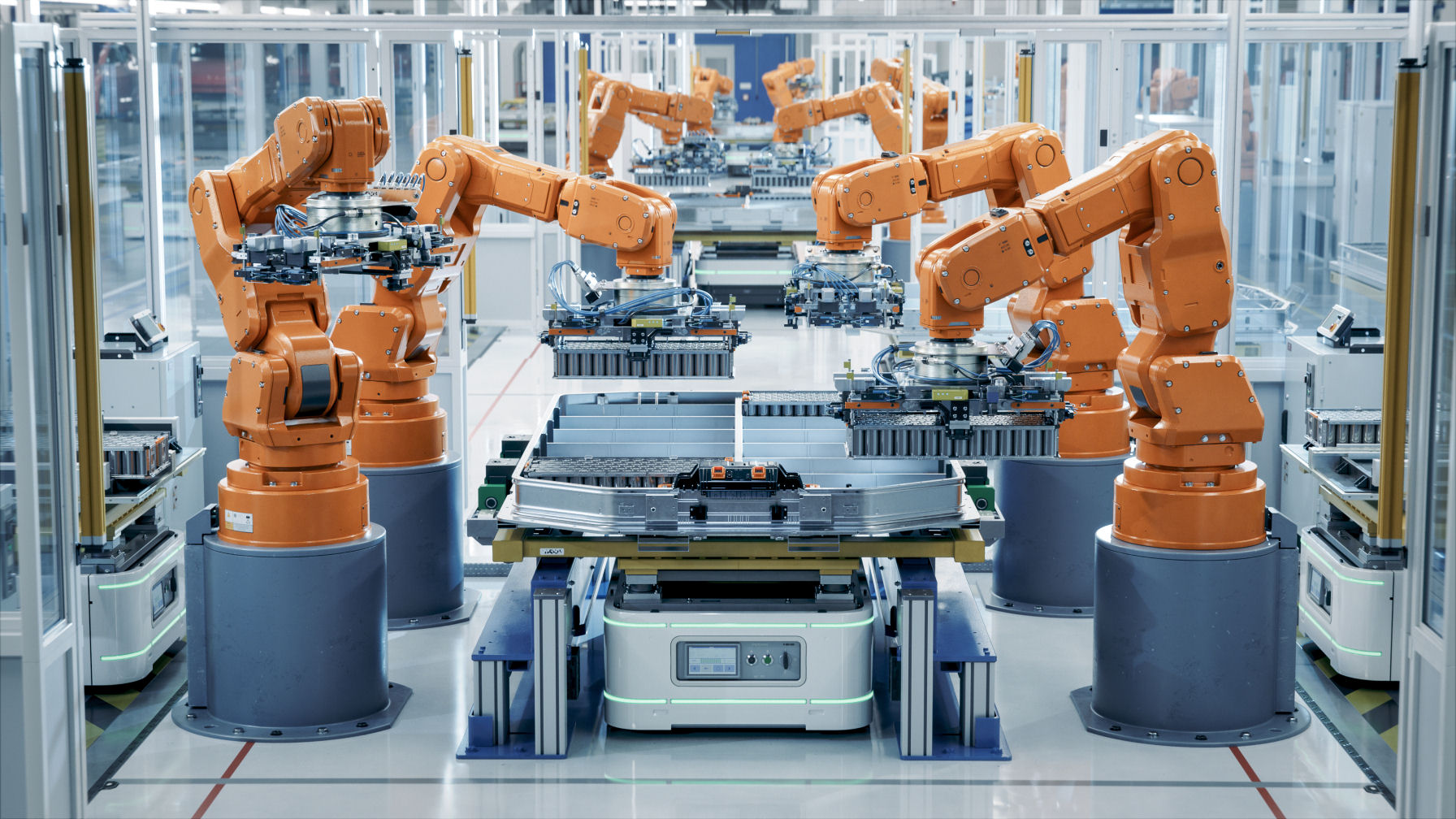

Let me spell it out. QuantumScape makes batteries. Not the kind in your phone. The kind that could power the future—or bury it in debt. Their solid-state lithium packs? Sleek, efficient, and missing the usual anode. A design that cuts costs like a hot knife through butter. But here’s the catch: they’re still building models, not factories. Prototypes, not products. Science with a silver lining—and a ledger full of red ink.

The numbers? Promising. 15–40% more range. 95% charge retention after 1,000 cycles. That’s 300,000 miles of driving without a nervous breakdown over replacement costs. But promises are like smoke. Easy to chase. Harder to catch.

A Big Leap Forward

June brought a bullet point: the “Cobra” separator process. Faster. Cleaner. Deadlier to competitors. The kind of tech that makes Wall Street sit up and ask, “How soon?” The answer? Not soon enough. Scaling this isn’t a checkbox. It’s a tightrope walk over financial quicksand.

The ceramic separator? A godsend. No flammable gels. No porous polymers. Just solid, stubborn efficiency. But efficiency doesn’t pay rent. Not yet. The bulls got ahead of themselves. The bears are circling again. Welcome to the casino of story stocks. The dice are loaded. The croupier’s grinning.

Don’t Waste the In-the-Meantime

Here’s the cold truth: QuantumScape’s burning through $500 million a year. No revenue. Less than $1 billion in the bank. A startup with a five-alarm fire under its ass. And let’s not pretend 2026 timelines are carved in stone. Automakers sign MOUs. They don’t sign death warrants. Yet.

Volkswagen’s the exception. The second-largest automaker, holding QuantumScape’s hand like a father at a funeral. But VW’s not here for profits. It’s here for batteries. For now, that’s enough. For shareholders? Not so much. The math’s simple: risk vs. reward. The reward’s a mirage. The risk? A cliffhanger.

Buy this stock if you like playing Russian roulette with a .45 full of promise. But don’t mistake volatility for momentum. The floor’s glass. One misstep, and you’re staring at a bottomless pit. And while you’re waiting for the tech to deliver, the rest of the market won’t wait for you. Opportunities rot. Patience doesn’t.

So here’s the kicker: If QuantumScape’s future’s as bright as they claim, the truth’ll scream loud enough to wake the dead. Until then, the game’s rigged. The deck’s stacked. And the house always wins. 💥

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top gainers and losers

- HSR Fate/stay night — best team comps and bond synergies

2025-08-02 18:04