A quiet thaw of interest in quantum computing stocks has unfurled, heralding a season of growth. Among the bloom, Quantum Computing (QUBT) has surged like a sapling reaching for the sun, its one-year gains a cascade of 2,800% as of Oct 1. From a micro-cap stock of $60 million, it has grown into a mid-cap entity of nearly $3 billion-a transformation as sudden as a spring thaw.

Yet the question lingers: will management, like a gardener, prune its branches with a stock split? The answer, as with all things in the market’s garden, is a whisper of possibility. The company’s past splits, like the scars of a tree, were reverse splits-acts of survival rather than growth. A 1-for-100 split in 2007, a 1-for-200 in 2018. Now, at $20 a share, a forward split feels distant, like a distant summer.

Stock splits, those subtle alchemies of capital, are the market’s way of balancing its scales. A forward split, like a tree shedding its leaves, multiplies shares while lowering their price. A reverse split, a thickening of bark, reduces shares to elevate their worth. The former, a sign of vitality; the latter, a cautious whisper against the storm.

QCi’s recent $500 million private placement-selling 26.9 million shares-was a sowing of seeds, though the harvest remains uncertain. It diluted existing stakes, yet infused the company with new life. A paradox, like a river that both erodes and nourishes.

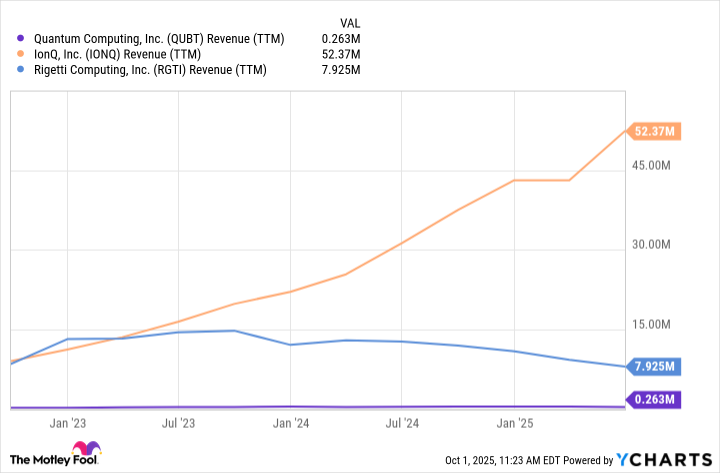

The future of QCi’s stock is a riddle wrapped in the market’s ever-shifting winds. A triple-digit price might beckon a forward split, while a plunge could force a reverse. Both scenarios, though, are as improbable as a snowfall in June. The company’s photonics technology, a beacon of promise, faces rivals like IonQ, whose trapped-ion systems also thrive at room temperature. Yet QCi’s revenue, a flickering flame, trails peers like Rigetti Computing and IonQ-a mere $263,000 in the trailing 12 months, a fraction of its former self.

Amidst the forest of tech giants, QCi’s revenue stands as a lone sapling, its branches barely reaching the canopy. The market’s winds are fickle, and even the tallest trees sway with the storm. To invest in QCi is to gamble on a seed, its roots yet to grasp the soil.

The story of QCi is not merely one of numbers, but of ambition and frailty-a testament to the fragile dance between innovation and survival. As the market’s seasons turn, its fate remains as uncertain as the first snowfall of winter.

🌿

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-10-05 14:32