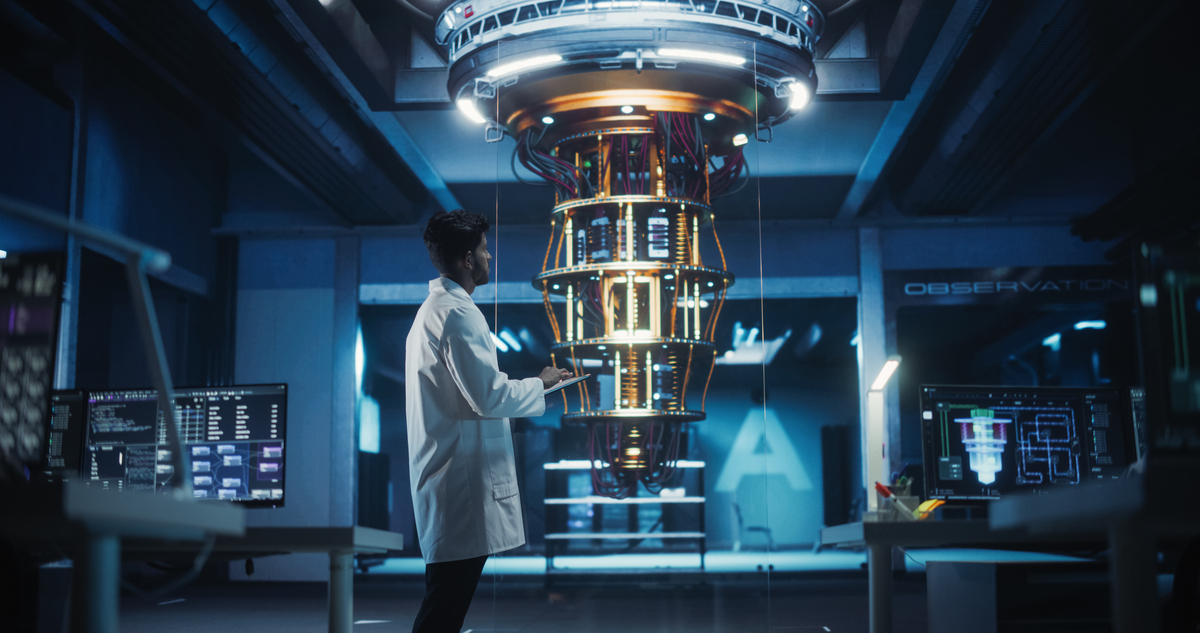

Many years later, as the servers cooled and the digital dust settled over the promises of limitless calculation, old Mateo, the custodian of forgotten algorithms, would recall the year of the quantum bloom – 2025 – as a fever dream, a summer of impossible valuations and whispers of a future that arrived too soon. It was a time when even the most skeptical investors succumbed to the illusion that reality itself could be rewritten with a cascade of qubits, and the scent of ozone hung heavy in the air, a premonition of the coming static. Now, in the waning days of 2025, a different stillness descends, a quietude that speaks not of progress, but of a reckoning. The companies that dared to chase the ghost in the machine – IonQ (IONQ 3.06%), D-Wave Quantum (QBTS 5.98%), Rigetti Computing (RGTI 1.88%), and Quantum Computing (QUBT 1.00%) – find themselves perched on a precipice, their market capitalizations swollen with the air of expectation, fragile as blown glass.

The Weight of Unproven Futures

The numbers, when examined without the haze of promotional fervor, possess a certain melancholy. D-Wave, a pioneer burdened by the weight of its early promises, commands a market capitalization of ten billion dollars despite trailing twelve-month sales barely exceeding twenty-four million. Rigetti, a company that once dreamt of building a quantum fortress, has managed a modest twelve and a half million in revenue, yet its value hovers around eight and a half billion. Quantum Computing, a fledgling enterprise, boasts a market cap of nearly three billion dollars on a mere half a million in revenue. These are not valuations; they are prayers whispered into the void.

Even IonQ, the most robust of this spectral quartet, with its nearly eighty million in revenue, is buoyed by a market capitalization of eighteen billion. It is a sum that demands miracles, a testament to the enduring human capacity for hope, even in the face of implausible odds. But the market, like the sea, is a fickle mistress, and her affections are rarely earned through faith alone.

The insistence on imminent breakthroughs, the constant refrain of “just around the corner,” feels increasingly like a desperate attempt to hold back the tide. The truth, whispered by the engineers in the server rooms, is that true commercialization, the kind that justifies these valuations, remains a distant horizon, perhaps a decade, perhaps even longer.

The Distance to Practicality

The proponents speak of a revolution, of a world transformed by quantum power. But the recent report from MIT, a sober assessment from the halls of academia, suggests a more cautious timeline. Large-scale commercial applications, they conclude, remain “far off,” lost in a fog of technical challenges. Morningstar’s analysis echoes this sentiment, placing early commercialization five to ten years away, and true general-use quantum computing a full twenty years distant. It is a patient man’s game, this pursuit of the quantum grail, and the market, it seems, has grown impatient.

This is not simply a matter of engineering; it is a collision with the very limits of human knowledge. Some of the most brilliant minds in the field, mathematicians and physicists alike, now question whether useful quantum computing is even possible. Gil Kalai, a mathematician at Hebrew University, argues that quantum error correction – the very foundation of a stable quantum computer – is inherently impossible. Mikhail Dyakonov, a theoretical physicist in Montpellier, goes further, suggesting that even a three-decade timeline is overly optimistic. Their voices, though often drowned out by the chorus of hype, deserve to be heard, for they speak of a fundamental barrier, a wall that may prove insurmountable.

The air is thick with uncertainty, a premonition of a coming shift. The year 2026, it seems, will be a year of reckoning, a time when investors demand proof, not promises. The companies that cannot deliver on their ambitious milestones will face a harsh reality, a correction that will sweep away the excess and leave only the truly viable. It is a pattern as old as the market itself, a cycle of exuberance and despair. One recalls the 3D printing boom of 2013-2014, when companies like 3D Systems and Stratasys commanded valuations based on the promise of revolutionary manufacturing. When that promise remained largely unfulfilled, both companies crashed, losing ninety percent of their value. The ghosts of those fallen fortunes linger, a warning to those who chase illusions.

A Prudent Path Forward

It is not to say that the future of quantum computing is bleak. The technology holds immense potential, and over the long term, it is likely to transform many aspects of our lives. But the current valuations of the pure-play quantum companies are unsustainable, inflated by speculation and divorced from reality. A more prudent approach is to focus on companies that are actively developing quantum technology as part of a broader portfolio, those with the resources and expertise to navigate the inevitable challenges.

Alphabet (GOOG +0.16%) (GOOGL +0.14%) is such a company. With its world-class talent and vast resources, it is uniquely positioned to lead the quantum revolution, regardless of how long it takes. It is a patient investor, willing to invest in long-term projects with uncertain payoffs. It is a company that understands that true innovation requires not only brilliance, but also resilience. And in the unpredictable world of quantum computing, resilience may be the most valuable asset of all.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-01-23 18:52