Quantum computing isn’t just a technological frontier-it’s a war. A digital arms race where ions and photons clash in a subatomic free-for-all, and the only prize is the godhood of computational supremacy. The corporations fighting this war? IonQ and Quantum Computing Inc. (QCi). One’s a laser-eyed titan, the other a chaotic alchemist. Let’s dissect these unholy beasts before the market collapses under its own weight.

IonQ (IONQ) and Quantum Computing Inc. (QUBT) are the two knights in this quantum joust. IonQ’s ions dance under laser beams like a psychedelic ballet, while QCi’s photons sprint through entropy’s chaos. But here’s the rub: one is a starving visionary, the other a bloated corporate ghost. Let’s ride the data highway and see who survives the next crash.

QCi’s Desperate Gambit

Quantum Computing Inc. is a company that thinks it’s in the future. It sells “room-temperature quantum machines” like they’re the last burgers at a drive-in. Its Q1 revenue? $39,000. Expenses? $8.3 million. That’s not a business-it’s a financial séance, hoping the dead market will rise from its grave. But hey, April brought a sale to an automotive leviathan, and July a $332K bank deal. Big numbers? Only if you’re blind to the fact QCi made $373K in all of 2024. This isn’t growth-it’s a gambler’s last roll of the dice.

IonQ’s Chaotic Ascension

IonQ is the laser-eyed madman of the bunch. Its ions? Trapped in a cryogenic cage of light, performing calculations that make your smartphone look like a stone age relic. In 2024, it sold $43.1 million in quantum dreams. But Q1? Flat revenue, $75.7 million in losses. Then Q2: $20.7 million in sales-double the previous year. Sounds good, right? Wrong. Acquisitions? They’re not partnerships-they’re corporate grenades. Operating expenses? $181.3 million. A hundred-and-eighty-one million. That’s not a business-it’s a financial apocalypse in slow motion.

In July, IonQ dropped $1 billion on an equity offering. Total assets? $1.3 billion. Liabilities? $168.2 million. That’s not balance-it’s a financial tightrope over a volcano. And the Trump administration’s tariff tantrums? They’re not just inflation-they’re economic napalm. IonQ’s balance sheet is a house of cards in a hurricane. Burn it down? Maybe. Build a quantum utopia? God help us all.

Choosing the Loser

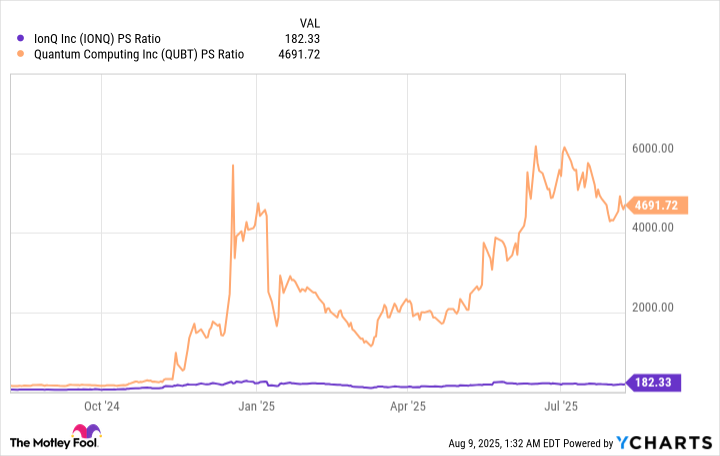

Let’s talk valuation. IonQ’s P/S ratio is a reasonable madness. QCi’s? A financial hallucination. Its stock is a quantum leap into the void. IonQ’s sales growth is real, but its expenses are exploding like a supernova. Microsoft’s lurking in the shadows, building its own quantum beast. This isn’t an investment-it’s a bet on the apocalypse. Only players with a death wish should touch it. And even then? Hope you’ve got a parachute.

So here we are, kids. The future is a quantum wasteland, and the only thing growing is the madness. IonQ or QCi? Pick your poison. But remember: in the end, the market doesn’t care who wins-it just wants your blood. 💥

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-12 19:52