For years, quantum computing existed in that peculiar realm of technological possibility usually reserved for faster-than-light travel and self-folding laundry. A fascinating notion, certainly, but about as likely to impact your daily life as a decent cup of coffee in a space station. Or so one thought. It turns out, this isn’t some far-flung fantasy. It’s happening, and, rather remarkably, it’s poised to become a rather substantial industry. McKinsey, those people who know about these things, estimate the quantum computing market could balloon from a modest $4 billion today to a rather eye-watering $72 billion by 2035. Which, if you’re keeping score, is a significant return on investment, should one know where to look.

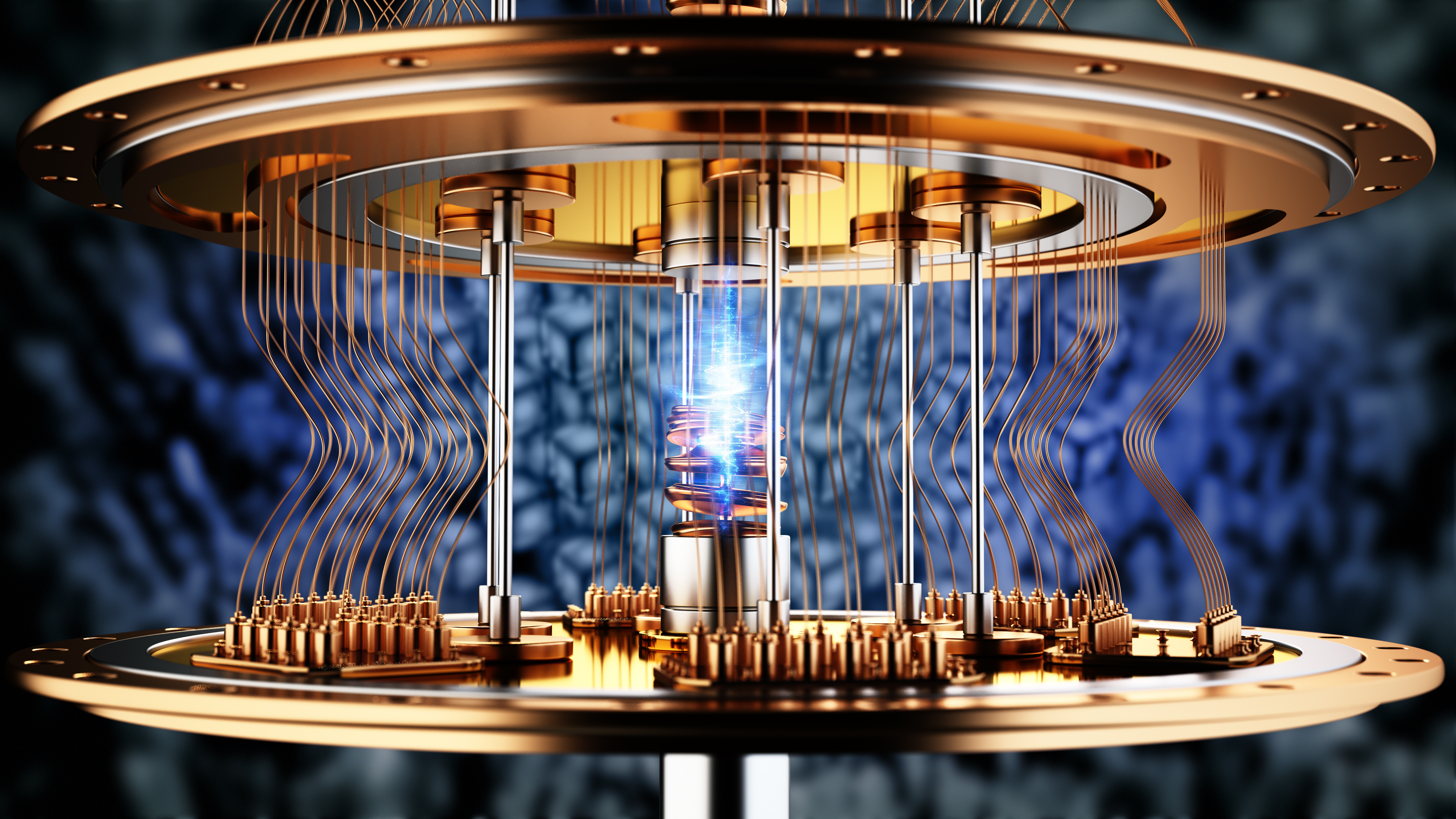

The technology itself is, admittedly, a bit baffling. Imagine trying to explain the rules of cricket to someone who’s only ever seen baseball. Quantum computers don’t so much calculate as they explore all possibilities simultaneously. They can tackle problems that would take even the most powerful supercomputers longer than the universe has existed to solve. It’s like the difference between walking to the shops and teleporting. The former is perfectly adequate, but the latter gets you there rather more quickly. Now, there are plenty of start-ups nibbling around the edges of this revolution, and one of them might just become the next Google. But start-ups, by their very nature, are a bit like Russian roulette. A thrilling gamble, perhaps, but not necessarily the soundest basis for a retirement plan. Fortunately, there are some established players getting involved, offering a more…stable route to participating in this potential boom.

Below are three companies offering a pathway to the quantum future, without requiring you to take quite the same risks as betting on a garage-based innovator.

Bridging the Gap

First up is Nvidia (NVDA 0.29%). You may know Nvidia as the folks who make the graphics cards that allow you to play video games in increasingly realistic detail. In 2025, they were the stock market story, reaching a market cap of $4.57 trillion. Quite a feat, really. But Nvidia isn’t content with simply dominating the gaming world. They’re also a serious contender in the quantum arena.

The problem with quantum computers, you see, is that they’re a bit like highly specialized artisans. Brilliant at one particular task, but utterly useless at everything else. They can’t surf the internet, check your email, or even run a spreadsheet. The solution? Hybridization. Combining the strengths of quantum and classical computers. And Nvidia’s NVQLink architecture does just that. It’s a bit like having a master carpenter build a single, exquisitely crafted chair, while a team of general contractors handles the rest of the house. It allows quantum computers to work with classical computers, rather than in isolation. And that, my friends, is a potentially game-changing development. Nvidia isn’t going anywhere soon, with a net income margin of 53% and revenue growth of 87% over the past three years. It’s a solid foundation for a quantum-focused portfolio.

The Original Tech Giant

Before the Magnificent 7, before the dot-com bubble, and even before personal computers were commonplace, there was International Business Machines (IBM +2.63%). Founded in 1911, IBM is truly America’s original tech giant. And, remarkably, it’s still going strong over a century later. A testament to adaptability, if ever there was one.

IBM has been tinkering with quantum computing since the 1970s. And since 2016, they haven’t missed a single milestone on their published roadmap. A level of consistency that’s rather refreshing in the often-chaotic world of technology. Their Nighthawk quantum processor is the current culmination of their research, boasting 120 qubits. But it’s scalable, meaning they can add more qubits to increase its power. By 2028, they expect systems using Nighthawk will be able to handle up to 15,000 two-qubit gates. A rather impressive feat of engineering, if I may say so. Given IBM’s history of delivering on its promises, it seems a safe bet they’ll continue to do so. While their revenue growth is more modest than Nvidia’s, they offer a solid net income margin of 12%, a gross margin of 57.8%, and a dividend yield of 2.17% with a 26-year history of increases. A dependable addition to any long-term portfolio.

The Bleeding Edge

Finally, let’s talk about Alphabet (GOOGL 0.80%) (GOOG 0.80%), the parent company of Google. You may have heard of them.

Alphabet is already emerging as a leader in the AI space, and with $98 billion in cash, they have plenty of resources to invest in multiple projects. Quantum computing is one such project. And they’ve made some rather remarkable progress. Remember that quantum computer I mentioned earlier, the one that solved that incredibly complex math problem in minutes? That was Alphabet’s Willow quantum computer. It solved a problem that would have taken even the most powerful classical supercomputer 10 septillion years. A rather significant improvement, wouldn’t you say? What’s more, Willow’s error rate – a serious problem with quantum computing – was cut in half. And, remarkably, Willow actually becomes more accurate with more qubits. A rather unusual and encouraging development. Alphabet is pioneering the frontier of quantum hardware, and with its vast resources, it’s well-positioned to overcome any challenges that arise. And, like Nvidia and IBM, it’s a far cry from a risky start-up. A solid and confident investment for the future.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-19 18:42