Right now, every artificial intelligence stock is priced as if it’s discovered the secret to turning lead into gold (and probably charging a premium for the privilege). Naturally, sensible investors – those not entirely convinced that hype is a viable investment strategy – are beginning to eye the next shimmering possibility: quantum computing. It’s the sort of thing that sounds incredibly clever, even if nobody’s quite sure what it’s clever at yet.1

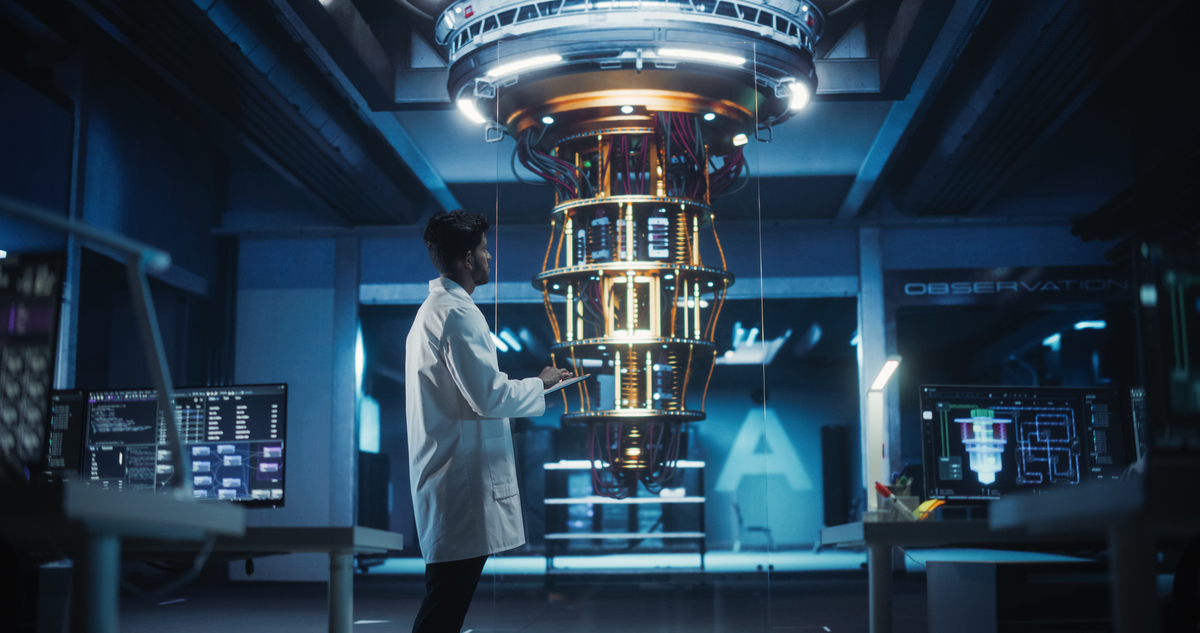

The basic idea, as far as one can gather, involves these… ‘qubits.’ Apparently, they’re derived from quantum particles, which are, if the physicists are to be believed, simultaneously everywhere and nowhere at once.2 This allows quantum computers to perform calculations at speeds that make a supercomputer look like a particularly sluggish abacus. The downside? Currently, these machines are the size of small buildings, cost more than several principalities, are prone to errors, and have about as much practical application for the average consumer as a self-stirring cauldron. But hey, progress isn’t always about immediate usefulness; sometimes it’s just about being able to say you have one.

Nevertheless, there are stocks that offer a pathway into this brave new world of probabilistic calculations and potentially existential paradoxes. Here are three, each with its own peculiar blend of promise and peril.

1. Rigetti Computing: The Tinkerers

Most people don’t own a quantum computer, largely because they’d need a dedicated power station and a team of highly-trained wizards to operate it. But Rigetti Computing (RGTI 6.05%) allows you to use one, from anywhere with a decent internet connection. They’ve created a ‘quantum-computing cloud platform,’ which is essentially a way to rent time on their incredibly expensive machines. It’s the future of computing, or at least a very expensive hobby for those with more money than sense.

Rigetti began offering these cloud services in 2017, wisely targeting developers – those individuals who enjoy spending vast amounts of time fixing problems that don’t actually exist. In 2023, they unveiled the Novera, a 9-qubit system that could be plugged into existing infrastructure. They then cleverly combined four of these chiplets to create the Cepheus-1, a 36-qubit behemoth. It’s like building a castle out of LEGO, except the LEGO cost several million pounds and is prone to collapsing into a state of quantum uncertainty.

Recently, Rigetti announced that their 108-qubit system is proceeding ahead of schedule, and they’ve even received an order from India’s Centre for Development of Advanced Computing. The price? A mere $8.4 million. It boasts incredibly fast gate speeds, but its accuracy is… let’s say, ‘enthusiastically probabilistic.’3

Quantum computing is still in its infancy, so expect years of unprofitability as Rigetti pours money into research and development. The share price is currently more than 50% off its peak, making it a risky, but potentially rewarding, investment for those who enjoy a good gamble.

2. IonQ: The Perfectionists

One of the inherent problems with quantum computing is its inherent inaccuracy. Rigetti’s 108-qubit system has a 99% accuracy rate, which sounds impressive until you realize that in the world of computing, 99% accuracy is roughly equivalent to a chimpanzee performing brain surgery.4

However, IonQ (IONQ 4.22%) recently announced a two-qubit gate fidelity of 99.99%. They achieve this by trapping ions with lasers, which allows them to operate at higher temperatures. The trade-off? Slightly slower speeds. It’s a bit like choosing between a fast, unreliable horse and a slow, dependable mule.

With trailing-12-month revenue of $79.8 million and a market cap of $17.1 billion, IonQ is the largest pure-play quantum computing company. They offer full quantum computer systems, not just chips. If they can maintain their accuracy while boosting speed, they could be a major winner. But that’s a very big ‘if.’ Their research and development expenses have resulted in a TTM net loss of $1.5 billion, so invest with caution – and a healthy dose of skepticism.

3. Alphabet: The Silent Benefactors

Rigetti and IonQ are both incredibly risky, largely because the quantum computing industry is still in its infancy. What if you’re looking for a more stable investment? Is there a viable option that doesn’t involve betting your life savings on a long shot?

Perhaps not a pure-play option, but when it comes to quantum computing, you can’t ignore Alphabet (GOOG 0.73%) (GOOGL 0.79). They’ve been investing in this field since 2012, and in 2022, they spun off a large chunk of their quantum computing division as SandboxAQ. The parent company retained enough to roll out the Willow quantum chip, which is so powerful it can perform calculations that would take a supercomputer 10 septillion years to complete.5

Google continues to devote significant resources to quantum computing, and is likely to be a major player for years to come, even though most of its revenue comes from other ventures. It’s a safer bet than Rigetti or IonQ, but it won’t offer the same potential for explosive growth.

1 It’s a bit like alchemy, really. Lots of complicated equipment, obscure terminology, and a distinct lack of actual gold.

2 Don’t ask us to explain it. We’re stock market enthusiasts, not physicists.

3 Which is to say, it works sometimes.

4 No offense to chimpanzees.

5 We suspect they’re exaggerating slightly.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-25 23:42