Right then. Quantum computing. It’s a bit like trying to herd cats made of probabilities. A profoundly expensive hobby, really, but one that certain individuals – let’s call them ‘optimists with access to capital’ – believe will, eventually, amount to something. The promise, as always, is acceleration. Faster calculations. The ability to break codes, design new materials, and generally make life more complicated for everyone else. It’s a technology still in its infancy, wobbling about on metaphorical legs, but with the potential to either revolutionise everything or simply become a very elaborate paperweight. Investors, naturally, are piling in. Because hope springs eternal, and so does the desire for a good return.

The Guild of Alchemists – or, as they’re known in the modern age, McKinsey – estimates a potential market value of a trillion dollars or more within the decade. A figure so large it makes one suspect someone forgot a decimal point. Still, it’s enough to get the attention of anyone with a portfolio and a penchant for risk. Let’s examine two contenders in this nascent field, shall we?

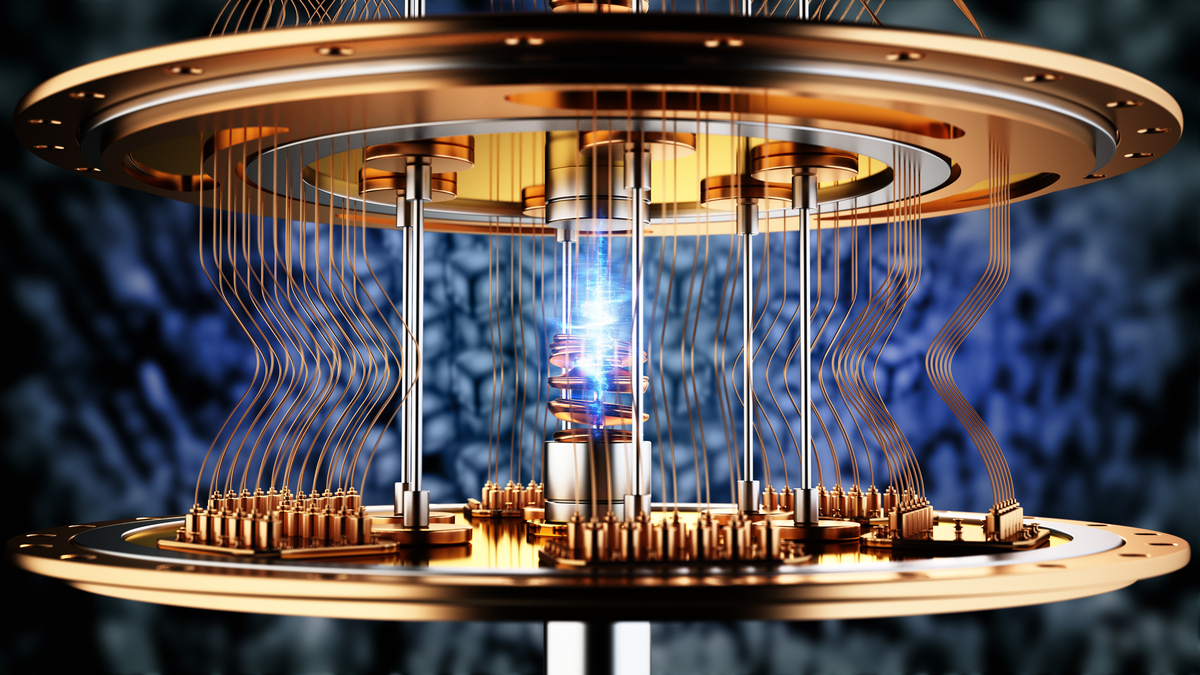

IonQ

IonQ (IONQ +1.27%) is, if you will, a purist. They’ve been wrestling with the quantum beast for over twenty years, which in tech years is roughly equivalent to several geological epochs. They claim their ‘Tempo’ system possesses a computational space 36 quadrillion times larger than their competitors. Which is…significant. Though measuring ‘computational space’ is a bit like measuring the potential of a particularly argumentative badger – you can get a number, but it doesn’t necessarily tell you much. What is telling is their revenue growth. They’re commercialising these quantum contraptions through cloud partnerships and enterprise agreements – basically, renting out time on their very expensive toys. Revenue jumped 222% year-on-year in the last quarter. A truly impressive number, though one must remember they’re starting from a base roughly the size of a particularly small pebble. Analysts predict revenue of $192 million this fiscal year, rising to $316 million next year. Optimistic, certainly. But then, optimism is the fuel that powers the entire financial system.

The benefit of growing from such a small base is the potential for explosive returns. The risk, of course, is that the pebble remains a pebble. The current revenue is…modest, underscoring the technology’s early stage. Patience, therefore, is paramount. And a strong stomach. The stock is currently down 58% from its recent peak, caught in the general tech stock wobble. It’s also rather expensive, trading at a sales multiple of 109. One might reasonably ask if that’s a sustainable valuation. Investors will be watching closely for technical progress – reducing error rates, addressing security concerns. These are, shall we say, rather important details. If IonQ can execute, continue to grow at a high rate, it has the potential to be a rewarding investment. Its $12 billion market cap remains relatively low, given the technology’s long-term potential. Though potential, as any seasoned gambler will tell you, is not the same as profit.

Nvidia

Quantum development, you see, is frightfully compute-intensive. It still relies on good old-fashioned processing and software. Researchers need it to run quantum simulations and prototypes. This requires resources. Tremendous resources. Which is where Nvidia (NVDA +2.58%) comes in. They supply the tools. The pickaxes and shovels for this particular gold rush.1

Nvidia is a leading supplier of graphics processing units (GPUs) for artificial intelligence and other use cases. They see quantum computing as another market to expand their dominance. For example, their NVQLink high-speed interconnect links GPUs to specialised quantum chips, enabling accelerated computing for quantum systems. They’re not just a chip company, you see. They offer high-value solutions across industries. IonQ is even using Nvidia’s CUDA-Q software to make quantum computing easier to use for enterprises. These high-value solutions are why Nvidia generated $99 billion in net income on $187 billion in revenue over the trailing 12 months. A rather impressive sum, even by modern standards.

The best thing about investing in Nvidia is the attractive valuation. The stock trades at 24 times this year’s earnings estimate, making it a solid counterbalance to IonQ’s high valuation. If quantum computing takes off in the next 10 years, Nvidia is well-positioned to benefit. It’s a more sensible, less speculative bet. A bit like backing a reliable workhorse instead of a particularly flamboyant unicorn.

1 And, as any seasoned prospector will tell you, the suppliers of pickaxes and shovels often do rather well, regardless of whether anyone actually strikes gold.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-10 13:33