Rigetti Computing has experienced a July of such meteoric ascent that even the most jaded investor might pause to marvel. To gain a 40% rise in a month is delightful; to risk losing it all in the next is merely the business of the market. Yet, as with all things ephemeral, the question lingers: is this a triumph of innovation or a fleeting mirage?

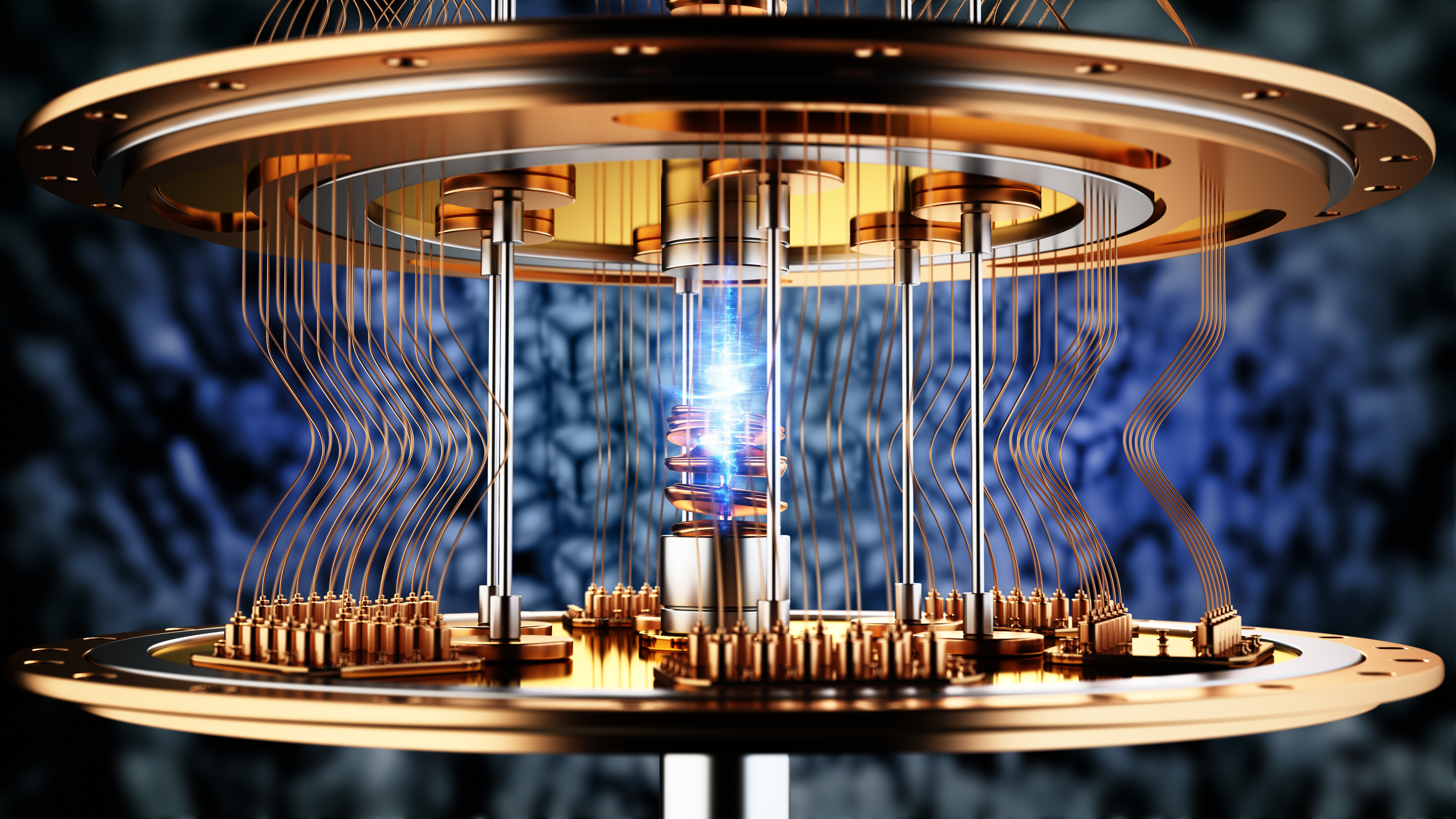

Last week, Rigetti unveiled its Ankaa-3 system, a feat that sent shares into a crescendo of euphoria. One might say the company has struck gold, though the true value of this discovery remains as elusive as a qubit’s state. After all, what is a 99.5% two-qubit gate fidelity but a whisper in the vast cathedral of computational ambition?

Rigetti’s breakthrough shows it’s on the right track

Rigetti’s Ankaa-3, a confluence of four 9-qubit chips, achieves a fidelity that would make even the most ardent traditionalist blink. Yet, let us not mistake precision for perfection. A 99.5% accuracy rate is a triumph, but in the realm of quantum computing, it is but a stepchild to the flawless logic of classical machines. To equate the two is to confuse a candle with the sun.

Qubits, those elusive entities that exist in a state of probabilistic limbo, defy the binary certainties of classical computation. Their beauty lies in their imperfection—a dance of possibilities that collapses into a single answer. Rigetti’s progress is commendable, yet the path to practicality remains a labyrinth of unresolved enigmas.

Though Rigetti claims the mantle of the largest multichip quantum computer, its rivals whisper of superior fidelity. A leader in size, perhaps, but not yet in supremacy. The market, ever fickle, will judge not by ambition alone, but by the weight of results.

The future, as ever, is a matter of perspective. Rigetti’s 2030 projections—$1–$2 billion in demand, then $15–$30 billion—sound like the fever dreams of a utopian. Yet, in the world of quantum computing, such visions are the fuel that drives both hope and hubris.

Rigetti’s stock is a high-risk, high-reward investment

To invest in Rigetti is to court the sublime and the absurd in equal measure. A $5 billion market cap, poised to eclipse its own aspirations—what could be more thrilling? Yet, as the saying goes, “The only difference between the impossible and the possible lies in a man’s determination.” Unfortunately, determination alone cannot prevent a company from collapsing into oblivion.

Should Rigetti’s technology falter, or be outpaced by a rival’s ingenuity, the stock may vanish as swiftly as it appeared. To place one’s faith in a single enterprise is to dance on the edge of a precipice, armed only with a parlor trick and a prayer.

Thus, the wise investor diversifies, ensuring no single holding wields disproportionate power over their portfolio. A 1% stake is a prudent hedge against the capriciousness of fate. For in the realm of quantum finance, as in life, it is better to be prepared for the worst than to be unprepared for the best.

The verdict remains pending. Yet, Rigetti’s recent feat suggests it walks a path of promise, if not yet of certainty. Time, that great arbiter, shall decide whether this is a spark or a flame.

🚀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-27 14:14