The chronicles of speculative finance are replete with phantom fortunes, ephemeral bubbles inflated by the promise of novelty. In the year 2025, a curious effervescence surrounds the so-called ‘quantum computing’ stocks. One might liken it to the feverish pursuit of the Golem in ancient Kabbalistic lore – a striving to animate the inanimate, to conjure wealth from the probabilistic haze of subatomic particles. The valuations, particularly those attached to firms such as IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc., have experienced a logarithmic ascent – a phenomenon that, as any student of market history knows, rarely concludes with serene equilibrium.

A recent compendium, ‘The Aleph of Investment’ (attributed to the apocryphal scholar, Dr. Elias Thorne), posits that such surges are merely echoes of past manias – the South Sea Bubble, the Railway Craze, the dot-com delirium – all variations on a singular theme: the human tendency to mistake potential for realization. The aggregate potential of quantum computing, as projected by the Boston Consulting Group, suggests a domain of economic value between $450 and $850 billion by 2040. A substantial sum, to be sure, yet dwarfed by the infinitely expanding universe of unrealized expectations.

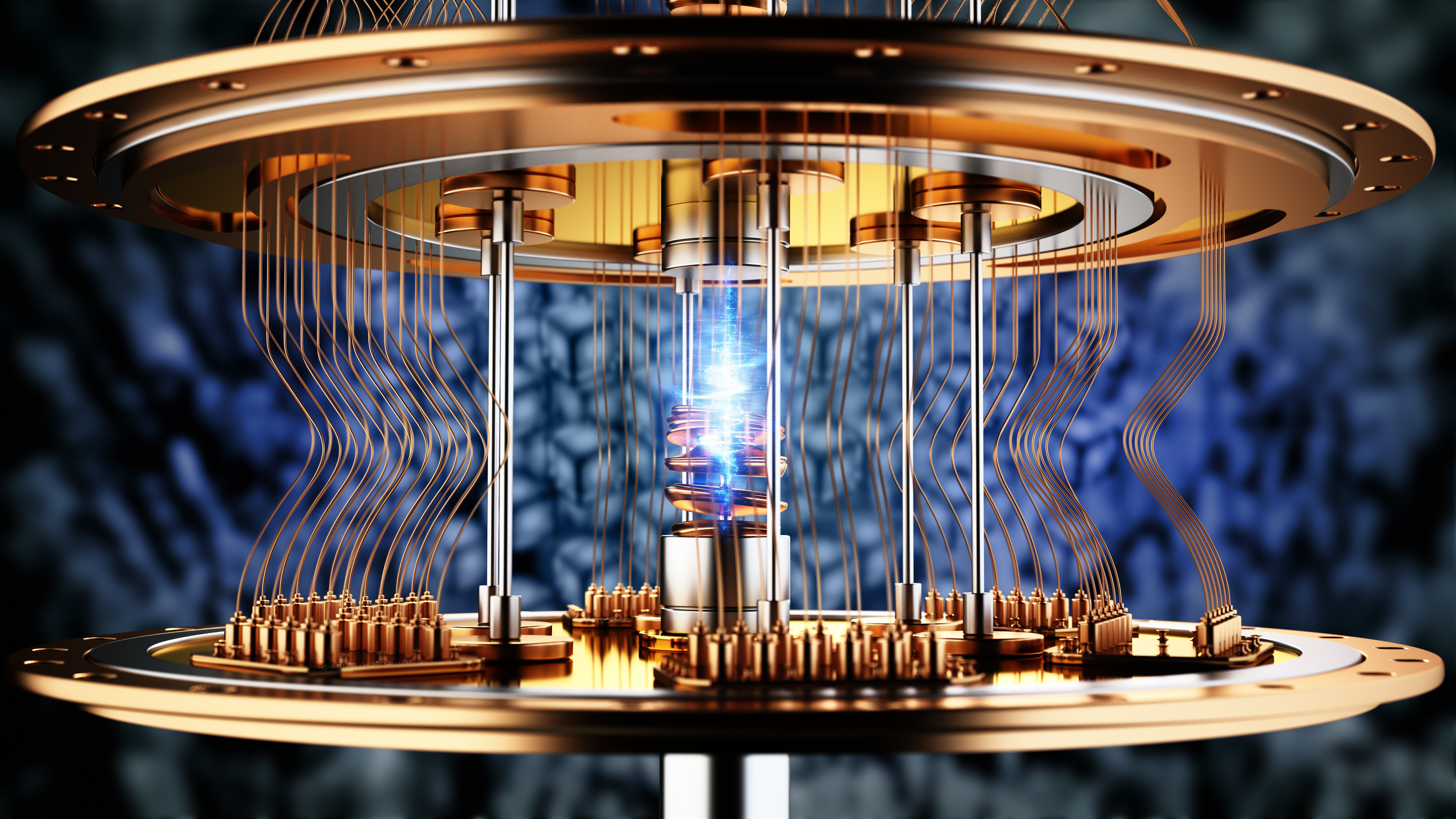

These nascent enterprises, propelled by the practical application of quantum algorithms and the patronage of clients – even those belonging to the ‘Magnificent Seven’ – have become objects of intense speculation. The allure is understandable. The promise of molecular simulations for pharmaceutical breakthroughs, enhanced cybersecurity, and accelerated artificial intelligence – all tantalizing possibilities. But consider this: the very nature of quantum mechanics, with its inherent uncertainty and superposition, seems to mirror the precariousness of these valuations. A stock trading on the promise of a probabilistic future is, in a sense, a quantum entity itself.

Loading…

—

The current optimism is further fueled by the accessibility offered by cloud services from Amazon and Microsoft, allowing subscribers to experiment with these nascent technologies. This access, however, is akin to offering a novice a glimpse into the Library of Babel – a vast, infinite repository of knowledge, yet utterly incomprehensible without a guiding key. JPMorgan Chase’s recent $1.5 trillion Security and Resiliency Initiative, with its allocation for quantum computing, has only amplified this fervor. A substantial investment, certainly, but a single drop in the ocean of global capital.

Yet, within this labyrinth of opportunity, a significant risk remains largely unacknowledged. The history of technological innovation is littered with the wreckage of early leaders, overtaken by larger, more resourceful competitors. The ‘Magnificent Seven’ – Amazon, Microsoft, Meta Platforms, and Alphabet – possess the capital, the infrastructure, and the strategic foresight to dominate any emerging field. They are not merely participants in the quantum revolution; they are potential architects of its future.

Alphabet’s Willow quantum processing unit and Microsoft’s Majorana 1 QPU are not mere experiments; they are declarations of intent. The fact that Willow successfully executed an algorithm 13,000 times faster than a conventional supercomputer is not merely a technical achievement; it is a harbinger of things to come. These are entities that can absorb losses, fund long-term research, and ultimately, dictate the terms of competition.

The pure-play quantum firms, by contrast, are constrained by limited resources and the constant need to raise capital. Their reliance on share issuances – over $4.1 billion in 2025 alone – dilutes shareholder value and undermines long-term sustainability. They are, in essence, ships sailing on uncharted waters, vulnerable to the storms of market volatility.

The paradox of quantum computing, therefore, is this: the very technologies designed to solve complex problems may, in the end, be eclipsed by the established powers who possess the resources to harness them. By the time quantum computers become cost-effective and commercially viable, the current leaders may well be relics of a bygone era. The future, as always, remains uncertain, a superposition of possibilities, waiting to collapse into a single, definitive reality.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-13 12:14