The whispers, you see, began last October. A grand pronouncement, a potential indulgence from the treasury, directed towards these…quantum contraptions. IonQ, that particular purveyor of probabilistic possibilities, experienced a fleeting moment of inflated expectation. The shares, naturally, danced a jig, reaching a height that seemed to mock the very foundations of sensible valuation. But the indulgence, alas, proved a phantom, a bureaucratic daydream. And now, in the year of our Lord 2026, a certain…cooling has occurred. The shares, like overripe plums, have begun to fall.

IonQ, for instance, briefly touched a peak of $84.64. A sum, one might observe, sufficient to purchase a respectable collection of samovars. Yet, as of late, the stock has retreated, surrendering 24% of its fleeting glory. A cautionary tale, perhaps, about the perils of mistaking speculation for substance.

IBM, that venerable institution, also felt the chill. A decline of 11% through February 13th. One suspects, however, that IBM, unlike some of its more…enthusiastic competitors, possesses a certain resilience. A certain…gravitas. These two, then, IonQ and IBM, present themselves as objects of…consideration. Though, let us be clear, consideration does not equate to endorsement.

IonQ’s Elaborate Apparatus

What makes IonQ…interesting, shall we say, is its ambition. A comprehensive technology, they proclaim. And now, they intend to acquire SkyWater Technology, a foundry. A foundry! As if the creation of these quantum devices were akin to casting church bells. The intention, of course, is to control the entire process, from the initial spark of inspiration to the final, shimmering chip. A laudable goal, perhaps, though one suspects it will involve a considerable amount of dust and a regrettable number of misplaced screws.

They have been collecting companies, you see. Like a magpie gathering shiny objects. Capella Space, focused on satellite quantum tech. Skyloom and Qubitekk, tinkering with quantum networks. A veritable menagerie of technological curiosities. They even deployed a citywide quantum network in Geneva. Geneva! A city renowned for its neutrality and its excessively precise timekeeping. A fitting location, one might argue, for a technology that exists in a perpetual state of uncertainty.

Their revenue, it must be admitted, is rising. $39.9 million in the last quarter, a 222% increase. A figure that, when viewed in isolation, is…impressive. They predict $106 to $110 million for 2025, more than double the $43.1 million from the previous year. A veritable explosion of digits. Yet, they remain…unprofitable. A loss of $168.8 million in the last quarter, a significant escalation from the previous year’s $53.1 million. One begins to suspect that they are burning money at a rate that would make a dragon blush.

However, their balance sheet is…solid. No debt, they claim. And a staggering $3.5 billion in cash and investments. A sum that could, theoretically, purchase a small principality. Or, more likely, fund a series of increasingly elaborate experiments.

IBM’s Measured Progress

IBM, unlike some of its competitors, has been toiling in the quantum fields for years. A slow, methodical process, characterized by careful calculation and a distinct lack of fanfare. Now, they promise…quantum advantage. By the end of 2026, they claim their machines will solve problems that are beyond the reach of conventional computers. A bold assertion, to be sure. But IBM, one suspects, is not a company prone to frivolous boasts.

They also aim for a fault-tolerant quantum computer by 2029. A machine that can correct its own errors. A truly remarkable feat of engineering. One imagines the countless hours of painstaking labor, the meticulous attention to detail, the sheer…stubbornness required to achieve such a goal.

Moreover, IBM is, demonstrably, profitable. Sales grew 8% to $67.5 billion, resulting in a net income of $10.6 billion. A figure that, when compared to the losses of some of its competitors, is…comforting. Free cash flow of $14.7 billion. A substantial sum, capable of funding dividends and further research. A dividend yield of 2.6%. A modest, but respectable, return on investment.

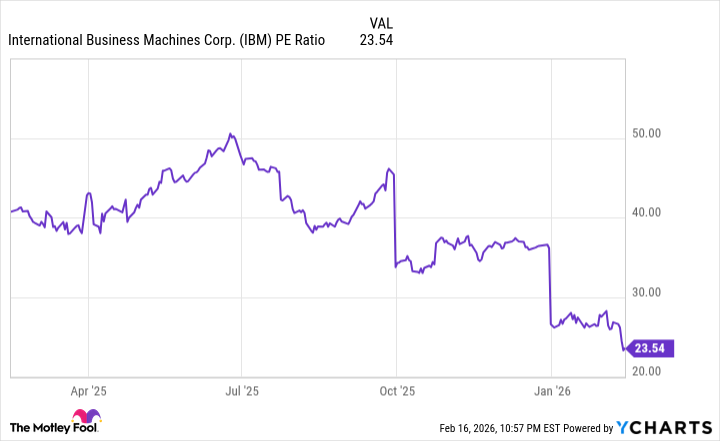

With its share price decline, IBM stock presents an…attractive valuation. A price-to-earnings ratio of about 24, near its lowest point in the past year. A signal, perhaps, that the market has…undervalued this venerable institution.

A prudent investor, therefore, might consider acquiring IBM shares. Not as a speculative gamble, but as a…calculated risk. A recognition that, in the chaotic realm of quantum computing, stability and profitability are virtues to be cherished.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- HSR Fate/stay night — best team comps and bond synergies

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Nvidia vs AMD: The AI Dividend Duel of 2026

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-02-20 00:22