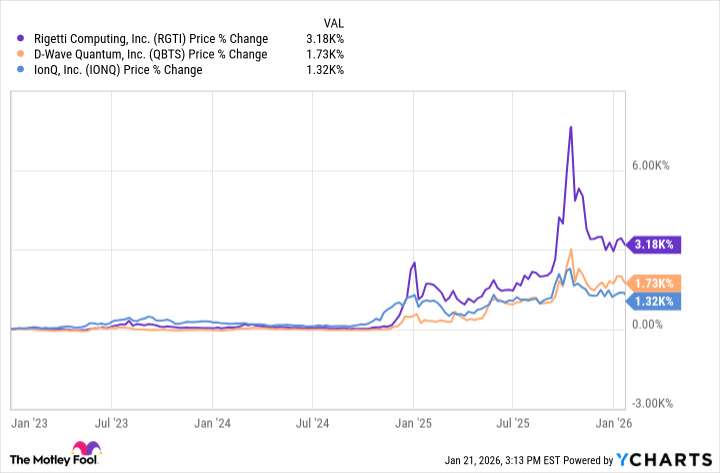

The current enthusiasm for quantum computing – a sector populated by concerns like Rigetti Computing (RGTI 5.95%), D-Wave Quantum (QBTS 6.56%), and IonQ (IONQ 4.22%) – recalls nothing so much as the South Sea Bubble, though without, as yet, the accompanying pamphlets promising fortunes based on the cultivation of exotic woods. Even Alphabet (GOOG 0.73%)(GOOGL 0.73%), that vast and generally sensible entity, has seen fit to dabble in this most speculative of ventures.

The premise, of course, is beguiling. That a machine might operate not on the pedestrian ‘bits’ that underpin our current digital existence, but on ‘qubits’ – entities existing in a state of, shall we say, enthusiastic uncertainty – and thereby unlock computational powers hitherto undreamt of. It is a prospect that appeals, naturally, to those with a surplus of capital and a deficiency in immediate application.

Ark Invest, a firm rather too readily associated with disruptive technologies – crypto-currencies and artificial intelligence being the more recent – has, one gathers, applied a certain cool scrutiny to the matter. One might have expected a more fervent endorsement, given their customary bullishness. Instead, a rather unsettling message has emerged.

A Cautionary Note

In their ‘Big Ideas of 2026’ presentation, Ark has suggested that practical application of quantum computing remains, shall we say, a project for the grandchildren. The performance, it appears, has been less than stellar. Billions have been expended, and yet Google has managed to double its qubit count only once in four years. A rate of progress that might generously be described as glacial.

The more qubits, naturally, the greater the potential power. But stabilizing these elusive particles proves problematic. Some optimists suggest that quantum technology will not only solve problems beyond the reach of today’s supercomputers but also offer a more secure method of encryption than the currently fashionable blockchain. A charming notion, though one suspects it is more wishful thinking than informed prediction.

Ark estimates that, at the current rate of improvement – qubits doubling and error rates decreasing by a modest 40% every four years – cryptographic decryption will not be within reach until 2063. A more aggressive scenario – doubling and a 40% reduction every two years – brings the date forward to 2044. One gathers the implication: a considerable wait, regardless.

Progress, undoubtedly, is being made. But pinpointing the moment when this technology will mature into something commercially viable – or even demonstrably useful – remains a matter of conjecture. Meanwhile, the companies involved trade at valuations that bear little relation to their current revenues, which are, to put it mildly, negligible.

I view concerns like Rigetti and D-Wave as distinctly speculative ventures. And the fact that Ark Invest, normally so eager to embrace the disruptive, is essentially advising investors to exercise restraint is, in itself, a rather ominous signal. One suspects that, in this particular field, the Emperor has no qubits.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Best Video Games Based On Tabletop Games

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

2026-01-25 01:33