My aunt Carol, a woman whose investment strategy peaks with clipping coupons for denture adhesive, recently asked me about quantum computing. “Is it like…the future?” she inquired, peering at me over her reading glasses. I explained, as patiently as one explains the offside rule to someone who primarily watches bowling, that it could be. It involves, essentially, tiny particles doing things that make even theoretical physicists slightly uncomfortable. And, naturally, someone is trying to turn a profit from it. That someone, recently, has been Rigetti.

The stock, RGTI, has seen a bit of a run – a 137.1% increase over five years. Which, frankly, feels less like shrewd investment and more like the kind of speculative bubble my Uncle Barry gets caught in with penny stocks and promises of revolutionary toilet attachments. I’m not saying it’s destined to fail. I’m just saying my portfolio needs a little more…certainty. Like, will I be able to afford a decent pair of walking shoes next year? That’s the level of risk I’m comfortable with.

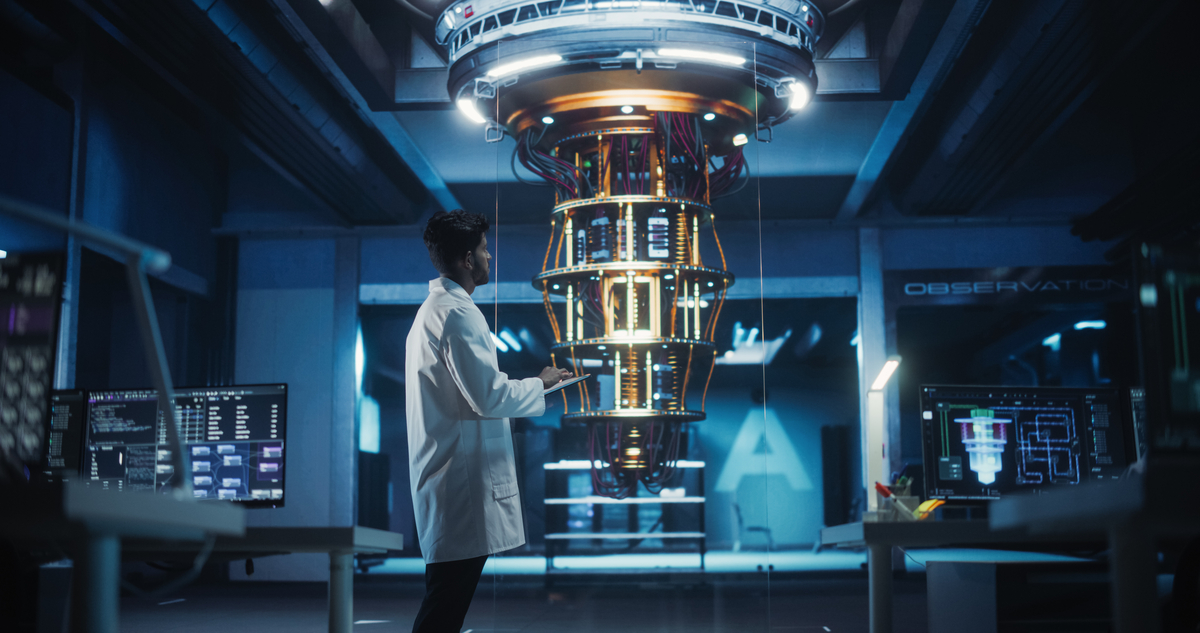

Because here’s the thing about quantum computing: it’s fascinating, incredibly complex, and currently about as useful to the average investor as a left-handed smoke shifter. There are prototypes, yes, hundreds of them. But scaling that up, making it reliable, affordable… it’s like trying to herd cats wearing oven mitts. Instead of bits, these machines use qubits, which are, as near as I can tell, Schrödinger’s cat in silicon form. They can be both 0 and 1 simultaneously, which sounds great until you realize that means your spreadsheet is constantly questioning its own existence.

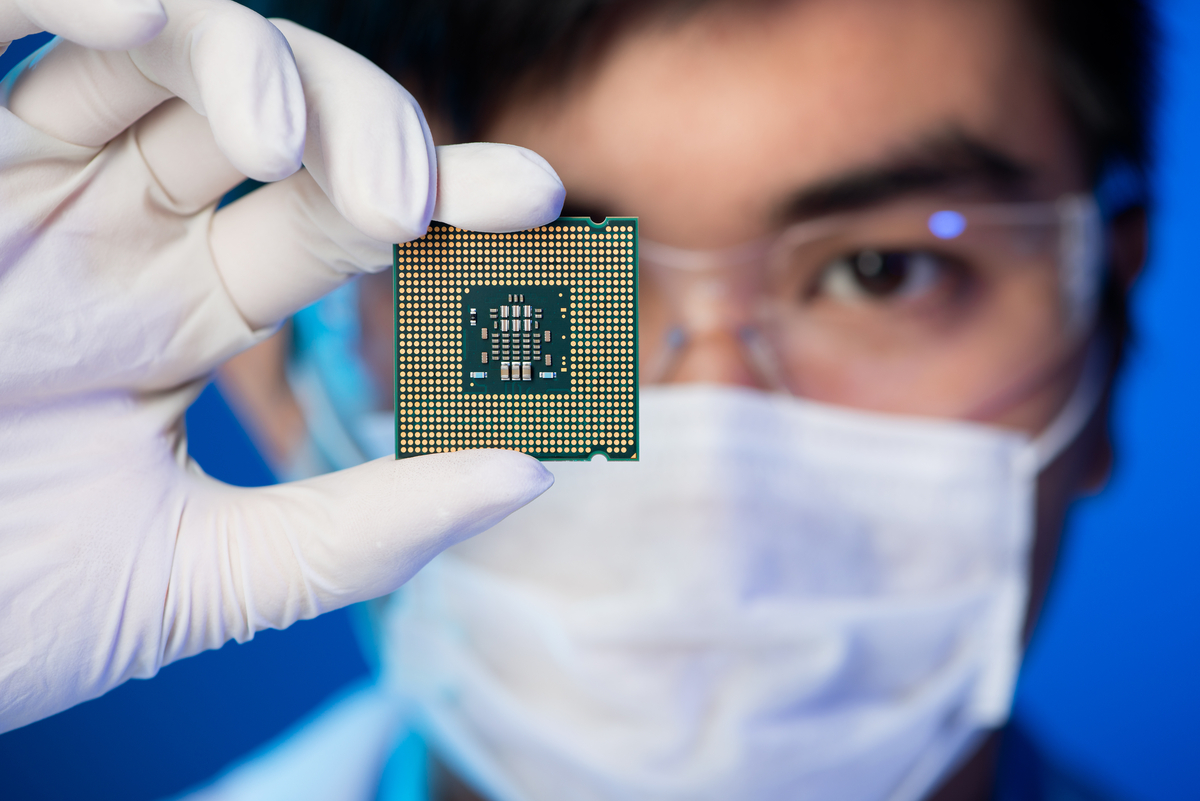

Google’s Willow chip managed a calculation in five minutes that would take a supercomputer trillions of years. Impressive, certainly. But my toaster takes about three minutes to achieve the perfect level of golden-brown, and I haven’t seen anyone rushing to invest in the appliance industry based on that metric.

Rigetti’s problem isn’t the technology, per se. It’s that the customer base is…limited. Government labs, universities, people with more money than sense. Their trailing twelve-month revenue? A modest $7.5 million. They did get an $8.4 million purchase order from India, which is good news, except it feels like they’re building a very expensive paperweight for a very discerning client. And they’re losing money, a lot of it – $351 million in the red. They’re funding this with new shares, which means my potential future gains are being diluted with every passing quarter. It’s like trying to fill a leaky bucket with seawater.

And the accuracy. Oh, the accuracy. Their two-qubit gate fidelity is 99%. Sounds good, right? Until you consider that these machines are performing billions of calculations per second. A 1% error rate quickly becomes…significant. My grandmother, bless her, has a higher success rate when predicting the weather.

Rigetti has about $450 million in cash, which sounds like a lot until you realize they’re burning through money at an alarming rate. It reminds me of my cousin, Dale, who once won the lottery and managed to squander it all on inflatable dinosaurs and a lifetime supply of mayonnaise.

Which brings me to IBM. Now, IBM isn’t a pure-play quantum company, and that’s precisely why I like it. They’re a diversified behemoth, with a strong foothold in cloud computing and AI. They’re not betting the farm on a technology that might not pan out for another decade. They’re building a sustainable business. And, crucially, they have clients. Over 210 of them, including Boeing, Wells Fargo, and the Oak Ridge National Laboratory. They’re partnering with RTX to develop quantum cryptographic technologies. They’re actually doing things.

IBM’s stock has been volatile, sure, but their 69.6% gain in net income over the last five years, coupled with a 2.3% dividend yield, makes them a much safer bet. It’s not glamorous, it’s not revolutionary, but it’s…reliable. Like a sensible pair of walking shoes. And, frankly, that’s what my portfolio needs right now. Something that won’t keep me up at night wondering if I’ve inadvertently invested in the future of theoretical physics…or just another bubble.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2026-01-29 23:43