Many years later, when the last server farm had succumbed to a digital melancholy and the rain tasted of silicon, old Mateo would recall the feverish bloom of quantum computing with a sigh. It began, as these things often do, with a promise – a shimmering illusion of infinite calculation, whispered on the wind and amplified by the insatiable appetite of the markets. Rigetti, they called it, a name that echoed with the brittle optimism of a forgotten alchemist. Like a moth drawn to a flickering lamp, investors flocked, seeking not just a return, but a glimpse into the impossible. The air itself, in those days, smelled of ambition and overheating processors.

Quantum computing, of course, is not a thing born of the present. It is a phantom limb of the future, reaching back to grasp at the intractable problems that have long haunted the halls of science. A world where calculations dance beyond the limitations of binary, where the very fabric of reality bends to the will of algorithms. But between the promise and the practicality lies a desert of engineering challenges, a vast expanse of unproven technology. The machines themselves, humming with barely contained energy, remain more akin to elaborate prototypes than to the engines of a new era.

And yet, the markets rarely concern themselves with such earthly details. They prefer narratives, legends, the scent of something new. Rigetti, alongside its brethren – IonQ and the enigmatic D-Wave – became the focal point of this frenzy. The stock, a fragile vessel carrying the weight of expectation, began to rise. It wasn’t a steady climb, mind you, but a series of breathless leaps and anxious corrections, as if the very shares themselves were attempting to escape gravity.

A Fleeting Bloom

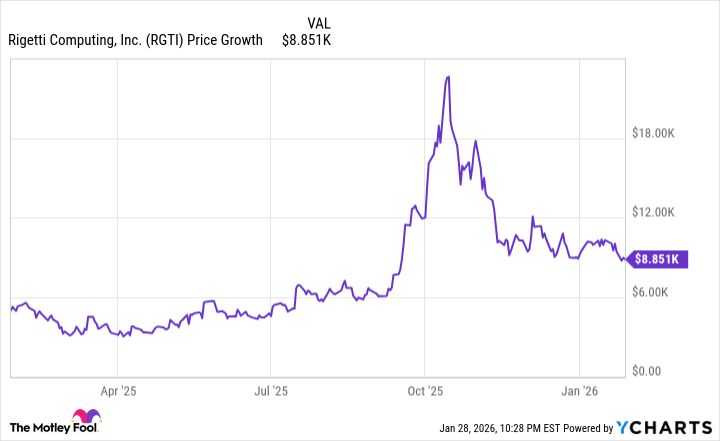

A year ago, the bloom was particularly vibrant. To have invested then, in January of 2025, would have yielded a respectable 77% return. Not insignificant, certainly. But those who arrived a few months earlier – those who dared to gamble on the very edge of the wave – witnessed a truly astonishing ascent, a gain exceeding 2,640%. A return of that magnitude, however, is rarely built on substance. It is more often a consequence of collective delusion, a temporary suspension of disbelief. To place $5,000 into Rigetti a year ago would have blossomed into $8,851. A pleasing sum, to be sure, but a phantom wealth, easily dissipated should the winds of fortune shift.

The Weight of Air

The truth, as it often does, lies beneath the surface. Rigetti, for all its promise, remains a company built on air. Its revenue over the past twelve months barely scrapes $7.5 million, while its market capitalization has swelled to over $7 billion. A disconnect of such magnitude is not a sign of innovation, but of irrational exuberance. It is as if the company is attempting to float on the sheer force of its own valuation, a precarious position indeed. The market, in its haste to embrace the future, has forgotten the fundamental principles of value. It has mistaken potential for profit, and hope for substance.

For those with a particularly high tolerance for risk – those who see speculation as a form of entertainment – a small stake in Rigetti might offer a fleeting thrill. But for the vast majority of investors, a more prudent path lies elsewhere. Consider, for example, Alphabet. A company that has already proven its ability to innovate and generate sustainable profits. A company that offers exposure to the quantum realm without the crippling weight of unrealistic expectations. In the end, the true measure of any investment is not its potential for growth, but its ability to withstand the inevitable storms of the market. And in that regard, Rigetti, for all its shimmering promise, remains a fragile vessel, adrift in a sea of uncertainty.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Where to Change Hair Color in Where Winds Meet

2026-01-30 22:12