In the 1990s, Nvidia (NVDA) pranced onto the semiconductor stage like a sprightly minuet, its graphics processing units (GPUs) designed to dazzle gamers with pixelated charm. Yet, co-founder and CEO Jensen Huang, with the flair of a stage magician, foresaw a grander spectacle: GPUs as the unsung heroes of parallel processing. One might say he saw the future in the flicker of a cathode ray.

QUBT”>

Is Quantum Computing the Next GPU?

Just as GPUs once graced the arcades of arcades, quantum computing remains a laboratory curiosity. The machines are complex, costly, and-much like a debutante at her first ball-have yet to prove their grace under pressure. Yet the potential, one must admit, is intoxicating. Unlike classical computers, which parse binary data like a rigid waltz, quantum computers leverage qubits and the whimsy of superposition to solve problems with a speed that would make a supercomputer blush.

Experts whisper of applications in drug discovery, financial modeling, and cryptography-fields ripe for disruption. The economic value at stake? Trillions, perhaps. But let us not mistake ambition for achievement. The gap between the pioneers’ dreams and the market’s demands remains a chasm, wide and yawning.

Analyzing Quantum Computing Inc.

Over the past year, Quantum Computing Inc. (QCi) has surged into the limelight like a society girl at a charity gala-dazzling, if slightly overdressed. Its shares have skyrocketed by over 3,200%, a performance that would make a seasoned Wall Street gambler whisper, “Darling, you’re on fire.” Yet for the astute investor, such momentum is a red siren, not a green light.

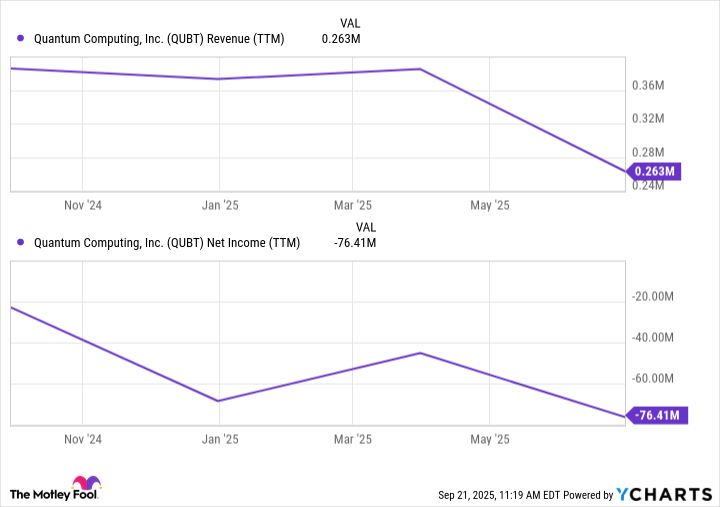

QCi’s financials? A modest trickle of revenue and a cash burn rate that would shame a Victorian opera. The company’s rise owes less to operational fortitude and more to retail investors’ penchant for speculative froth. It is, in essence, a meme stock with a quantum veneer-capitalizing on timing, not substance.

Is QCi the Next Nvidia?

Nvidia’s ascent was no mere branding coup. It was a masterclass in innovation, underpinned by CUDA, a software architecture so seamlessly woven into the tech ecosystem that developers became its unwitting serfs. Mr. Huang, ever the strategist, turned GPUs into the lifeblood of AI, data centers, and gaming. A moat, if ever there was one.

QCi, alas, lacks such defences. Its hardware and software lag behind peers, and its name-while marketable-fails to mask a dearth of traction. Meanwhile, the titans of tech (Microsoft, Alphabet, Amazon, and IBM) are already laying claim to the quantum frontier, their resources as vast as their ambitions.

Thus, QCi has become a plaything for day traders, a stock to be flipped like a deck of cards at a Monte Carlo casino. For those seeking exposure to quantum computing, prudence dictates investing in established players with diversified portfolios and the staying power to weather the quantum winter.

And there you have it. A tale of dreams and dollars, where the line between vision and vaporware is as thin as a well-tied cravat. 😉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2025-09-25 14:26