The market’s fevered breath has swept through the silicon canyons, chasing the ghost of quantum supremacy. In this parched terrain, two companies-IonQ and D-Wave-have carved out claims in the gold rush of electrons and algorithms. Yet beneath the glitter of stock price surges, the land is brittle with uncertainty.

IonQ’s shares have climbed 511%, a lean colt dodging the cactus spines of doubt. D-Wave, meanwhile, has leapt nearly 2,000%-a jackrabbit’s gamble, its feet never quite touching the earth. But in this desert of dreams, even the boldest bets are measured by the depth of their wells.

Let us walk this frontier, not as gilded prospectors but as men with pickaxes, digging for truth in the dust of financial statements and the whispers of cloud servers.

The Lone Ranger of Quantum: IonQ’s Clouded Horizon

IonQ rides into town not with a herd of servers but a lone horse-its quantum-as-a-service model. It’s a curious thing, this idea of leasing the future through the clouds of Microsoft, Amazon, and Alphabet. The townsfolk (startups, researchers, the desperate) can hitch their wagons to these giants and borrow IonQ’s magic. But magic, they say, is just science the world isn’t ready for.

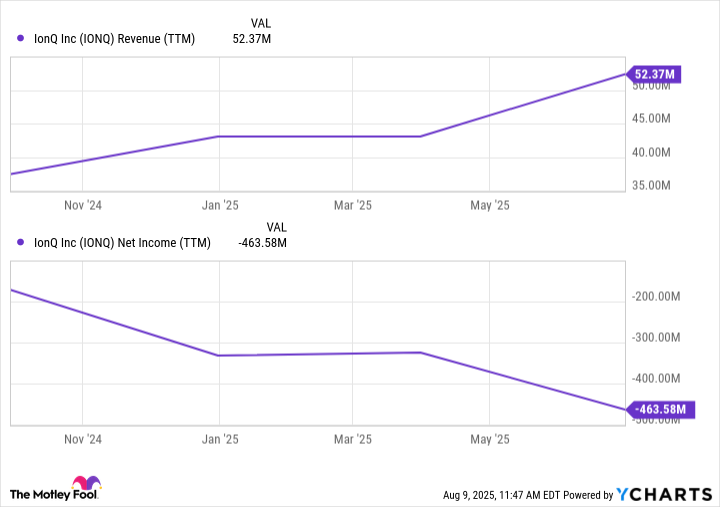

IonQ’s ledger tells a tale of parched soil and overworked derricks. Revenue grows like a sapling in a storm-slow, stubborn, and prone to snapping. But the company’s burn rate? A wildfire in a dry field. By midsummer, it had $140 million in its pocket, a meager pouch for a town needing a dam. Add the bonds it hoards-$656 million total-and you’d think it’s prepared for drought. Yet this is barely enough to keep the lights on for another year. The town’s elders mutter: more stock will be printed, more blood drawn from the veins of shareholders.

And so the question lingers, sharp as a cactus spine: Does IonQ’s quantum promise yield a harvest, or is it just another mirage?

D-Wave: The Quick Sand and the Mirage

D-Wave’s tools are for the desperate-annealing machines that solve narrow problems with the speed of a man running from a hailstorm. But like a well in the desert, its revenue is a flicker, not a spring. Below, a ledger reveals the truth:

| Category | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|---|

| Revenue | $1.9 million | $2.3 million | $15.0 million | $3.1 million |

| Net Income | ($22.7 million) | ($86.1 million) | ($5.4 million) | ($167.3 million) |

| Cash and equivalents | $29.3 million | $177.9 million | $304.3 million | $819.3 million |

D-Wave’s cash hoard grows like a mirage-$819 million by midsummer. But where is the rain to fill it? The answer lies in the ATMs of Wall Street. Like IonQ, it siphons liquidity from the same spigot, selling shares to strangers who bet on the ghost of quantum supremacy. The numbers are a paradox: a town with a gold mine in its pocket and a saloon that never fills its cups.

Yet the town’s sheriff (management) insists all is well. “We’re building for the future,” they say, as the ground shifts beneath their boots.

The Verdict: A Gamble in the Desert

If I were to stake my claim, I’d lean toward IonQ. Its QaaS model feels like a seed in good soil, even if the harvest is years away. D-Wave, for all its cash, is a ghost town with a gilded façade. But make no mistake-both are bets on a mirage.

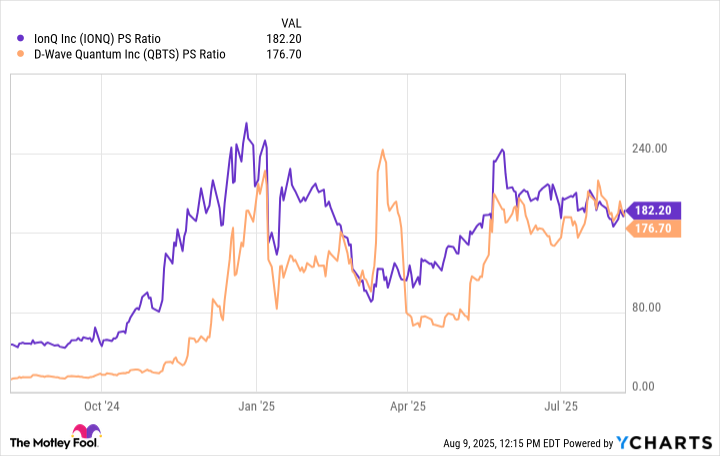

These companies ride the market’s back like wild broncos, their valuations bloated with the same speculative air that once inflated tulip bulbs and dot-com dreams. The ranchers (investors) who buy in now are chasing a ghost. Their fences (capital) are built on sand, and the wind (volatility) is always at their backs.

There’s dignity in the gamble, yes-but also a kind of quiet tragedy. For in this silicon frontier, the small man (the retail investor) is always the one who pays the toll. Unless you’re a gambler with a high tolerance for ruin, these stocks are a fire you warm your hands to at your own peril.

And so the market moves on, a river of electrons and hope, carving canyons where dreams once stood. 🌪️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-13 16:02