Right. So, quantum computing. Everyone’s terribly excited. Faster computers, apparently. It sounds…expensive. And complicated. Companies are throwing money at it, naturally. One, called Quantum Computing (QUBT 4.50%), or QCi for short, is trying to do it with light. Photons, if you must know. It’s all very…modern. And they do it at room temperature, which is good, because I really can’t cope with anything that needs to be supercooled. It just adds to the list of things that could go wrong.

The stock has, apparently, soared. 591% in three years. Which is…a lot. It makes you wonder if everyone else knows something you don’t. Or if it’s just…a bubble. I’m leaning towards the bubble. I’m always leaning towards the bubble. It feels safer. Anyway, despite the impressive numbers, I’m not touching it. Not with a ten-foot pole. Or even a very long selfie stick. Here’s why. It’s a list, because lists are helpful when you’re on the verge of a financial breakdown.

It’s Priced Like a Lost Unicorn

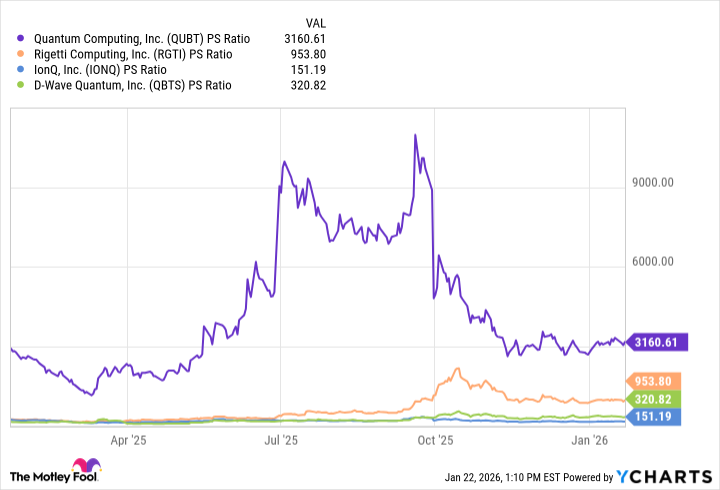

They haven’t actually made much money, have they? Just $546,000 in the last year. And the company is worth $2.7 billion. That’s…a lot of faith in photons. It’s over 3,000 times sales. Honestly, it’s like pricing a slightly used toaster at the cost of a small island. For comparison, Nvidia – which, let’s be honest, actually makes things – trades at a much more sensible 20-40 times sales. Even the other quantum hopefuls – D-Wave, IonQ, Rigetti – look positively frugal. See chart below. It’s terrifying.

They say the room-temperature thing is a big deal. And low power. Which is good. I’m all for low power. My electricity bill is already a source of constant anxiety. But honestly, who knows which quantum method will actually work? It feels like betting on a horse that hasn’t been born yet. And even if it does, it might turn out to be a donkey.

Share Dilution: A Constant Source of Dread

They have a lot of cash. Over $1.5 billion. Which is reassuring, I suppose. Quantum computing is expensive, and you don’t want them running out of money mid-experiment. But where did all this cash come from? New shares. Lots and lots of new shares. Three years ago, there were about 60 million shares outstanding. Now there are 224 million. Which means if you invested three years ago, your piece of the pie is now…about a quarter of the size it used to be. It’s like a slow, agonizing erosion of your financial future.

Dilution can be okay, if it actually leads to growth. But their earnings are still tiny. It feels a bit like they’re just printing money to stay afloat. It’s a vicious cycle. And it keeps me awake at night.

The Competition is…Intense

Okay, so let’s say QCi actually does crack the quantum code. Great. But so could D-Wave, IonQ, Rigetti…they’re all trying to solve the same problem, just in different ways. And then there are the tech giants. Alphabet, IBM, Nvidia…they’re all throwing money at this too. It’s like a crowded race, and QCi is starting with a very small bicycle.

Their revenue is a fraction of their competitors’. The valuation is sky-high. The risk is enormous. So, yeah. I’m avoiding it. I’m going to stick to slightly less terrifying investments. Perhaps a nice, stable index fund. Or a really good mattress. Because frankly, the stress of this whole thing is giving me palpitations.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. Will become disciplined long-term investor: 0.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- Top 15 Celebrities in Music Videos

- Top 15 Movie Cougars

- Top 20 Extremely Short Anime Series

2026-01-25 11:42