Last year, darling, was rather selective in its affections for quantum computing ventures. Some flourished, others…didn’t. One suspects the market, like a particularly fussy aunt, simply prefers a bit more demonstrable progress before showering accolades.

IonQ, bless its ambition, actually managed to outpace the S&P 500 – a mere 17% gain, but one mustn’t be greedy. Rigetti Computing, with a positively exuberant 75% leap, was clearly having a good time. And D-Wave Quantum? Well, quadrupling in value is simply showing off. Quantum Computing, however – the singular entity – lagged behind. A mere 5% return. Rather tiresome, really.

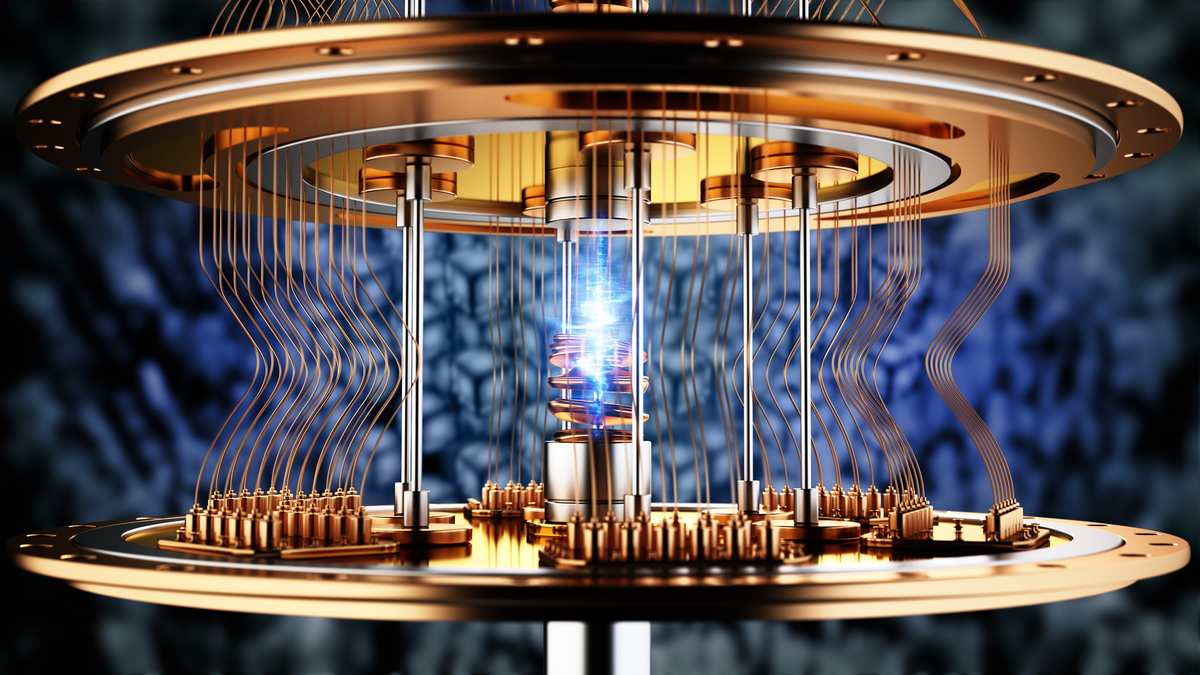

What, Precisely, Is Quantum Computing?

The aim, as I understand it, is to create quantum machines that are both affordable and, crucially, don’t require one to build a miniature arctic landscape around them. Room temperature operation, you see, is the key. One simply hasn’t the staff to manage all that liquid nitrogen. A perfectly sensible ambition, though achieving it appears to be proving…challenging.

They recorded their first revenue in 2022 – a charming $136,000. Three years later, they’re still struggling to break the million-dollar mark. Losses are substantial – around $68 million in the last year – though the actual cash burn is a slightly less alarming $31.5 million. One begins to suspect a rather extravagant office coffee budget.

But why, you ask, does one entertain the notion that 2026 might be…different?

A Spot of Momentum, Perhaps?

Let’s be clear: Quantum Computing isn’t on the verge of collapse. It’s simply…slow. It’s burning cash, naturally, but it possesses a rather impressive $555 million in reserves. Enough, apparently, to keep the show on the road for another 17 years at the current rate. One assumes they’re not investing in particularly exciting stationery.

The interesting thing about 2026 is the potential for…acceleration. From a rather modest base, revenues grew by 55% year-over-year through the first nine months of last year. Analysts anticipate a full 100% for the year. And in 2026? They’re predicting a surge to $2.8 million, followed by a quintupling to $15 million in 2027. If, of course, it actually happens.

It won’t turn them profitable – not until 2029, apparently – but it might attract the attention of those tiresome “momentum traders.” One shudders to think.

A Short Squeeze, You Say?

The slow start has, understandably, left most investors rather unimpressed. Currently, 48.6 million shares – over a fifth of the total – are sold short. If Quantum Computing delivers on its projections, and investors regain a modicum of confidence, this stock could take off. A short squeeze, you see. A perfectly predictable, and rather vulgar, display.

I haven’t quite reached the point of buying the stock, myself. But I would advise extreme caution to anyone contemplating a short position in 2026. One wouldn’t want to be caught with one’s trousers down, darling. Not at all.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Games That Faced Bans in Countries Over Political Themes

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

- Most Famous Richards in the World

2026-01-25 15:12