![]()

It’s often said that the universe is expanding. Which is, frankly, a bit rude. As if it’s not crowded enough already. And speaking of things expanding – or, more accurately, not expanding at quite the rate everyone hoped – let’s discuss Intel. A perfectly respectable company, of course, but currently experiencing a bit of a gravitational wobble. Their recent earnings report, while not actively hostile, suggested a trajectory less “up and to the right” and more… “slightly downwards, with a possible sideways drift.” A 16% share price adjustment followed. It’s a reminder that even the most established entities aren’t immune to the chaotic whims of the market. (Which, incidentally, is a complex system governed by forces we barely understand, much like a particularly stubborn garden gnome.)

But don’t despair. Because while one technological behemoth appears to be navigating a particularly dense patch of space-time, another is quietly positioning itself for, well, not necessarily dominance, but a comfortably advantageous orbit. We’re talking about Qualcomm. A name that, for many, still conjures images of mobile phones. Which is a bit like judging a planet by its weather. They do rather more than just facilitate conversations and cat videos, you know.

More Than Just a Phone Chip – It’s a Conspiracy (of Competence)

Qualcomm’s evolution from purveyor of pocket-sized communication devices to architect of advanced processing power has been, shall we say, understated. It began, back in 2007, with the Snapdragon processor. A chip that, at the time, was genuinely impressive. (Though, let’s be honest, most processors are, in their own silicon-based way. It’s just a matter of how impressive.) The timing, however, was… unfortunate. It coincided with the launch of the first iPhone. A device that didn’t just raise the bar for smartphones; it launched the bar into orbit. (And then charged a premium for the oxygen.)

Undeterred, Qualcomm continued to refine its ARM-based technology. A crucial decision, given that ARM processors are remarkably efficient. (Which is fortunate, because inefficiency is, generally speaking, a bad thing. Unless you’re a sloth. Then it’s practically a lifestyle choice.) This led to the development of AI-capable processors that could handle increasingly complex tasks directly on the device, freeing users from the tyranny of cloud-based services. (The cloud, while convenient, is essentially someone else’s computer. A disconcerting thought, really.)

Then, in 2023, they unleashed the Snapdragon X Elite. A processor specifically designed for laptops, capable of handling generative AI tasks directly on the device. (Meaning you can create art, write stories, and generally pretend to be a genius without relying on a distant server farm.) Major PC manufacturers – Microsoft, HP, Dell – have embraced it, touting its energy efficiency and on-board AI capabilities. (Which, let’s face it, is a good selling point. Everyone loves a laptop that doesn’t overheat and occasionally displays sentience.)

But the ambition doesn’t stop there. Qualcomm is now venturing into new territory: automobiles and AI data centers. (Yes, you read that correctly. They’re trying to power both your commute and the machines that are slowly learning to replace us. A bold strategy, to say the least.) While they’re not about to dethrone Nvidia or Intel in the data center market anytime soon, they’re offering a viable alternative. (Competition is good, after all. It forces everyone to innovate, or at least pretend to.) The AI200 and AI250 chips promise impressive performance and efficiency. (The details are, admittedly, rather technical. Something about rack-scale performance and superior memory capacity. It’s enough to say they’re fast and don’t require a dedicated cooling system.)

Forget the Past, Invest in the Improbable

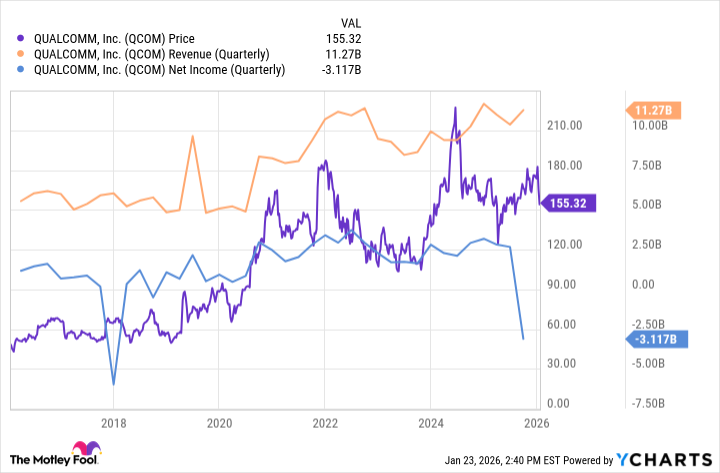

Qualcomm’s developmental efforts haven’t yet translated into significant revenue growth. The stock price has been, shall we say, restrained since late 2020. (It’s been up, down, and sideways, like a confused penguin.) This is largely due to the post-pandemic slump in smartphone demand. (Approximately three-quarters of Qualcomm’s revenue still comes from mobile handsets. A sobering reminder that even the most innovative companies are vulnerable to the whims of consumer behavior.) Supply chain issues are also a factor. (Because nothing is ever simple, is it?)

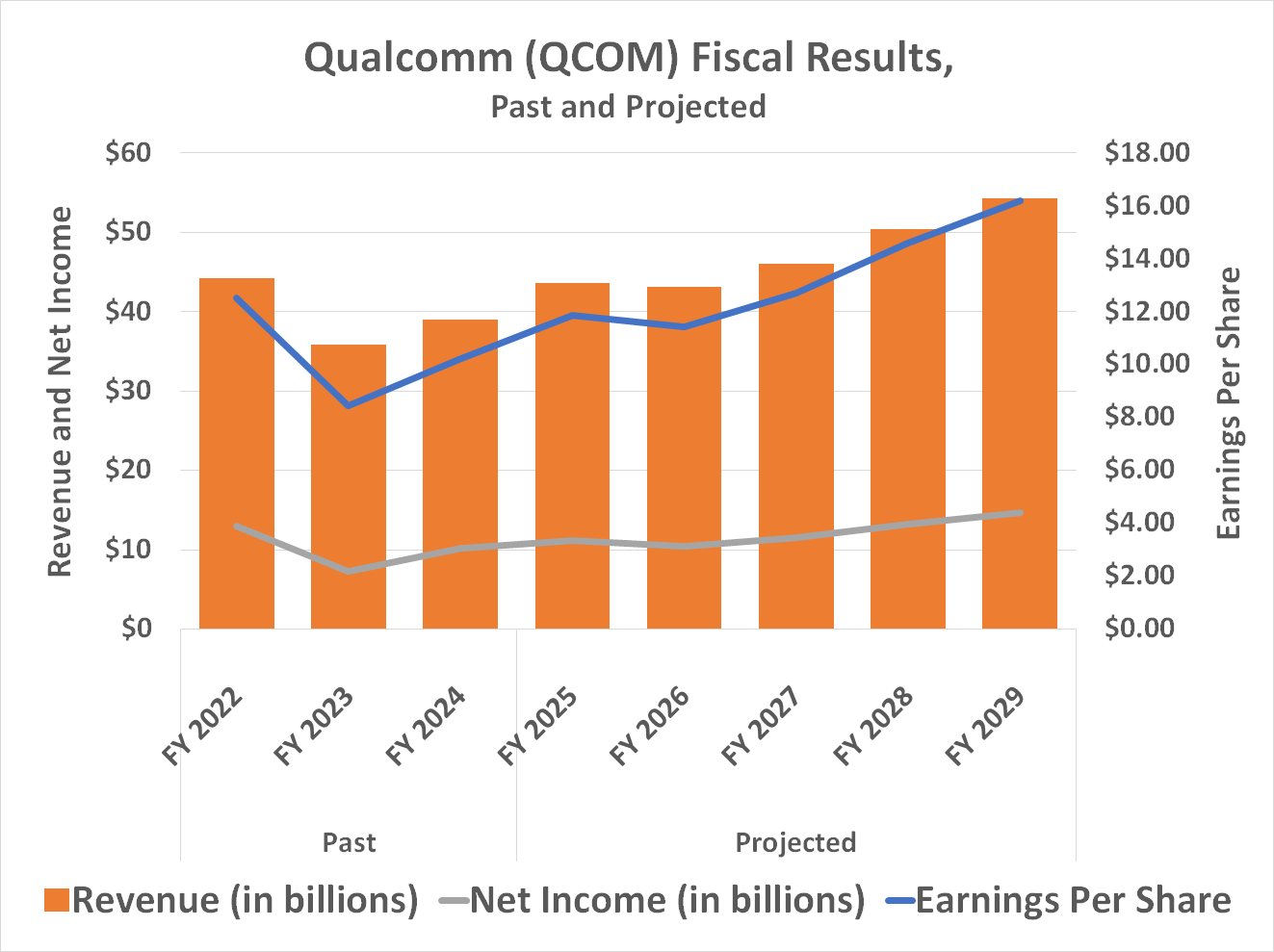

But the truly astute investor isn’t fixated on the past or even the present. They’re looking towards the future, trying to discern where a company is heading. (Because, ultimately, the stock price will follow.) And in Qualcomm’s case, the future looks remarkably bright. Once the AI200 and AI250 processors are fully deployed, analysts predict accelerated sales and earnings growth. (A comforting thought, given the current state of the universe.)

This growth will be further bolstered by demand for next-generation smartphones, AI-capable laptops, and the increasing adoption of AI in automobiles and edge computing solutions. Precedence Research predicts the global AI processor market will grow at an average annual rate of over 26% through 2034, reaching over $460 billion. (A truly staggering number. Enough to buy a small planet, probably.) All of these trends align perfectly with Qualcomm’s long-term strategy. (They’ve been patiently waiting for this moment, like a chess master setting a trap.)

Qualcomm doesn’t need to capture the entire market to succeed. Even a modest share of this growth could yield significant returns. The challenge, of course, is patience. (A virtue in short supply in the modern world.) Fortunately, the company’s current dividend yield of just under 2.3% provides a small incentive to remain calm. (A little something to tide you over while the AI revolution unfolds.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-01-28 00:54