As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of meme coins and their wild price swings. The recent surge of Pudgy Penguins (PENGU) has piqued my interest, given its rapid rise and the subsequent cautionary signs in the technical indicators.

With a background in both fundamental and technical analysis, I always look for a balanced approach when making investment decisions. In the case of PENGU, the recent 9% price increase and surging trading volume are certainly eye-catching. However, the RSI and ADX readings suggest that while there is momentum, it’s not as strong or sustained as some may think.

The current RSI of 51 indicates a neutral market, with buying pressure diminishing somewhat but still within the neutral zone. This suggests that traders are assessing the next direction for PENGU price, hinting at a potential consolidation phase. The weakening trend strength, as indicated by the declining ADX, further supports this notion of reduced directional force in the market.

While I’m not suggesting that PENGU won’t reach its targets at $0.045 and $0.05, I would advise caution. The lack of strong trend strength means that the price may experience limited volatility unless the indicators show a decisive shift in buying or selling pressure.

Remember, even the most promising meme coins can be unpredictable, and as the saying goes, “you can’t make an omelette without cracking a few penguins.” So, keep your investments diversified and always do your own research before jumping into any new opportunity!

As a researcher, I’ve noticed an intriguing surge in the value of Pudgy Penguins (PENGU) over the past 24 hours, with a remarkable increase of more than 9%. This uptick has been accompanied by a staggering 150% rise in trading volume, pushing it to an impressive $907 million. Currently, PENGU stands as the second-largest meme coin on Solana, just behind BONK. The growing interest in Pudgy Penguins is evident as its market capitalization approaches the $2 billion mark. This development is certainly worth keeping an eye on!

Although a recent increase in RSI and a bullish outlook suggested by DMI exists, the overall trend’s intensity is still relatively low, indicating a cautious optimism among traders. Meanwhile, the altcoin is approaching a significant resistance level at $0.043, with possibilities for further growth or a sudden drop based on whether the current momentum persists or reverses.

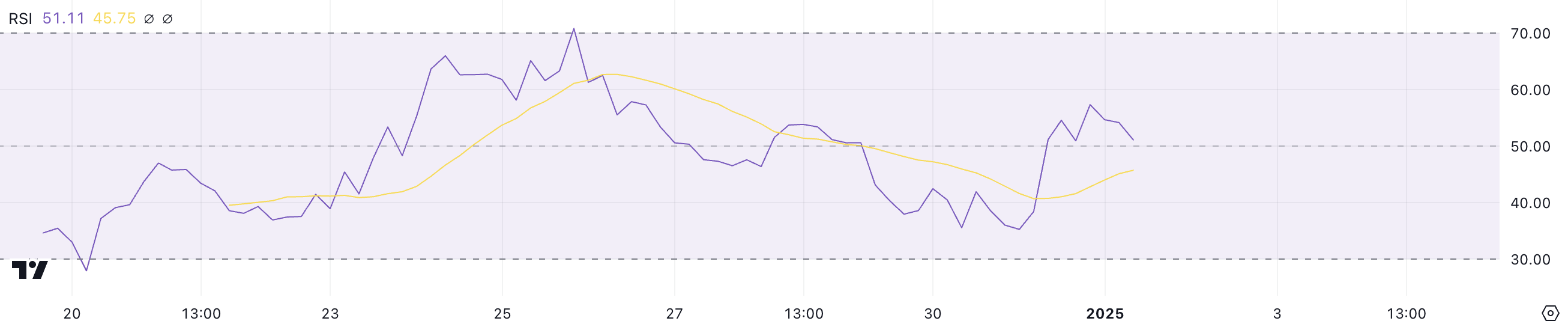

PENGU RSI Spikes but Remains in Neutral Zone

The PENGU Relative Strength Index (RSI) stands at 51 today, which is a slight drop compared to yesterday’s 57. This change follows a rapid rise from 35 that occurred within a day. This shift suggests a decrease in buying pressure, but the RSI remains within the neutral range.

The swift rise from undervalued positions indicates a recent period of recuperation, yet the steady holding near 51 implies a moment of contemplation among traders as they ponder the upcoming trend for PENGU’s price movement.

The Relative Strength Index (RSI) is a tool used in trading that evaluates the rate at which prices are changing between zero and one hundred. Values over seventy imply the market might be overbought, potentially requiring a correction. Conversely, values below thirty could indicate an oversold market, possibly preparing for a price surge.

Using PENGU’s Relative Strength Index (RSI) at 51, the indicator suggests neither a strong bullish nor bearish trend is present, indicating market uncertainty. In the immediate future, this neutral RSI reading implies that the price of PENGU might stabilize unless an increase in buying or selling pressure clearly tips the scale towards a definite trend direction.

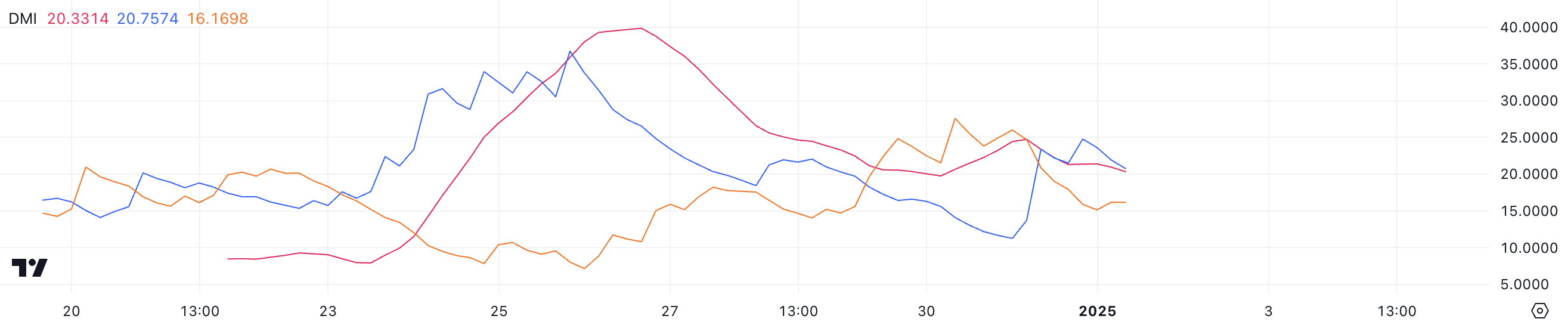

PENGU Trend Lacks Strength

PENGU’s DMI chart reveals its ADX at 20.3, a slight decrease from yesterday’s 25 level, suggesting a lessening trend strength. This drop in ADX implies that while there was some strong momentum earlier, the market is now moving towards a period of decreased directional pressure.

Based on a +DI of 20.7 and a -DI of 16.1, the chart suggests a predominantly bullish trend, as buying activity exceeds selling activity, although this difference is relatively subtle.

The Average Directional Index (ADX) gauges the intensity of a market trend, ranging from 0 to 100, irrespective of its direction. A value exceeding 25 signifies a robust trend, whereas readings under 20, such as PENGU’s 20.3, imply a weak or non-existent trend. The fact that the Positive Directional Index (DI) is slightly greater than the Negative DI indicates that the bullish drive continues; however, the decreasing ADX hints at insufficient force driving the movement.

For a while, it’s likely that PENGU’s price will remain relatively stable, unless the Average Directional Index (ADX) increases significantly to signal a more robust trend, or if the directional indicators suggest a clear change in demand or supply dynamics.

PENGU Price Prediction: Will It Reach $0.05 in January?

In the past day, the value of PENGU has surged by more than 9%, propelling its market capitalization to a whopping $2 billion. This places PENGU among the largest meme coins on Solana, as robust momentum fuels optimistic expectations. If this upward trend persists and gains further strength, we could see the PENGU price challenging the resistance at approximately $0.043 in the near future.

Overcoming the current hurdle might pave the way for additional advancements. With sights set on $0.045 and $0.05, PENGU could potentially reach or even exceed its prior record highs, regaining its dominance over BONK in terms of market capitalization.

Should the trend flip and bullishness wane, the PENGU price might see a significant drop. The most robust support it has is around $0.025 – an essential level that should ideally be maintained to avoid any additional decrease.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-02 00:04