As a researcher with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of volatility and unpredictable price movements. The recent downturn in PENGU‘s price has caught my attention, as it approaches a critical support level at $0.0229.

The price of PENGU has dropped more than 10% in the last 24 hours, reaching fresh lows amidst intense selling across the cryptocurrency sector. If it falls below the key support level at $0.0229, this could influence its near-term direction. A drop beneath this level might cause PENGU to slip under $0.020, potentially triggering additional losses.

If the purchasing power switches back to buyers, the PENGU price might aim for resistance points at around $0.030, $0.034, and possibly $0.039. This scenario could result in a potential increase of 56% compared to its current value.

PENGU RSI Shows a Neutral Zone

Currently, PENGU’s Relative Strength Index (RSI) is at 48.95 – this marks a significant increase following a dip below 20 previously. The RSI is a tool that assesses the rate and intensity of price changes, fluctuating between 0 and 100.

The RSI levels provide valuable information about market situations. When the RSI is less than 30, it signals an overbought state, implying that the asset might be underpriced and could offer profitable purchasing chances.

In other words, when Relative Strength Index (RSI) goes above 70, it indicates that an asset could be overbought, suggesting potential selling pressure as the asset may be overvalued. A RSI between 30 and 70 indicates neutral conditions, often associated with periods of consolidation or a slow and steady trend development.

Using PENGU’s Relative Strength Index (RSI), currently standing at 48.95, indicates that the asset’s price is neither unduly bearish nor bullish. The recent recovery from severely oversold conditions below 20 indicates a decrease in selling pressure.

For a brief period, when the Relative Strength Index (RSI) hovers around 50, it suggests uncertainty in the market. The PENGU price may stabilize as traders consider whether to foster bullish energy or if bearish pressure will return again. Moving above 50 might suggest an increase in bullish power, while a decline towards 30 could hint at renewed bearishness.

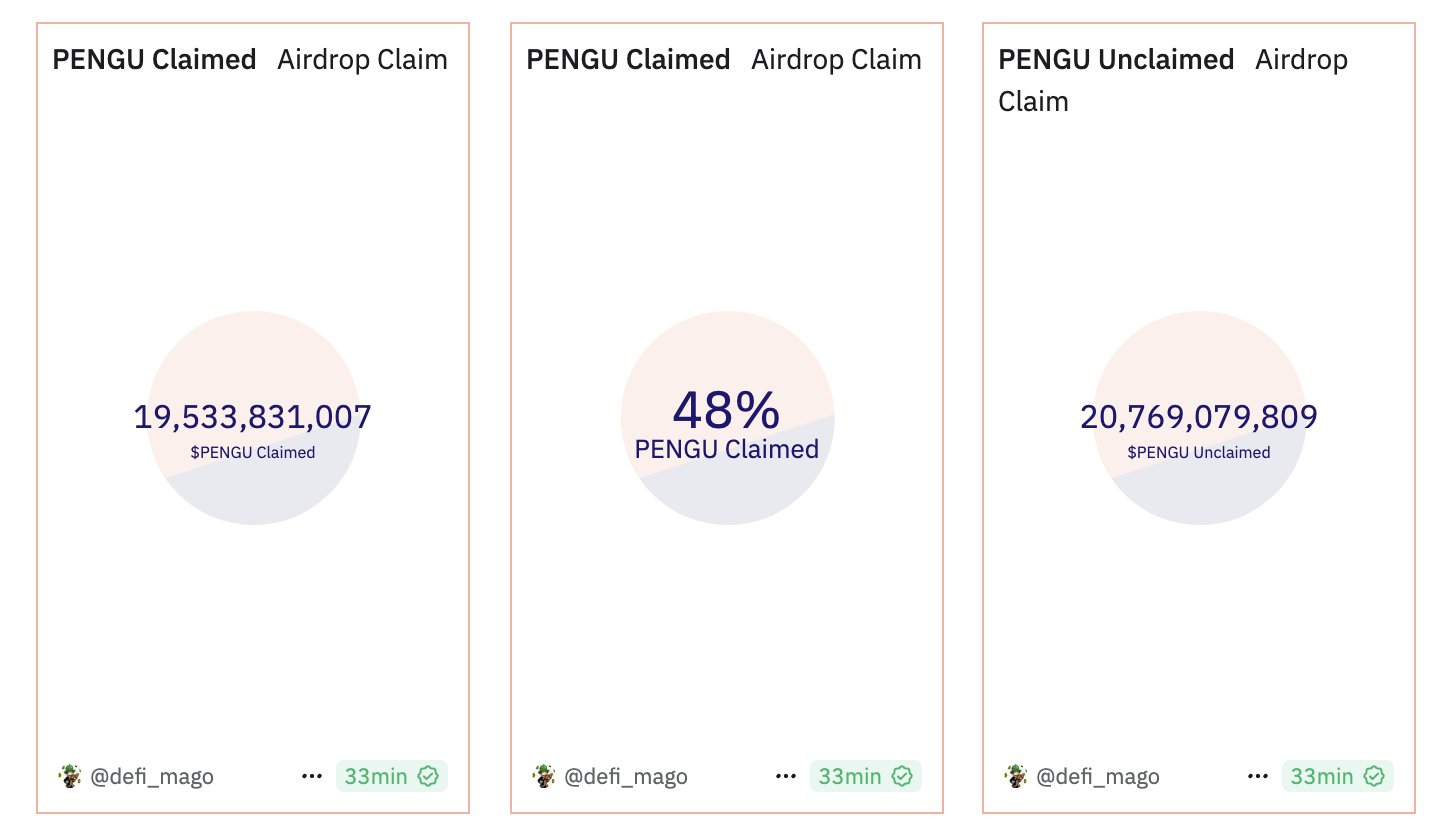

48% of PENGU Available In the Airdrop Were Claimed

About half of the PENGU airdrop supply has already been claimed, which means there are more than 20 billion PENGU tokens yet to be claimed. This large quantity of unclaimed tokens could potentially end up in the trading market.

Receiving a token via an airdrop can lead to an increase in supply, which might induce some sellers to offload their new tokens promptly, especially if the cryptocurrency has previously shown price growth. This quick selling could potentially put pressure on the market and cause prices to drop.

For a while, if the unused tokens aren’t claimed, they might pose as a possible burden for the PENGU price. Should many of these tokens be claimed and quickly sold, it may boost supply, intensify selling pressure, and potentially depress the market value.

If these leftover tokens are taken gradually by users or kept rather than being purchased, the effect on the market might be less intense.

PENGU Price Prediction: Will It Make New Lows?

The cost of PENGU is nearing a significant support point at around $0.0229. If this level doesn’t keep the price up, it may continue to drop, possibly going below $0.020 and reaching new lows. Therefore, $0.0229 becomes an important area for buyers to step in and prevent further decline, as they try to halt any more bearish trends.

If PENGU manages to gain significant traction and create a solid upward trend, it might initially aim for resistance at around $0.030. Overcoming this barrier could pave the way towards $0.034, and if successful, it may even reach $0.039.

such an increase would amount to approximately 56%, implying that it would necessitate substantial buyer enthusiasm and a marked shift in the overall market outlook towards optimism.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-20 20:39