It is a truth universally acknowledged, that a gentleman (or lady) in possession of a comfortable fortune, must be in want of a judicious investment. Should one find oneself with five thousand dollars not immediately required for household necessities, nor unduly risked in the pursuit of emergency funds, a careful consideration of the current market presents several opportunities most deserving of attention. These are not ventures for the speculative gambler, but rather for the discerning investor who recognizes the burgeoning influence of what is now termed ‘artificial intelligence’ and seeks to partake in its anticipated prosperity.

It appears to me that shares in Nvidia (NVDA +8.01%), Broadcom (AVGO +7.26%), Taiwan Semiconductor Manufacturing (TSM +5.57%), and Microsoft (MSFT +2.00%) offer a particularly sound footing for future gains, and merit the closest examination. One might consider them, in essence, the most eligible partners in a rather promising financial dance.

Nvidia

Nvidia, presently enjoying a position of considerable esteem – indeed, it is the most highly valued company in the realm – owes its elevation to a relentless demand for its graphics processing units. These are, it seems, the preferred instruments for the training and execution of these new ‘intelligent’ systems. Even after a period of robust growth, the prospects for the coming years remain exceedingly favorable. One observes a certain eagerness amongst the technological set for these devices, a desire that appears unlikely to abate soon.

Analysts predict a growth of fifty-two percent in the coming fiscal year, a figure that, while substantial, does not appear entirely unreasonable given the circumstances. Some express concern over a potential ‘bubble,’ but such anxieties often stem from a lack of understanding. Nvidia, it seems, is providing the essential tools for this new ‘rush,’ and will likely prosper even should the initial excitement diminish. A prudent acquisition of Nvidia shares, therefore, appears a most sensible course.

Broadcom

Broadcom, while not directly challenging Nvidia’s dominance, pursues a different, and perhaps more subtle, strategy. Rather than attempting to replicate the graphics processing unit, they have devised application-specific integrated circuits, which appear to be gaining favor amongst those who manage the largest of computing endeavors. These specialized chips, it is said, offer superior performance for particular tasks, though they require a degree of configuration that not all possess. The advantage, naturally, extends to a more moderate cost.

Those with unlimited resources are increasingly drawn to these efficient designs. Broadcom anticipates a doubling of its AI semiconductor revenue in the current quarter, a rate of growth that surpasses even Nvidia’s. While these chips are unlikely to entirely displace the graphics processing unit, they may well capture a portion of the market, leaving ample opportunity for both companies to flourish.

Taiwan Semiconductor Manufacturing (TSMC)

TSMC occupies a uniquely advantageous position, being the foremost manufacturer of these complex chips. No other company possesses their technological expertise or production capacity, making them the preferred foundry for nearly all who compete in this ‘arms race.’ Thus, an investment in TSMC offers a neutral, yet secure, means of participating in the expansion of artificial intelligence. It is a most convenient arrangement, allowing one to profit from the endeavors of others without directly aligning with any particular faction.

So long as expenditure on artificial intelligence remains elevated – and current projections suggest it will persist through at least 2030 – TSMC’s fortunes are likely to remain favorable. Analysts foresee a growth of thirty-one percent this year, and twenty-two percent the next, measured in New Taiwan dollars. Currency fluctuations may somewhat affect these figures, but they remain impressive and justify a careful consideration of the stock.

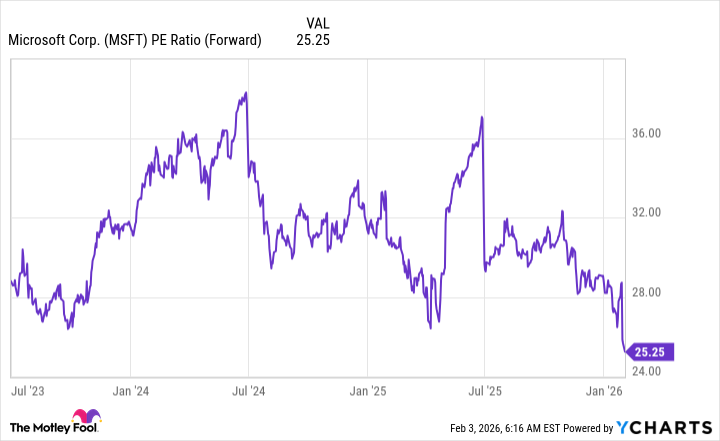

Microsoft

Microsoft, with its involvement in both the application and infrastructure of artificial intelligence, appears well-positioned to benefit from its expansion. Its cloud computing platform, Azure, is experiencing both market share growth and a substantial increase in revenue. The revenue rose an impressive thirty-nine percent year over year. The company still has a backlog of six hundred and twenty-five billion dollars, suggesting that there is much growth to come.

However, the market has recently expressed some dissatisfaction, causing a temporary decline in the stock price. This presents a rare opportunity for a prudent investor, allowing one to acquire shares at a most advantageous price. A temporary setback, it seems, should not deter one from recognizing the underlying strength of the company.

I believe this presents a rare buying opportunity for Microsoft stock, and investors should use this temporary sell-off to their advantage and scoop up shares now.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-07 19:52