As a seasoned traveler and investor with over two decades of experience, I find Madison Mills’ analysis of the weakening U.S. dollar to be both insightful and timely. Her ability to dissect complex economic issues and translate them into practical implications for everyday consumers is truly commendable.

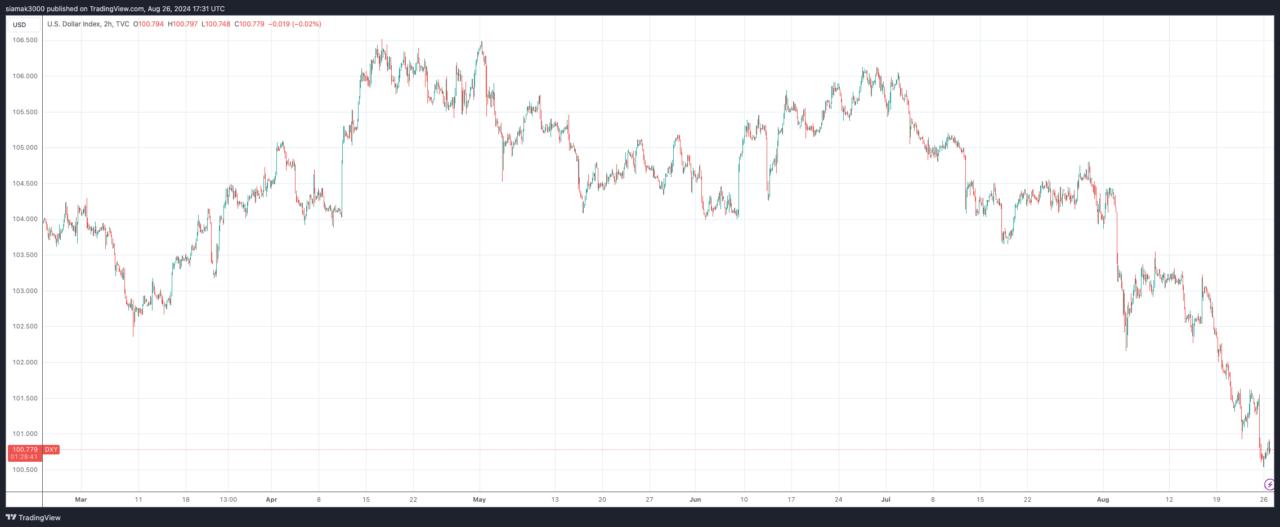

As a researcher, I’ve noticed a consistent decline in the strength of the U.S. dollar over the recent months. At first glance, this trend might raise some alarm, but delving deeper into the matter, as suggested by Madison Mills on Yahoo Finance, offers a more nuanced perspective. Her analysis encompasses both the potential advantages and disadvantages that a weaker dollar might bring.

In her comprehensive analysis, Mills explains the potential effects of currency depreciation on factors such as inflation rates, consumer costs, tourism, and investment prospects.

Inflation and Domestic Prices

In her analysis, Mills first focuses on a key issue for consumers: the risk of inflation. She points out that a weakened U.S. dollar might cause an increase in the prices of imported goods, potentially boosting inflation within the country. Given that numerous common products are imported, a weakening dollar means these items become more expensive to buy. Mills underscores the importance of monitoring this situation closely, especially when economic strategists evaluate the broader impacts of currency changes. The possibility of heightened inflation due to a weak dollar is a substantial drawback, as it can directly impact the buying power of American consumers.

Impact on International Travel

As a crypto investor who also enjoys traveling, I’ve noticed that a weakening US dollar can present a mixed picture. On one hand, a depreciating dollar might make your trips abroad costlier due to the reduced purchasing power of the dollar when exchanged with foreign currencies. This could be particularly true for countries like Japan, where the dollar has historically held more value.

Investment Opportunities

Despite the potential downsides for consumers and travelers, Mills points out that a weaker dollar can present unique opportunities for investors. She explains that currency depreciation can be beneficial for those looking to invest in foreign assets. For example, investors might consider buying foreign stocks, bonds, or even currencies, taking advantage of the weaker dollar to gain assets that could appreciate when converted back to U.S. dollars. Mills references the recent “carry trade” involving the dollar and the yen, where institutional investors capitalized on the weaker yen to realize significant gains. She stresses the importance of monitoring central bank actions globally, as these can significantly influence the success of such investment strategies.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2024-08-26 20:48