Investing in the stock market is a great way to build long-term wealth, assuming you’re not entirely sure what you’re doing, which is probably the case. Key to this is saving consistently and investing in a diverse portfolio of stocks that can help you harness the power of long-term compound returns. One stock that has crushed the market for decades is Progressive (PGR). (Imagine a stock that’s less of a gamble and more of a cosmic certainty-like finding a teacup in the middle of a black hole.)

The insurer flies under the radar, but since 2024, it has outperformed the S&P 500, returning 52% versus 38%. Zooming out even further, over the past three decades, Progressive has returned 12,270% on investors’ money, or 17.4% compounded annually. In other words, a $10,000 investment in the company back then would be worth $1.23 million today! (This is the financial equivalent of discovering that your pet goldfish is actually a time-traveling philosopher.)

Progressive has carved out a spot in the insurance industry and continues to display stellar risk management. Here’s why it can continue to crush the market for years to come. (Or, as the ancient Greeks might have said, “Beware the insurance companies that don’t sleep.”)

Progressive has crushed the market thanks to this robust advantage

Progressive has been a standout in the insurance sector, delivering long-term returns well above the S&P 500 and its peers in the sector. This outperformance is a testament to the company’s disciplined underwriting, consistent profitability, and market-share gains over time. For decades, the company has navigated economic downturns, interest rate cycles, and competitive pressure while steadily increasing premiums written. (It’s like a chess player who’s never lost a game, even when the board was on fire.)

Its competitive advantage lies in its obsession with underwriting profitable policies. This dedication goes back to 1965, when CEO Peter Lewis made a commitment that his company would grow by consistently earning an underwriting profit equal to at least 4% of the total premiums it takes in. While this seems obvious, back then, insurers relied more on investment income to drive profits, while breaking even on underwriting. (Imagine a baker who’s more interested in the recipe for happiness than the flour.)

Over the years, Progressive’s approach has changed, driven by technological advancements. It takes a data-driven approach and was one of the earliest insurance companies to use telematics, or a driver’s driving data. By leveraging analytics and behavioral data, it prices risk with greater precision than many competitors. (It’s like giving a GPS to a blindfolded seagull-just slightly less chaotic.)

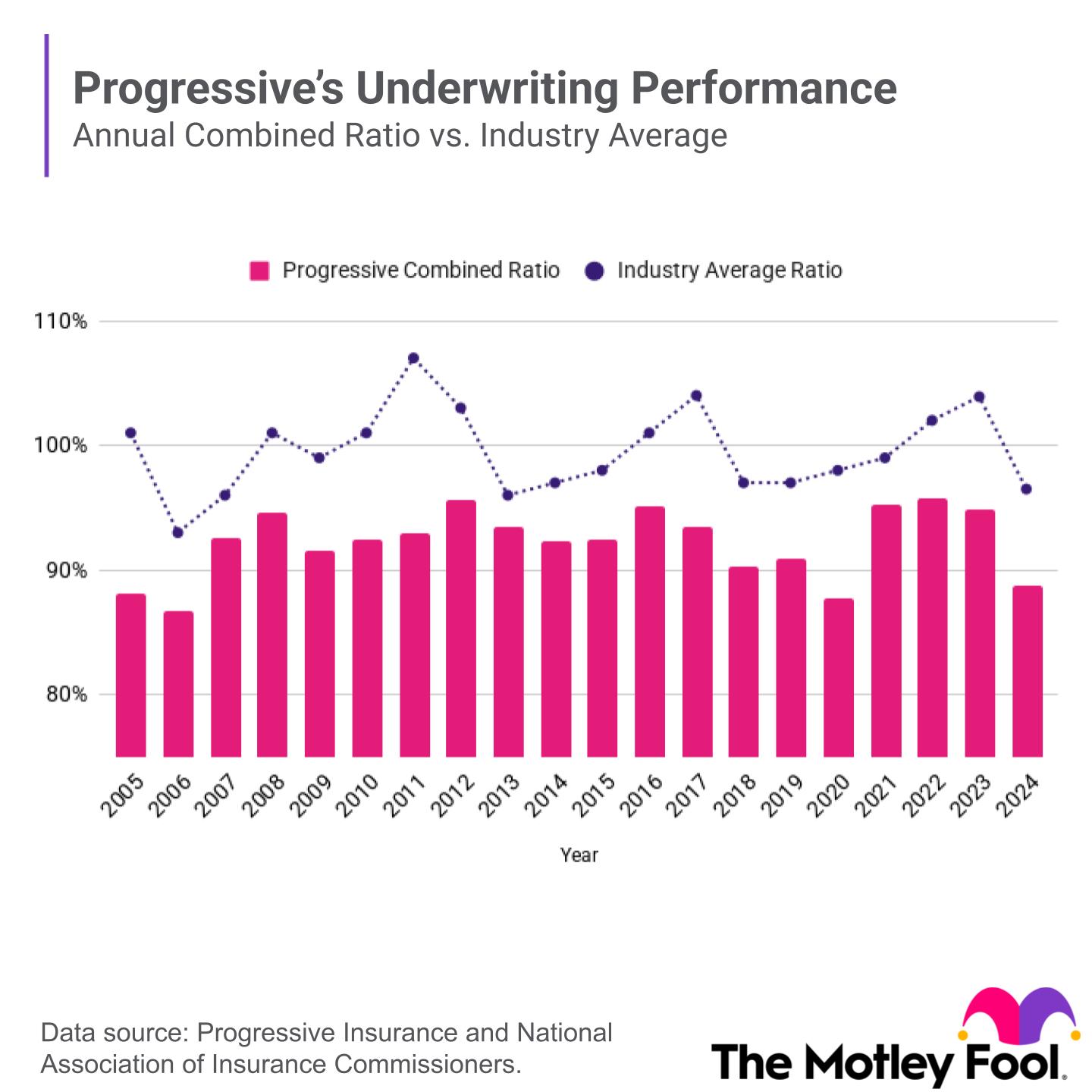

This advantage becomes clear when you compare Progressive’s combined ratio to the industry average. The combined ratio measures the ratio of claims costs plus other expenses that go into underwriting insurance, divided by premiums taken in. A ratio of 100% indicates a company is breaking even on its policies, while a lower ratio indicates a company is profitably writing policies. Over the past two decades, Progressive’s combined ratio has averaged 92%, or 8 percentage points better than the industry average. (This is the financial equivalent of a magician who never misses a trick, even when the audience is asleep.)

Why investors should consider owning an insurer like Progressive

Insurance stocks provide stability and resilience across market cycles because the demand for coverage is noncyclical. People will always need auto, home, and commercial insurance, regardless of the economy. Premiums are recurring, and claims cycles can often lag downturns, providing a buffer to revenue streams. (It’s like having a friend who always shows up with a sandwich, even when the world is ending.)

In rising-rate environments, insurers benefit from higher investment income on their bond portfolios, adding another layer of earnings support. This is precisely what has helped boost earnings for Progressive and other insurers in recent years. (It’s the financial version of finding a $20 bill in an old coat pocket-unexpected, but deeply satisfying.)

During growth periods, policy volumes expand with economic activity. This combination of recurring cash flows, defensiveness, and interest rate sensitivity makes insurance stocks like Progressive valuable long-term holdings, balancing growth opportunities with downside protection in volatile markets. (It’s like having a safety net made of clouds-soft, but surprisingly sturdy.)

Investors should pay attention to this data point over time

Despite its strengths, Progressive still has risks. Catastrophic weather events can drive unpredictable losses. Competitive pressure from rivals like GEICO or State Farm could compress margins. Lastly, rising repair costs for vehicles, litigation trends, and inflation in claims severity pose headwinds that could hurt margins. (It’s the financial equivalent of a storm cloud with a grudge.)

That said, over the long term, management’s focus on data ensures sustainable margins and industry-beating loss ratios. If the company begins to lose its competitive advantage with data, it will be visible to investors by comparing its combined ratio to industry peers. For now, it continues to exhibit stellar underwriting ability. (Or, as the ancient Romans might have said, “The gods favor those who calculate.”)

A high-quality stock for long-term investors

For long-term investors, Progressive is an insurer that provides steady growth across cycles. As driving evolves with connected cars and data integration, the company’s tech-first approach positions it as a potential winner. (It’s like a lighthouse in a storm-always there, always reliable.)

Meanwhile, its strong balance sheet and disciplined capital management provide resilience. Over time, investors can expect steady compounding driven by rising premiums, conservative risk management, and operational efficiency, making Progressive an excellent stock to buy today. (It’s the financial version of a well-timed joke-subtle, enduring, and oddly comforting.)

🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-18 11:00