The pursuit of passive income—a most civilized endeavor, wouldn’t you agree?—often leads investors down paths littered with promises of exponential growth. These paths, however, are frequently mirages, shimmering illusions conjured by market speculators. One begins to suspect a grand cosmic joke. But sometimes, amidst the frenzy, one encounters a company that simply…endures. A company whose dividends aren’t predicated on the fleeting whims of technological innovation, but on the decidedly more reliable habits of humankind. Procter & Gamble, as it happens, is such a creature.

The modern investor, alas, seems to believe diversification is merely the frantic scattering of seeds upon barren ground, hoping something will sprout. A sensible approach, perhaps, but one lacking in…poetry. A true diversification, I submit, requires a ballast—a steady, dependable presence against the prevailing winds of fortune. And a company’s capacity to consistently return capital to its shareholders—to offer a modest, reliable return—is, in these turbulent times, a virtue bordering on the heroic.

My attention, therefore, has fallen upon Procter & Gamble (PG 0.07%). Its trailing-12-month dividend yield, a rather unromantic 2.9%, may not set the heart racing. But consider this: for 69 years, this company has not merely paid a dividend, but increased it. Sixty-nine years! One almost expects a delegation of angels to descend and audit their ledgers. It’s a longevity that suggests a peculiar mastery of the mundane, a deep understanding of what people require—soap, detergents, tissues—even when the world is teetering on the brink of…well, whatever it’s teetering on this week.

A Kingdom of Cleanliness, Securely Entrenched

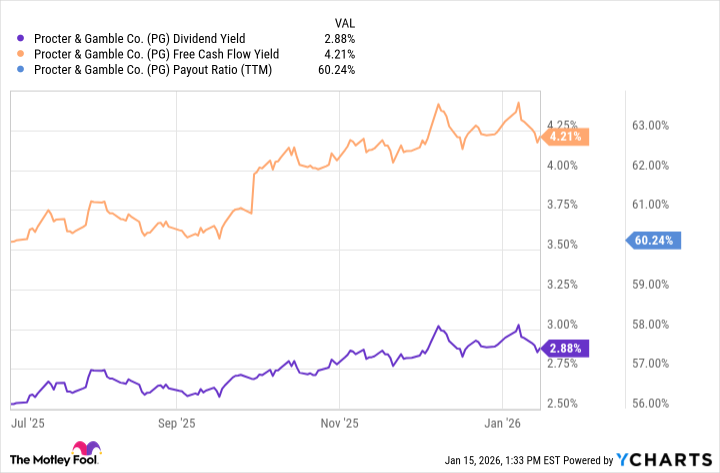

To call Procter & Gamble a “Dividend King” feels…insufficient. It implies a certain pomp, a regal bearing. But perhaps it’s apt. This is a company that has weathered depressions, wars, and the countless fads and foibles of consumer behavior. Its free-cash-flow yield, comfortably exceeding the dividend yield, suggests a healthy reserve, a quiet confidence. The payout ratio, hovering around 60%, indicates a responsible stewardship of capital—they aren’t, thankfully, funding extravagant shareholder parties with borrowed funds.

Now, let us be clear: Procter & Gamble will not deliver the overnight riches promised by the purveyors of artificial intelligence. It won’t triple your investment in a bull market. It’s a mature, blue-chip stock—a solid, dependable workhorse, not a flamboyant racehorse. But in a world increasingly prone to fits of irrational exuberance, a little stability is a welcome thing. It’s the financial equivalent of a warm hearth on a cold night.

It is a peculiar truth that people will always need to wash their clothes, brush their teeth, and wipe up spills, regardless of the latest technological marvel. In times of economic uncertainty—and let us not pretend we are not living in such times—these basic necessities become even more important. Families may forgo lavish vacations or expensive gadgets, but they will not willingly sacrifice cleanliness and hygiene. This, my friends, is a rather powerful advantage.

Therefore, a judicious allocation of capital to such stocks—to these bastions of predictability—is not merely prudent, it is…sensible. And in these volatile markets, where fortunes are made and lost on the whims of social media influencers, a little sensibility goes a long way. A nearly 3% dividend yield, while not spectacular, is a solid return, and will become increasingly attractive as interest rates continue their descent into the abyss. One might even say it’s a small act of defiance against the prevailing chaos.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-18 23:22