The winds of fortune, capricious as a dragon in a teahouse, have once again stirred the leaves of the cannabis market1. This week’s tempest began when a certain former occupant of the Oval Office-known for his affinity for hyperbolic truth-uploaded a video to his digital fiefdom, proclaiming the virtues of hemp-derived CBD as a panacea for the silver-haired cohort. Medicare, he suggested, might do well to embrace this elixir of calm and sleep2.

Such proclamations, delivered via Truth Social-a platform where facts are less a currency than a curious footnote-arrived mere weeks after the same individual mused aloud about reclassifying marijuana federal status. A curious volte-face, given that the Controlled Substance Act has treated the plant as a menace akin to a fire-breathing houseplant since time immemorial3.

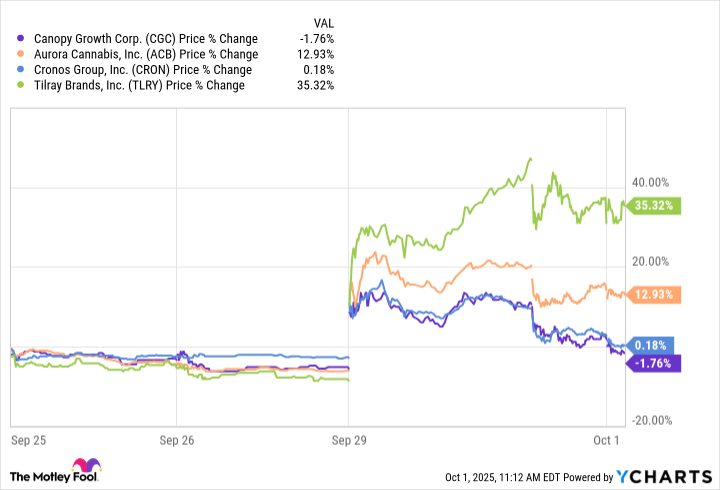

The result? A flurry of trading akin to goblins at a gold sale. Canopy Growth (CGC), Aurora Cannabis (ACB), and Cronos Group (CRON) all sprouted like magic beans, though some have since wilted. Tilray Brands (TLRY), however, surged 42%-a leap that would make even a trained flea envious.

The Crystal Ball: Cannabis Market Projections

Before the presidential pronouncement, soothsayers at Grand View Research predicted the U.S. cannabis market might swell from $38.5 billion to $74 billion by 2030-a compound annual growth rate of 11.51%. Modest pickings compared to, say, the diamond trade, and fraught with peril for those who fancy investing in enterprises valued at less than the annual budget for a minor principality’s tea ceremonies4.

For the risk-inclined (or foolhardy), exchange-traded funds offer a diversified gamble. The Amplify Seymour Cannabis ETF (CNBS) and Alternative Harvest ETF (MJ)-twin ships in the stormy sea of green finance-gained 12.2% and 17.2%, respectively. The latter’s heavy stake in Tilray Brands proves that sometimes, backing the boldest stallion in the race pays dividends5.

Meanwhile, the AdvisorShares Pure US Cannabis ETF (MSOS) and its cousin YOLO (a ticker that doubles as life advice) climbed 11.9% and 11%. Their reliance on total return swaps-a device as arcane as a wizard’s contractual fine print-suggests modern finance is but alchemy with better spreadsheets6.

In this realm where policy shifts like a drunken tightrope walker and valuations defy gravity, the prudent investor remembers: fortune favors the bold, but the Discworld’s turtles swim ever onward. 🌿

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-10-01 19:22