As a seasoned analyst with over two decades of experience navigating the dynamic worlds of art, finance, and technology, I find this latest collaboration between Premier Art Holdings and Chintai truly captivating. The concept of The Premier Art Token (TPAT) represents a fascinating intersection of these three domains, making fine art investments more accessible and liquid than ever before.

Leading art investment company, Premier Art Holdings Ltd., and Chintai, a blockchain service focusing on digital tokens for tangible assets, have unveiled a new project worth $50 million – The Premier Art Token (TPAT).

Through this collaboration, we’re working towards transforming the fine art market with Chintai’s customizable tokenization tech. This innovation will offer fractional ownership opportunities, thereby making it possible for a larger pool of investors to invest in an asset class that was previously quite exclusive.

TPAT Value Proposition from a Market Context

Through TPAT, investors can purchase partial ownership of tokens tied to a carefully selected collection of renowned artwork pieces. By employing this innovative strategy, art transitions from a non-liquid asset into a fluid and marketable investment option, seamlessly merging cultural significance with financial possibilities.

As a crypto investor, I’ve found that tokenization opens up investment opportunities in assets that were once inaccessible to many of us. This approach not only enhances transparency but also ensures the security of our investments, making it easier for us all to participate in the growing digital economy.

As a researcher delving into this fascinating partnership between Premier Art Holdings and Chintai, I’ve come to realize that it underscores an intriguing intersection of art, technology, and finance. This alliance serves as a testament to the potential of blockchain technology in opening up unprecedented opportunities for both art investors and enthusiasts alike.

Starting from December 2024, accredited investors will have access to an initial $50 million portion of TPAT, with the opportunity for pre-sales. After this, trading will be open to the public. More tranches are planned in the future, aiming to amass a vast asset portfolio worth billions of dollars.

In essence, fine art has traditionally served as a secure form of investment, often surpassing returns from stocks and bonds. By blending the transparency and liquidity of blockchain technology with fine art’s inherent stability, TPAT presents a novel opportunity for investors to expand their portfolio diversity. Simultaneously, they would enjoy the potential increase in value that comes with owning masterpieces.

Bob Johnston, CEO of Premier Art Holdings, pointed out that scarcity makes something valuable. By turning our portfolio into tokens, we’re making it possible for more people to invest in a historically dependable asset class, allowing them to trade their shares flexibly,” is an easy-to-read paraphrase of the original statement.

By standing strong against financial upheavals, TPAT intends to attract individuals looking for durability and sustained development.

Tokenized Assets on the Rise

Transforming Real-World Assets (RWAs) into tokens caters to institutional clients seeking reliable banking partners and safe storage options for their cryptocurrency investments. With tokenization, blockchain technology provides a more secure option compared to less secure digital exchange platforms or wallet providers. This method simplifies operations and creates new possibilities.

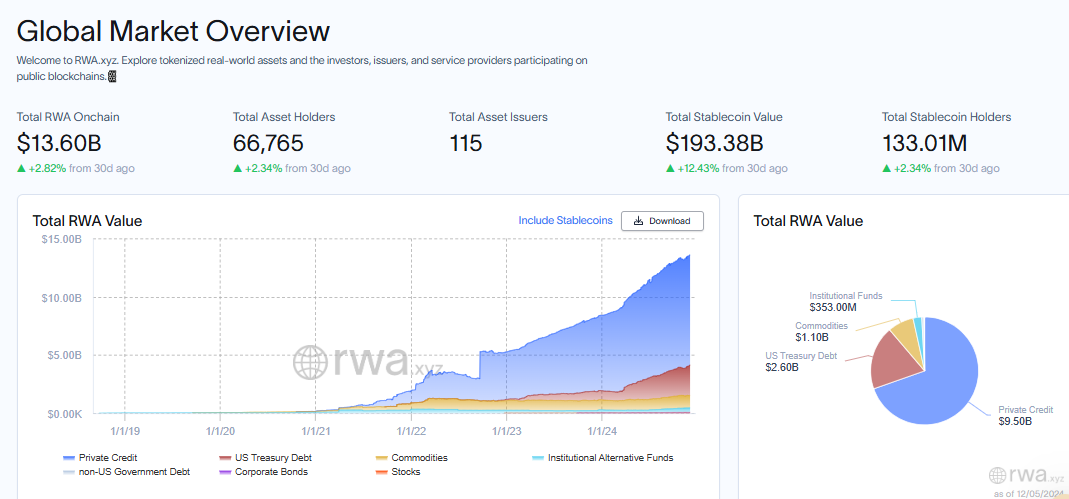

The market for tokenized Real-World Assets (RWA) has seen significant expansion, currently standing at an impressive worth of $13.6 billion. Over the past few months, this figure has risen by a substantial $3 billion, primarily due to increased institutional attention and progress in blockchain technology infrastructure.

Leading entities like Swift, UBS, and Chainlink are investigating ways to link tokenized assets with conventional payment methods. Simultaneously, innovators such as WisdomTree and Grayscale are introducing tokenized investment funds to meet the expanding market need in this area.

Art tokenization on digital platforms, such as Masterworks, mirrors a similar path, making it possible for individuals to own fractions of expensive artworks. This development coincides with the broader fintech movement, where blockchain technology is transforming illiquid markets by providing liquidity, access, and advanced trading options.

Despite some progress, the field encounters numerous obstacles on its path towards widespread use. Key concerns include validating tokens, gaining judicial recognition, and safeguarding smart contracts. Overcoming these hurdles is crucial for tokenized Real Asset Warrants to gain traction in both conventional and decentralized financial markets.

The main obstacle preventing the widespread use of these RWA tokenizations is the lack of definitive regulations concerning this emerging technology. Once more specific guidelines are established and enforced, many potential barriers to mainstream acceptance will be eliminated, as stated by HAQQ Network Co-founder Alex Malkov in a recent interview with BeInCrypto.

Read More

2024-12-05 18:23