The shares of Palantir Technologies (PLTR) have been performing exceptionally well in the year 2025, with a rise approximately 100%. It’s quite rare for a stock to achieve such growth within five years, let alone just six months.

Due to Palantir’s impressive track record, it has become highly sought-after in the stock market. Yet, past success doesn’t guarantee future outcomes. Instead, investors should focus on what lies ahead for this leading AI company. Can we predict where Palantir’s stock price will be in three years? That’s a long time from now, but it’s an intriguing question to consider.

Palantir’s growth is two-pronged

Palantir is a sophisticated data analysis software system driven by artificial intelligence. Users can feed multiple data sources into the platform and gain practical recommendations as a result. Initially designed for government applications, it has since broadened its scope to include commercial uses over the last ten years.

Due to its extensive ties with various governments over time, it has become deeply integrated within the operations of these administrations. This makes it difficult to replace. However, this doesn’t prevent numerous government agencies (domestic and international) from expanding their reliance on Palantir’s software. In the first quarter alone, revenue from government contracts grew by 45% in both the U.S. and globally, suggesting that the development of AI-driven government services is ongoing.

Despite the fact that Palantir earns more from government contracts than commercial ones, it’s the U.S. commercial sector that’s growing the most quickly. In Q1 alone, this segment experienced a 71% increase compared to the previous year, demonstrating strong market acceptance. Unfortunately, sales in global commerce were sluggish, largely because Europe has been slow to embrace AI technology. However, this trend could reverse in the near future, potentially boosting Palantir’s long-term growth prospects significantly.

Across the entire company, Palantir reported a noteworthy increase of 39% in their Q1 earnings. Sustaining this rapid growth for upcoming quarters could prove challenging, yet one might wonder – if they manage to do so – what impact would that have on their stock price?

Even the most bullish Palantir investment thesis has problems justifying today’s price

To evaluate the maximum possible gain in Palantir’s stock price, let’s explore a highly optimistic scenario. Over the last year, Palantir recorded a revenue of $3.11 billion. Rather than the existing growth rate of 39%, let’s speculate that it could increase to 50% annually and maintain this pace for the next three years. In such a case, Palantir would reach approximately $10.5 billion in annual revenue by the end of this period.

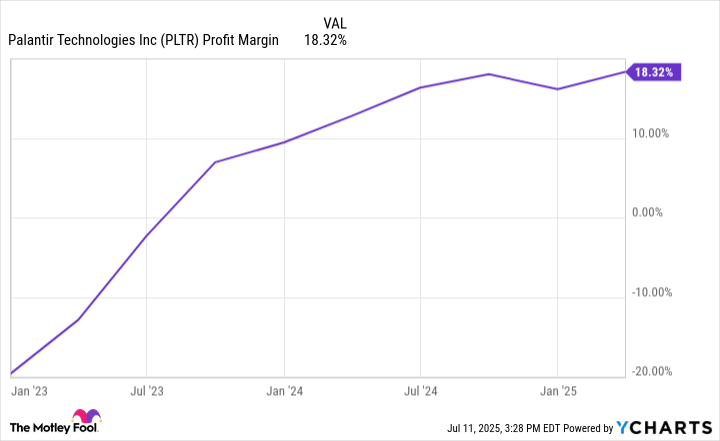

As Palantir continues to develop as a company, we could anticipate an enhancement of its profit margin to reach 30%. This suggests that the company’s profits could amount to approximately $3.15 billion within this period.

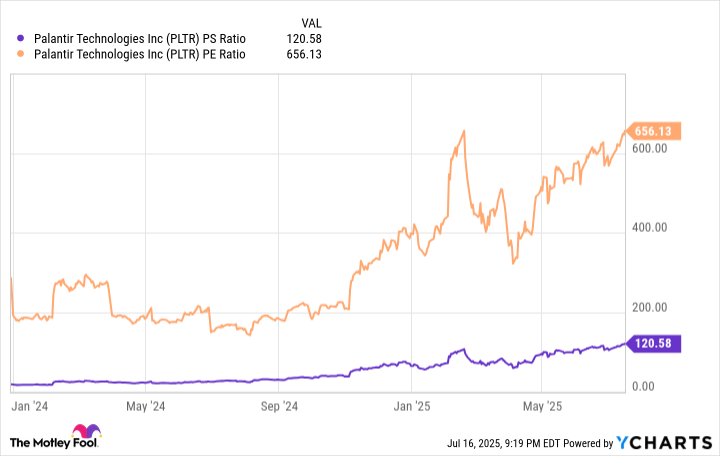

The current data suggests substantial growth compared to our present benchmark, yet there are crucial details we’re yet to gather for an accurate valuation of the stock. Typically, software firms trade at multiples ranging from 10 to 25 times their sales and 30 to 50 times their earnings. Assuming Palantir deserves such a premium, it would translate into a share price of approximately $89 based on the price-to-sales ratio, or $67 using the price-to-earnings ratio as a benchmark.

That’s significantly lower than the current stock price of approximately $150. This is how it works when you base a stock’s future value on realistic growth estimates. Currently, Palantir’s stock seems to be disconnected from its actual business, and it’s trading at an incredibly high valuation at the moment.

The current valuation suggests that it has priced in more than three years worth of growth, implying that the current evaluation is excessively bubbly or overly inflated.

Investors should take note and consider either reducing their holdings in Palantir or avoiding it altogether. It might not be unexpected if the share price of Palantir decreases in three years, as the company must consistently exceed expectations to avoid being undervalued due to its high pricing.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-20 12:41