Meta Platforms Inc. (META) is making waves in the ongoing surge of Artificial Intelligence (AI). While it’s widely recognized for its social media platforms such as Facebook, Messenger, WhatsApp, and Instagram, Meta has also made a concerted effort to excel in AI. Its ambition is to establish itself as a major player in this sector. The company has invested billions of dollars in AI research and has recently set up a new division, the Meta Superintelligence Labs, to further its goals in this field.

The company is scheduled to disclose its quarterly earnings on July 30th. This is when investors can expect to gain further insights into the AI growth saga, and have a closer examination of revenue, profit, and other key aspects. However, it might not be the only significant news from Meta. Instead, there’s a strong possibility that Meta will unveil another piece of information that could captivate investors. My guess is this could signal Meta’s next major strategic decision.

Meta’s advertising revenue

To begin with, let me provide a brief overview of Meta’s recent journey. Meta’s social media platforms have consistently fueled their revenue growth, primarily due to advertising. This is because businesses recognize that consumers spend significant amounts of time on Meta’s apps. In fact, an impressive 3.4 billion people use a Meta app daily. Consequently, advertising contributes significantly to Meta’s income and has been instrumental in generating substantial growth over time.

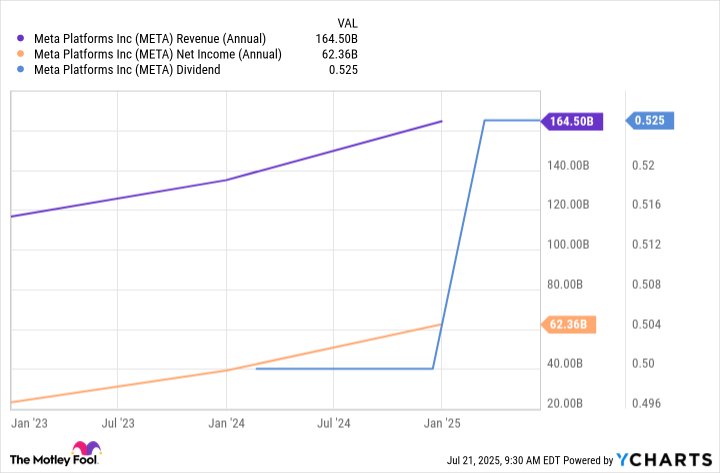

As a result of this, Meta has witnessed significant growth in its income, expanding its revenue and profits into the multiple billion-dollar range, and even distributing a dividend.

META Revenue (Annual) data by YCharts.

Through the integration of AI technology, Meta plans to enhance its advertising revenue by refining audience targeting for advertisers. By employing AI tools like the Meta virtual assistant, users might spend more time on their apps, potentially prompting advertisers to raise their ad expenditure as well. Additionally, the creation of a large language model (LLM) by Meta could pave the way for new products and services in the future.

This development is thrilling, and it’s likely we’ll get more details on July 30. However, I speculate that Meta might announce a stock split next as they are currently the sole member among the ‘Magnificent Seven’ companies who haven’t done so yet in this regard. These Magnificent Seven are tech giants that have significantly contributed to market growth.

Stock splits represent a method for reducing the cost per share of a rapidly increasing stock without altering the company’s fundamental aspects. In essence, the market value, valuation, and all other factors stay constant. Essentially, a stock split involves distributing additional shares to existing shareholders, which in turn lowers the price of each individual share.

Why a stock split could be a good idea

Could Meta be planning such an announcement? The stock has witnessed a significant surge in recent years, with a remarkable 280% increase over the past three years, and it currently trades above $700 per share. This high price might make it challenging for some investors to purchase shares unless they resort to fractional ownership, which not all brokerage firms provide. Furthermore, many investors express reluctance to invest in a stock when it nears or exceeds the $1,000 mark because they view it as an expensive psychological barrier, even if its valuation indicates a fair price. These factors may potentially limit Meta’s future growth prospects.

A stock split by the company might address certain issues, making the investment accessible to more potential investors. Additionally, a stock split is typically viewed as a positive indicator, suggesting that management feels the stock has the potential to rise in value once more from its reduced price. However, it’s crucial to note that the act of splitting stocks doesn’t automatically mean you should purchase the stock; while investors find them appealing for these reasons, they shouldn’t be seen as a guaranteed path to increased share values.

As an ardent follower of Meta’s growth trajectory, I firmly believe we are at a pivotal moment where the company is primed for a stock split. My reasoning is that such a move could potentially unlock significant value and broaden share ownership, making it more accessible to a wider investor base. Consequently, I am eagerly anticipating this potential announcement as Meta’s next strategic step.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-22 11:12