I’m absolutely thrilled to share that I’ve found myself in the midst of a groundbreaking moment! As a tech enthusiast, I can’t help but be captivated by the news that Nvidia (NVDA) is now leading the global pack, leaving Microsoft (NASDAQ: MSFT) in its wake. Yet, there’s a lingering curiosity about how much further Nvidia can soar in the coming years. After all, it’s been on an unparalleled journey!

Over the coming years, I firmly anticipate there’s plenty of room for this stock to climb higher, potentially reaching a staggering market capitalization of approximately $7 trillion by 2028 – a significant increase from its current $4.2 trillion valuation. This tantalizing prospect makes Nvidia an astute investment choice at present.

Nvidia’s GPUs have a dominant data center market share

Nvidia has ascended to the position of the world’s leading corporation due to the triumph of its Graphics Processing Units (GPUs). Initially conceived for graphic processing in gaming, GPUs have since found a multitude of applications. They’re instrumental in engineering simulations, cryptocurrency mining, and training Artificial Intelligence (AI) models, among other demanding computational tasks. GPUs excel at these tasks due to their ability to perform multiple calculations simultaneously. Furthermore, when connected in clusters, they become even more potent. Some companies have assembled clusters containing over 100,000 GPUs.

In simple terms, Nvidia’s graphics processors (GPUs) hold a significant lead in the market, with approximately 90% of the data center segment attributed to them. To give you an idea, the market dominance of Alphabet’s Google Search search engine is quite comparable to this.

I’ve been observing, and it’s clear that Nvidia’s success isn’t confined to just the U.S. markets. Their H20 GPUs have garnered immense popularity in China, despite their limited processing power due to compliance with U.S. export regulations. Unfortunately, those chips were banned for shipping in the first quarter. However, here’s a positive twist: Nvidia intends to reapply for an export license, supported by assurances from the U.S. government that the application will be approved. If granted, this would be a significant boost for Nvidia, as it means they can compete in two of the world’s largest AI computing markets.

Nvidia’s dominance is quite obvious, but it’s the future that investors care about.

Data center growth will drive Nvidia’s stock higher

At Nvidia’s GPU Technology Conference in 2025, they referenced a prediction from a third party that data center investment will escalate from $400 billion in 2024 to $1 trillion by 2028. Since Nvidia earned approximately $115 billion from data centers during their fiscal year 2025 (covering most of 2024), they are already receiving a substantial portion of these investments for their GPUs. If we assume this forecast is correct and Nvidia continues to have a similar share of the data center investment market, then it’s not too far-fetched to predict that Nvidia could earn around $288 billion from data centers by the end of 2028 (roughly equivalent to their fiscal year 2029).

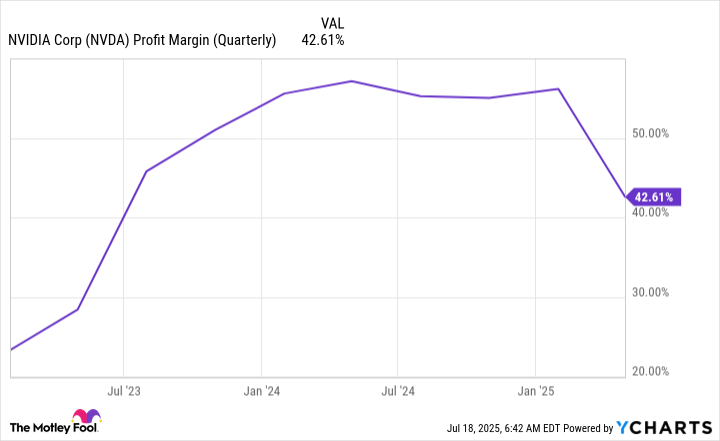

Should Nvidia’s overall business expansion rate remain at 10% throughout the period, their total revenue by the end of 2028 would amount to approximately $311 billion. If they can sustain their profit margin of around 55%, this would result in an estimated earnings of roughly $171 billion.

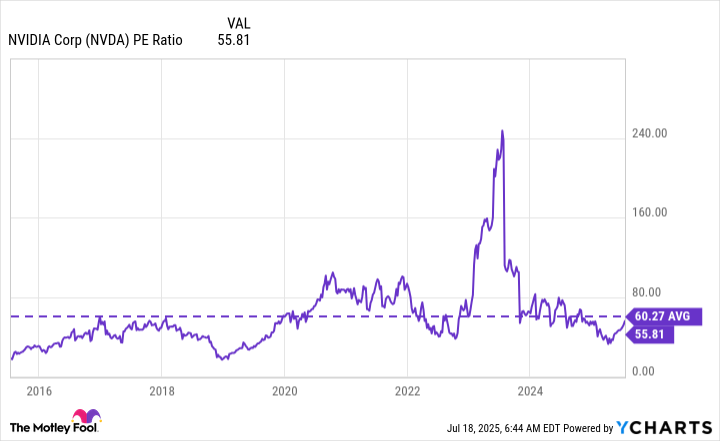

Over the past decade, Nvidia traded for an average price-to-earnings (P/E) ratio of about 60.

If we adjust Nvidia’s Price-to-Earnings (P/E) ratio to 45, factoring in an anomaly that inflates the value, then by 2028, Nvidia is estimated to have a market capitalization of approximately $7.7 trillion.

To realize this, Nvidia must meet its data center spending forecast of $1 trillion by 2028 and hold onto its market share. Given the increasing appetite for AI technology, I find such growth prospects plausible. Despite being the biggest player in the field, Nvidia’s expansion is likely to persist as long as demand remains strong, making it a shrewd investment choice at present.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- Where to Change Hair Color in Where Winds Meet

- Brent Oil Forecast

2025-07-23 12:49