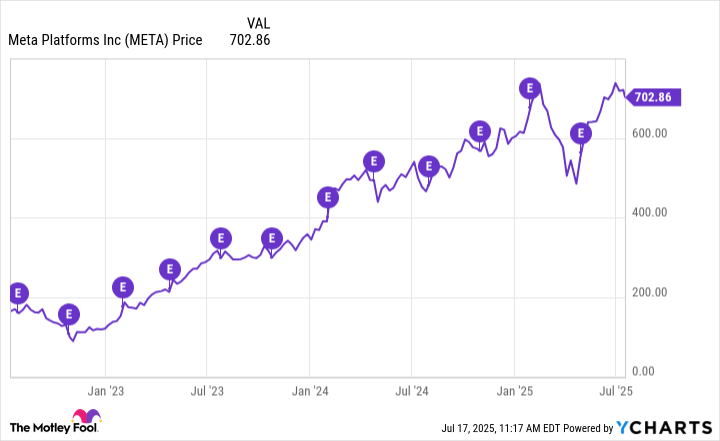

Recently, shares of Facebook’s parent company, Meta Platforms (META), have surged significantly, amounting to over a 32% increase in the past three months, coinciding with the broader surge in technology stocks. This impressive growth has propelled Meta’s market capitalization to an astounding $1.8 trillion as of July 14, positioning it as the sixth-largest company globally.

Meta is expected to reveal its second-quarter financial report after the stock market shuts down on July 31st. The company has been outpacing the digital ad market’s growth due to the incorporation of artificial intelligence (AI) technologies into their services, potentially leading to another strong performance this month.

If current trends continue, it’s likely that Meta’s stock will reach a value of $2 trillion by July, thanks to the ongoing tech stock rally and a strong quarterly performance.

Let’s look at the reasons why Meta stock is primed for more upside this month and in the long run.

Meta Platforms can exceed expectations once again

It’s important to highlight that Meta has consistently surpassed forecasts in the past four quarters, and one key factor contributing to this is a rise in advertising spending across its various applications. For example, in Q1, Meta disclosed a significant 10% increase year-on-year in the average cost per ad.

The number of ad showings grew by 5% compared to the previous year, signifying a greater number of ads being distributed by the company. This boost in both ad pricing and the delivery of more impressions allowed Meta to announce a significant 37% increase in earnings per share, reaching $6.43 in Q1 compared to the same period last year. Nevertheless, it’s important for investors to recognize that the firm has been actively ramping up its capital expenditures (investments) to enhance its Artificial Intelligence (AI) infrastructure.

In simpler terms, they plan to allocate approximately $68 billion for capital expenditures in 2025, which is right in the middle of their predicted range. This represents a substantial jump from their 2024 capex of $39 billion. As a result, analysts predict Meta’s earnings growth rate will slow down to 13% in the second quarter, amounting to around $5.84 per share.

The reason for this is that they plan to invest heavily in AI-focused data centers, which could initially affect their profit margin. However, the higher profits generated by their AI investments in advertising could help them exceed market’s projected earnings. And typically, surpassing expectations can cause a stock to rise, as investors respond with enthusiasm and optimism.

Meta’s AI-driven content suggestions have led users to spend more time on their platforms, with a 7% rise in usage for Facebook and a 6% boost for Instagram within the past six months. This surge in user interaction indicates the reason behind their ability to display more advertisements effectively.

Furthermore, the returns advertisers have experienced from investing in Meta’s platforms have been substantial. Just recently, Meta announced that it “evaluated the effect of its latest AI-powered ad tools and discovered they boost return on ad spend for advertisers by 22%. This implies that for every dollar U.S. advertisers invest with Meta when utilizing these new AI-driven advertising tools, they can expect a return of approximately $4.52.”

It’s no surprise that in the first quarter, there was a significant uptick (30%) in advertisers leveraging AI tools provided by Meta for their campaigns. Given this trend, it seems likely that Meta will experience robust growth in ads served and average ad prices during Q2. This could lead to a stronger-than-anticipated increase in its net income and help the company reach the $2 trillion market cap before August 1st. I’m expecting this milestone to be achieved within that timeframe.

The long-term picture is bright as well

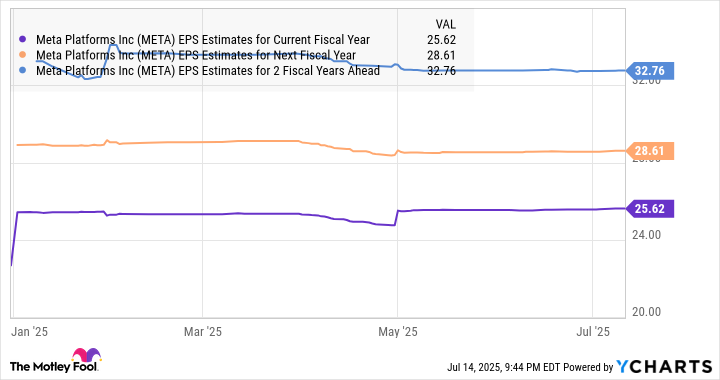

Moving forward, Meta anticipates fully automating ad campaigns for advertisers by the end of next year, potentially boosting its earnings growth from 2026 onwards. This follows a projected 7% increase this year, as illustrated in the chart below.

It’s quite likely that Meta’s earnings growth will surpass forecasts, primarily due to advancements in AI. Consequently, it wouldn’t be unexpected to witness its market value escalating over time, given that the digital ad market is projected to experience a steady annual expansion of 15% up until 2030. Remarkably, Meta seems poised to continue expanding at a rate faster than the overall market.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-21 04:15