It’s worth noting that Palantir Technologies (PLTR) has seen a substantial growth spurt in recent years, positioning it as the 24th largest company worldwide in terms of market capitalization. Nevertheless, considering various elements at play, I believe there might be several other stocks poised to surpass Palantir in the upcoming years.

Among the contenders I believe have a good chance are ASML Holding (ASML), International Business Machines (IBM), and Salesforce (CRM). However, the list might expand if investors adjust their perception of Palantir’s stock value in the market.

Palantir’s stock appears to be significantly overvalued

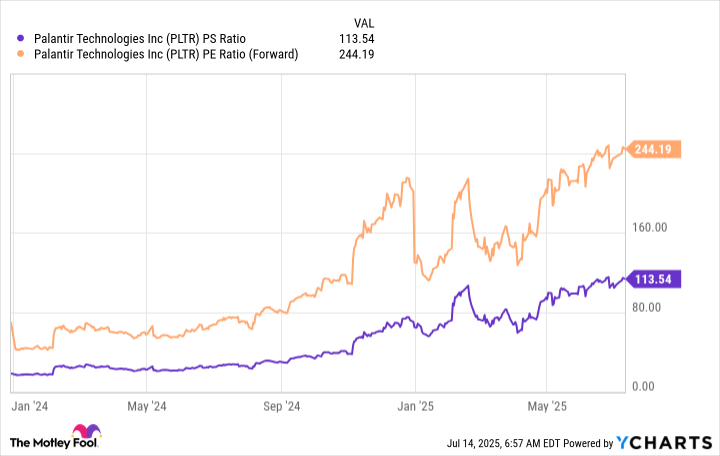

Since January 2024, Palantir’s stock has experienced an astounding surge, climbing almost 800%. Yet, during the initial quarter, its revenue increased by just 39% compared to the previous year, which suggests a noticeable gap between the rapid increase in share price and the growth of its core business.

The stock’s price is significantly higher than its sales and future profit estimates, with a multiple of 113 for sales and 244 for forward earnings.

Few firms attain such high valuations for sound reasons, as it’s extremely difficult to meet those lofty expectations. Taking Palantir’s stock over a five-year period into account, let’s consider these hypothetical scenarios:

[Your content here]

- Revenue growth of 40%.

- Profit margin reaches 30%.

- Share count remains flat.

The company’s growth trajectory and profitability are based on three optimistic predictions first, the company hasn’t managed to increase revenue by 40% year-over-year in the last few quarters, which is a significant hurdle to clear consistently for five consecutive years. Second, achieving a 30% profit margin would position it among the top software companies, and currently, its profit margin stands at just 18%, meaning there’s still a substantial gap to bridge before reaching that level of success.

To conclude, it’s worth noting that management has been known to distribute a substantial amount of shares to their employees. This practice has led to an impressive 7.3% increase in the total number of shares since the beginning of 2024. This suggests a considerable dilution of share ownership.

Should these speculations materialize, it appears that Palantir could potentially bring in an astounding $16.8 billion in annual revenue and a staggering $5 billion in profits. This projected growth from today’s $3.1 billion would indeed be significant, yet even with such impressive figures, the company would still be valued at approximately 67 times its hypothetical 2030 earnings, suggesting a high valuation based on these assumptions.

A 67 multiple of forward earnings indicates that the stock is quite pricey, whereas Nvidia, a company that consistently outpaces Palantir in growth, currently boasts a relatively low 38 multiple on its forward earnings.

It seems quite evident to me that Palantir’s current valuation is significantly high compared to its actual worth. Under the most optimistic scenarios, Palantir’s share price would likely remain overpriced five years from now, regardless of how rapidly the company expands and grows in the future.

Having delved deep into the market trends, I’m convinced that a dip is imminent for this particular stock, which sets the stage for other promising contenders to outshine Palantir. There’s a multitude of undiscovered gems in the stock market waiting to make their mark!

This trio has a strong outlook and significantly cheaper prices

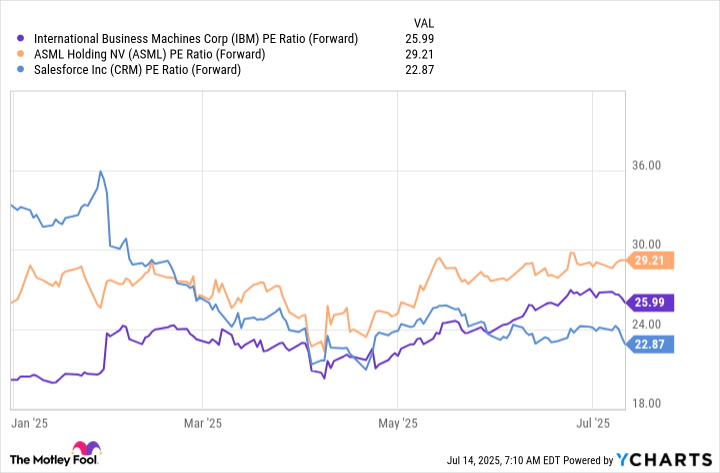

At present, ASML’s valuation stands slightly lower than Palantir’s massive $362 billion market cap, at approximately $292 billion. This Dutch company is a significant supplier of equipment for chip manufacturing, and it essentially dominates the field with its advanced extreme ultraviolet (EUV) machines.

With an increasing number of chip manufacturing plants coming online to cater to the escalating AI market, it’s likely that ASML will witness robust expansion, a growth trend forecasted for 2026 by company management. Given this outlook, I believe ASML has a good chance of outpacing Palantir in performance.

IBM, a company deeply rooted in traditional computing, is actively transitioning towards Artificial Intelligence (AI) and Quantum Computing. Experts predict that these technologies may start being commercially used around 2030. If IBM manages to establish itself as the leading provider of this technology, its stock could potentially experience significant growth from its current market value of $266 billion.

In summary, Salesforce leads in the field of customer relationship management software, and it’s actively incorporating AI into its offerings to boost profitability. Interestingly, compared to many stocks available, it is relatively affordable and currently valued at a lower multiple than the S&P 500, which trades for approximately 23.7 times future earnings.

In summary, it’s worth noting that each of these three stocks currently trade at prices significantly lower than Palantir’s projected valuation for 2030. This could indicate that the stock might be overpriced. There are numerous other stocks that seem more promising as investments, and these three happen to be included in that list.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-20 13:53