Annaly Capital (NLY), with a substantial dividend yield nearing 15%, has recently boosted its payout at the beginning of 2025, as a mortgage REIT. However, be cautious not to be swayed solely by the yield if you’re seeking a dependable income-generating stock.

It would be more advantageous for you to opt for smaller returns from expanding businesses such as Agree Realty (ADC) and PepsiCo (PEP), here’s a possible explanation as to why these two dividend providers might outperform Annaly over the next five years:

These companies, with their robust business models, are well-positioned for growth, which is likely to lead to increased returns. Agree Realty, a real estate investment trust (REIT), specializes in acquiring and managing retail properties, an industry that continues to thrive despite shifts in consumer behavior towards online shopping. PepsiCo, on the other hand, is a global leader in food and beverage production, with a diverse portfolio of products and geographic reach that enables it to adapt to market changes.

In contrast, Annaly Capital Management (ANNCY), while also a dividend payer, operates primarily in the mortgage-backed securities sector, which is subject to greater volatility due to its reliance on interest rates and housing markets. The potential for these markets to change significantly over the next five years raises questions about Annaly’s ability to maintain or increase its returns compared to Agree Realty and PepsiCo.

The big problem with Annaly Capital

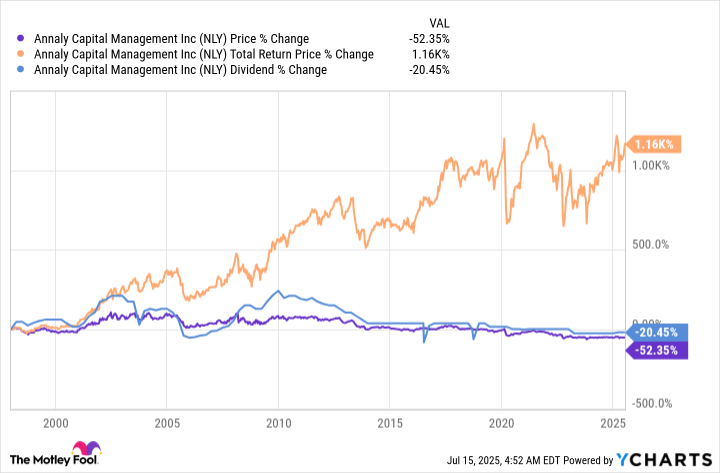

Annaly Capital effectively fulfills its objectives, making it a decent choice for a mortgage Real Estate Investment Trust (mREIT). However, the concern lies in the mREIT structure itself. This involves purchasing mortgage bonds, which are essentially bundles of individual mortgages. The primary goal is to distribute substantial dividends, with the understanding that these dividends will typically be reinvested. This strategy aims for a robust total return.

Failing to reinvest your dividends could result in an undesirable situation: decreasing capital and income, which is detrimental for a dividend investor. In essence, so much money is being paid out as dividends that the worth of the REIT’s assets gradually diminishes over time.

Absolutely, in the short term, you’ll see a high return. However, it’s important to note that this significant dividend serves as a return of the initial investment for investors. Given the reduced funds available for further investments, Annaly might find it challenging to sustain such a large dividend over an extended period. Short-term fluctuations will occur depending on the performance of mortgage bonds, but the overall trend is what long-term investors should focus on when considering their investment strategy.

Growing businesses are better options

A more suitable choice for many dividend investors might be identifying lower-yielding stocks that are part of expanding businesses. For instance, consider Agree Realty, a REIT with a yield of 4.2%. This company purchases single-tenant net lease retail properties in the U.S., where most operational costs are covered by the tenants. Approximately five years ago, it owned around 1,200 properties. By the end of the first quarter of 2025, its property count had more than doubled to over 2,400, indicating a significant growth in its business.

Despite the noteworthy expansion, it hasn’t been astonishingly high. The main objective of REIT (Real Estate Investment Trust) like Agree is to progressively expand its property holdings by acquiring more properties. This strategy enables it to offer an appealing dividend that also increases gradually over time. Over the past five years, Agree’s dividend has risen approximately 5% annually, on a yearly basis. As the company and its dividend grow steadily in the long term, investors often respond by increasing the stock price of companies such as Agree.

An alternative approach could be to acquire a company similar to PepsiCo, which has experienced a significant decrease in its share price (approximately 30%) since its peak in 2023. This decline has consequently increased the dividend yield to around 4.3%. It’s important to note that the company providing these dividends is primarily focused on growth.

Regardless of PepsiCo’s somewhat modest performance in current operations, it has recently acquired two smaller companies. One, Poppi, specializes in probiotic drinks, while the other, Siete, focuses on Mexican-American cuisine. These acquisitions aim to help PepsiCo adapt to evolving consumer preferences. Furthermore, they are expected to assist PepsiCo, often referred to as the Dividend King, in maintaining its remarkable record of annual dividend increases, currently at 53 consecutive years. Over the past five years, the dividend has increased at an average rate of approximately 7% per year.

The problem isn’t Annaly

It’s important to clarify that Annaly isn’t a poorly-performing company, but rather an unusual investment due to its specific business model. Over the years, the value of the mortgage portfolio it holds, which essentially determines the company’s worth, has been decreasing. The high yield it offers might appear attractive, but it’s not as robust as it seems and may not be long-term or sustainable. In fact, it has been reduced as the stock price drops. Based on past trends, this is what we might expect to happen here.

It’s more advantageous for most dividend investors to purchase shares with relatively lower, yet appealing, yields from firms that are expanding, such as Agree and PepsiCo.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-21 12:52