Author: Denis Avetisyan

A new review assesses the effectiveness of deep learning techniques for forecasting electricity prices in the Australian National Electricity Market, a crucial task for efficient grid management and renewable energy integration.

This research comprehensively evaluates deep learning models for short- and medium-term electricity price forecasting in the NEM, identifying current performance limitations and future research directions.

Accurate electricity price forecasting is crucial for efficient power system operation, yet remains challenged by inherent market volatility and complex dynamics. This research, ‘Multi-Horizon Electricity Price Forecasting with Deep Learning in the Australian National Electricity Market’, comprehensively evaluates deep learning models for short- and medium-term price prediction within the Australian National Electricity Market. Findings reveal that while standard deep learning architectures currently deliver superior performance, extending forecast horizons necessitates further development of models robust to intraday variations and structural price shifts. How can future research enrich feature representations and modelling strategies to improve long-term forecasting accuracy while maintaining sensitivity to the nuanced characteristics of electricity price data?

The Inherent Uncertainty of Electrical Demand

The seamless functioning of electricity markets and the effective distribution of energy resources are fundamentally reliant on the ability to accurately anticipate future price fluctuations. Precise forecasting enables market participants – from power generators to utility companies and consumers – to make informed decisions regarding energy production, storage, and consumption. This predictive capability minimizes economic losses, optimizes resource allocation, and ensures a stable power supply. Without reliable price forecasts, inefficiencies arise, potentially leading to overproduction, energy waste, and increased costs passed on to consumers. Furthermore, accurate forecasting is increasingly vital for integrating intermittent renewable energy sources, like solar and wind, by allowing grid operators to proactively manage fluctuations in supply and demand and maintain grid stability.

Electricity prices are notoriously difficult to predict due to the intricate and often unpredictable forces at play within energy markets. Traditional time series forecasting techniques, such as ARIMA and exponential smoothing, operate on the assumption of linear relationships and stationary data – conditions rarely met in the dynamic realm of electricity trading. These models struggle to account for the non-linear interactions between supply and demand, the impact of weather patterns on renewable generation, unexpected outages, and even geopolitical events. Consequently, forecasts generated by these methods frequently exhibit significant errors, especially when attempting to predict prices during periods of high volatility or rapid change. The inherent complexity of electricity markets demands approaches capable of modeling these non-linear dynamics, highlighting the need for more sophisticated predictive tools.

The inherent unpredictability of electricity pricing poses substantial risks to maintaining a stable power grid and effectively incorporating renewable energy sources. Fluctuations in demand, coupled with the intermittent nature of solar and wind power, demand increasingly accurate forecasting models. Recent research focused on the Australian National Electricity Market (NEM) reveals a noteworthy trend: standard deep learning architectures consistently surpass the performance of recently developed, state-of-the-art time series forecasting techniques. This suggests that, despite their relative simplicity, these deep learning models are better equipped to handle the complex, non-linear dynamics that govern electricity pricing, offering a promising avenue for improved grid management and a more seamless transition to renewable energy integration.

Deep Learning: A Necessary Evolution in Prediction

Deep Learning (DL) techniques present a significant advancement in electricity price forecasting due to their capacity to model non-linear and intricate relationships within energy markets. Traditional statistical methods often struggle with the high dimensionality and dynamic nature of price data, while DL models, specifically those utilizing artificial neural networks with multiple layers, can automatically learn these complex patterns directly from historical data. This capability extends to identifying interactions between numerous influencing factors – including demand, weather conditions, fuel costs, and grid congestion – without requiring explicit feature engineering. The ability to process and interpret these multifaceted relationships results in improved forecasting accuracy and a more robust prediction of future electricity prices, which is crucial for efficient energy trading, grid management, and resource allocation.

The Transformer architecture is particularly well-suited for time series data due to its inherent ability to process sequential information without the limitations of recurrent neural networks. Unlike RNNs which process data step-by-step, Transformers utilize a self-attention mechanism that allows each data point in the sequence to be directly related to all other points, regardless of their distance. This parallel processing capability significantly reduces training time and enables the model to capture long-range dependencies within the time series data. The architecture consists of an encoder and a decoder, both composed of multiple layers of self-attention and feed-forward networks, facilitating the learning of complex temporal patterns crucial for accurate forecasting.

Transformer models, a type of deep learning architecture, utilize self-attention mechanisms to identify and weigh the importance of different data points within a time series, enabling the capture of long-range dependencies crucial for accurate electricity price forecasting. Evaluations demonstrate that standard deep learning models consistently outperform traditional forecasting methods, as evidenced by lower Mean Absolute Error (MAE) values observed across diverse geographical regions and forecast horizons. This improved accuracy stems from the model’s ability to effectively model the complex, non-linear relationships inherent in electricity price data, something that simpler methods struggle to achieve.

The Inevitable Complexity of Renewable Integration

The integration of renewable energy sources, while vital for long-term sustainability, inherently introduces greater variability into electricity supply compared to traditional generation methods. Unlike dispatchable sources such as coal or nuclear power, the output of wind and solar generation is dependent on intermittent natural phenomena. This intermittency manifests as fluctuations in power output, ranging from short-term variations due to cloud cover or wind gusts to seasonal changes in resource availability. Consequently, grid operators face the challenge of balancing supply and demand with a less predictable energy input, requiring advanced forecasting and grid management techniques to maintain system reliability.

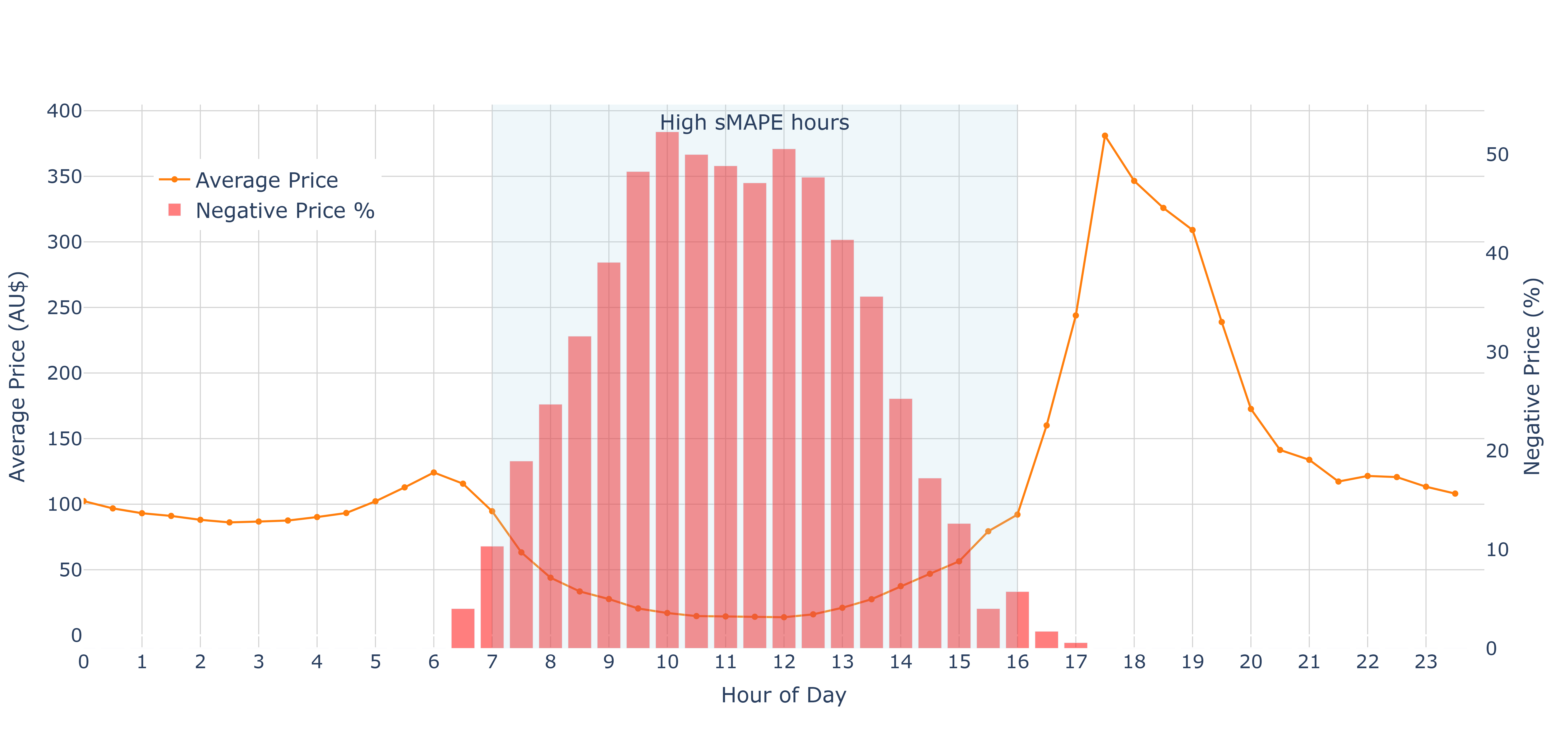

The inherent intermittency of renewable energy sources, such as wind and solar, introduces fluctuations in electricity supply that directly correlate with increased market volatility. When renewable generation exceeds demand, a surplus of electricity enters the grid. In established energy markets, this oversupply can drive down wholesale electricity prices, potentially resulting in negative price regimes where generators are effectively paid to reduce output rather than curtailing production, which is economically inefficient. The frequency and duration of these negative price events are directly linked to the penetration level of variable renewable energy (VRE) and the ability of the grid to absorb or redistribute excess power.

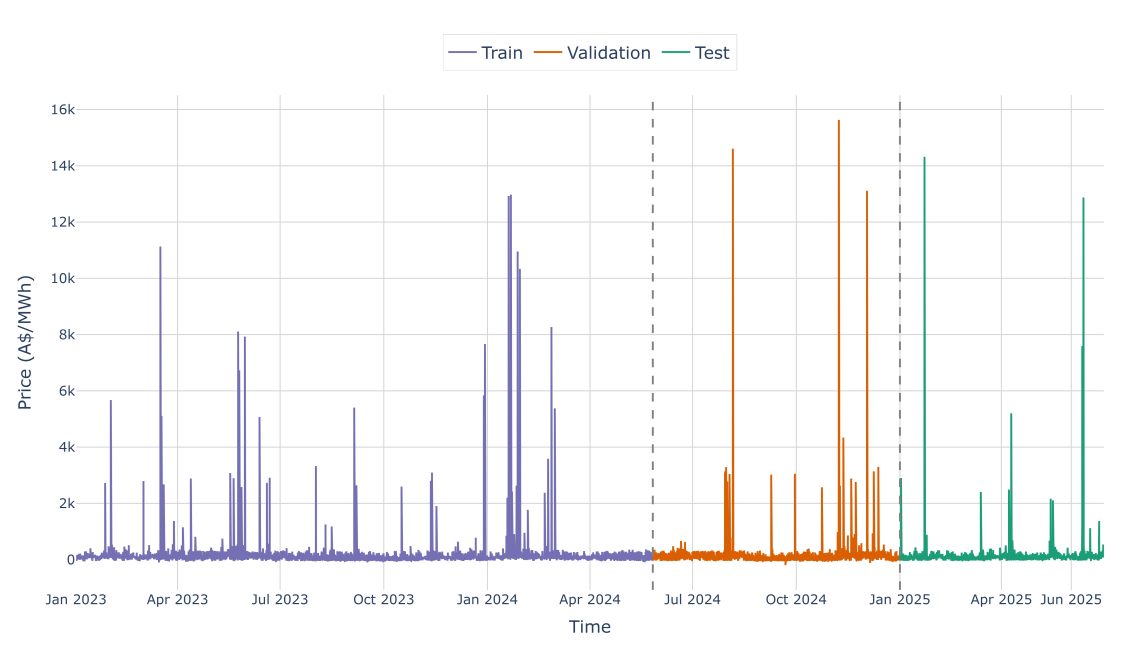

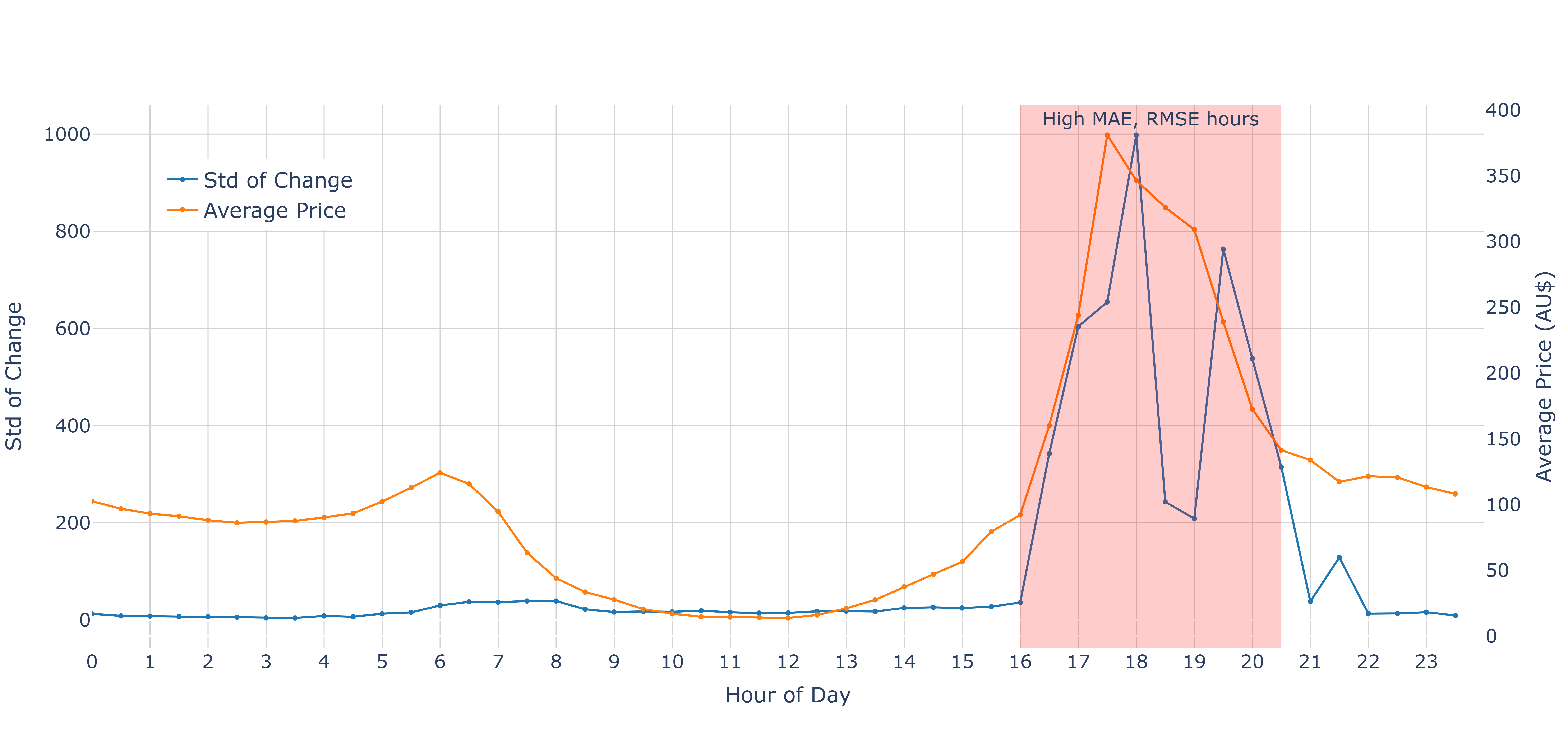

Effective electricity forecasting is paramount for grid stability as renewable energy sources increase system variability. Performance evaluations demonstrate that extending forecast horizons from 24 to 48 hours significantly impacts model accuracy; standard deep learning (DL) models experience performance degradation rates of approximately 10-13% at this extension, while state-of-the-art time series models maintain accuracy with degradation rates below 5%. Furthermore, regions with high variable renewable energy (VRE) penetration, specifically South Australia (SA) and Victoria (VIC), exhibit elevated symmetric mean absolute percentage error (sMAPE) values, directly correlating with the increased frequency of negative electricity prices caused by oversupply.

The pursuit of accurate electricity price forecasting, as demonstrated in this research, echoes a fundamental principle of mathematical rigor. The study’s findings – that established deep learning models, while currently superior, still fall short of fully capturing market complexities – highlight the limitations of purely empirical approaches. As Brian Kernighan observed, “Debugging is twice as hard as writing the code in the first place. Therefore, if you write the code as cleverly as possible, you are, by definition, not smart enough to debug it.” This sentiment applies directly to model building; a seemingly effective model, built without a deep understanding of the underlying price dynamics – let N approach infinity – will ultimately prove fragile and inaccurate. The search for robust forecasting methods necessitates a focus on provable, mathematically sound algorithms rather than merely achieving satisfactory performance on present datasets.

What’s Next?

The observed performance of established deep learning architectures in forecasting Australian electricity prices, while demonstrably effective, offers little in the way of fundamental advancement. The continued reliance on empirically successful, yet theoretically opaque, models feels… unsatisfying. It is not enough to simply observe predictive power; a rigorous mathematical understanding of why these models function remains elusive. The field must move beyond a focus on incremental improvements to existing structures.

A critical limitation lies in the current treatment of price distributions. Electricity prices are notoriously non-Gaussian, exhibiting skewness, kurtosis, and, crucially, time-varying conditional heteroskedasticity. Models that fail to explicitly account for these distributional characteristics – that treat price as a simple point estimate rather than a probabilistic outcome – are, by definition, incomplete. Future work should prioritize the development of models grounded in stochastic calculus and capable of accurately capturing the dynamic evolution of price volatility.

Ultimately, the true test of any forecasting model is not its ability to predict accurately on historical data, but its capacity to generalize to unforeseen market conditions. The increasing penetration of renewable energy sources, with their inherent intermittency and complex interactions, will undoubtedly present significant challenges. A model’s elegance, its true worth, will be revealed not in its empirical success, but in its provable robustness against such systemic shifts.

Original article: https://arxiv.org/pdf/2602.01157.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 15:50