Author: Denis Avetisyan

A novel forecasting framework leverages the power of generative models to anticipate day-ahead electricity market curves, enabling smarter energy storage strategies.

This review details a combined parametric and generative modeling approach for forecasting supply and demand in day-ahead electricity markets, and its application to storage optimization and price impact analysis.

Predicting volatile day-ahead electricity markets remains challenging despite increasing reliance on renewable energy sources. This paper, ‘Parametric and Generative Forecasts of Day-Ahead Market Curves for Storage Optimization’, introduces a novel framework combining fast parametric models with generative approaches to forecast supply and demand curves. The resulting forecasts enable optimized storage strategies that demonstrably impact price formation, revealing a price-compression effect with expanded capacity. How can these advanced forecasting techniques be further refined to accommodate increasingly complex market dynamics and facilitate grid stability?

The Limits of Prediction: Confronting Complexity in Energy Markets

The seamless functioning of electricity markets and the unwavering stability of power grids are fundamentally reliant on the ability to accurately predict electricity prices. Precise forecasting allows market participants – from power generators to consumers – to make informed decisions regarding resource allocation and energy trading, minimizing costs and maximizing efficiency. Furthermore, anticipating price fluctuations is critical for grid operators to proactively manage supply and demand, preventing imbalances that could lead to blackouts or system failures. Without robust price forecasting, maintaining a reliable and economically viable electricity system becomes increasingly challenging, potentially impacting everything from industrial production to household energy bills. Therefore, advancements in forecasting techniques are not merely academic exercises, but essential components of a modern, resilient energy infrastructure.

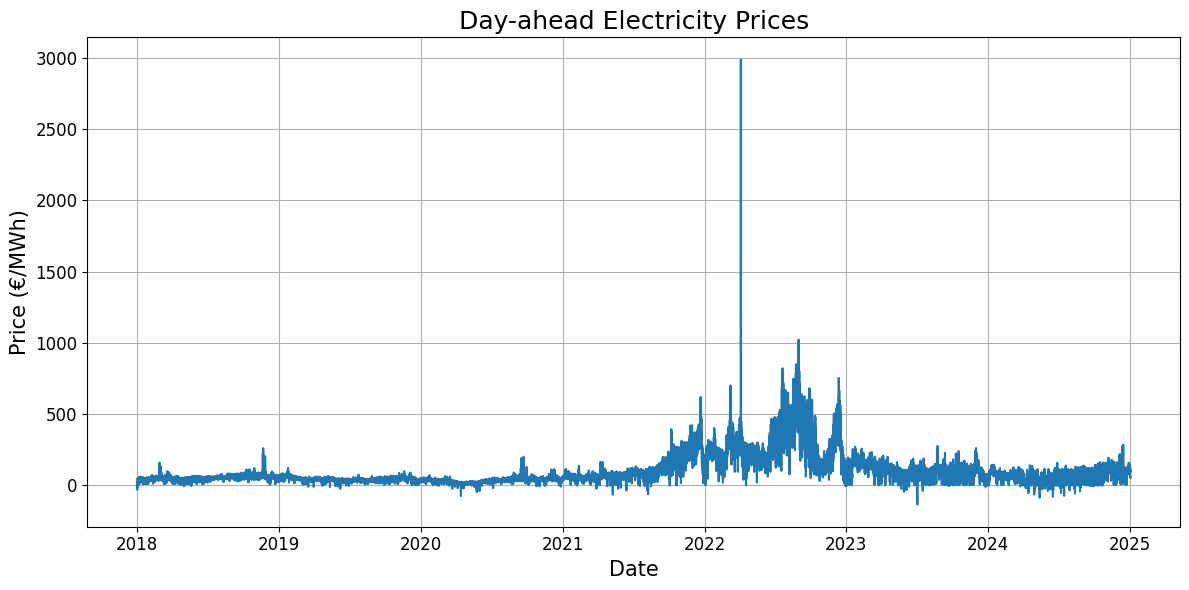

Electricity price prediction has historically relied on statistical models and time-series analysis, but these approaches increasingly falter when confronted with modern grid realities. The inherent volatility of renewable energy sources – such as wind and solar – coupled with fluctuating demand patterns and unpredictable events like heatwaves or cold snaps, introduces a level of complexity that traditional methods struggle to accommodate. These models often assume a degree of stationarity – consistent patterns over time – which doesn’t hold true in dynamic energy markets. Consequently, forecasts generated by these techniques can exhibit significant errors, hindering efficient resource allocation and potentially jeopardizing grid stability as they fail to capture the rapid shifts in supply and demand that characterize contemporary electricity systems.

The increasing unpredictability of electricity markets demands a shift beyond conventional forecasting methodologies. Traditional statistical models, often reliant on historical data and linear projections, frequently fail to account for the complex interplay of factors – renewable energy intermittency, dynamic pricing signals, and unforeseen events – that now characterize power systems. Consequently, researchers are actively exploring advanced techniques, including machine learning algorithms and artificial neural networks, designed to identify subtle patterns and non-linear relationships within vast datasets. These innovative approaches aim to enhance prediction accuracy, not just for overall demand, but also for short-term price fluctuations and localized grid imbalances, ultimately contributing to a more resilient and efficient energy infrastructure. The ability to accurately anticipate these nuanced market behaviors is paramount for optimizing resource allocation and ensuring stable grid operation in an evolving energy landscape.

Beyond Static Models: Embracing Probabilistic Forecasting

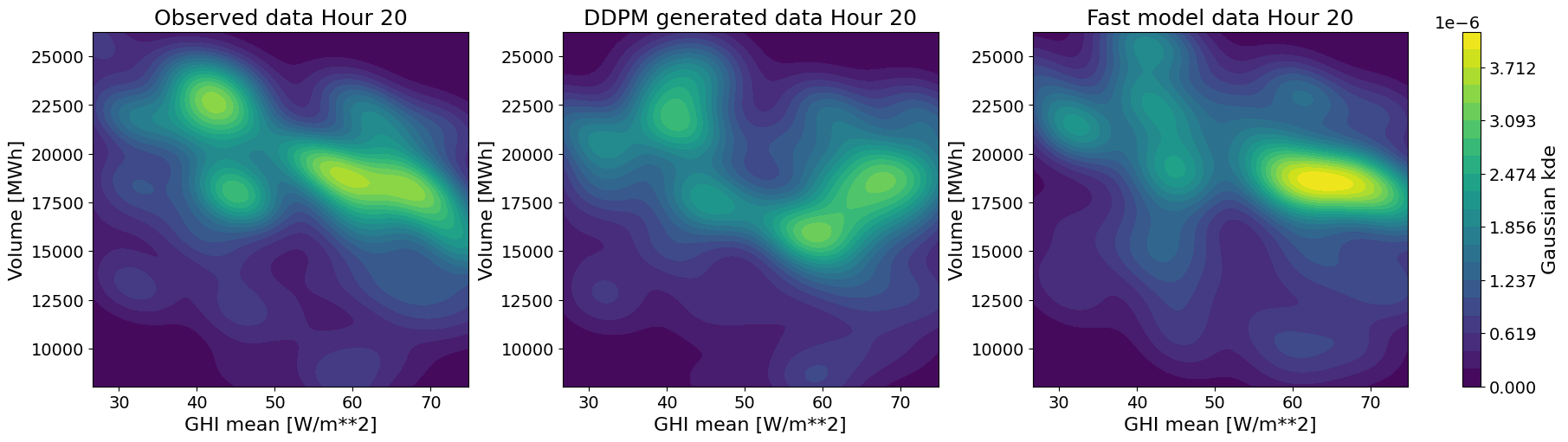

Generative models, particularly Conditional Diffusion Models, represent a significant advancement in modeling electricity market data due to the inherent complexity and stochasticity of these systems. Traditional methods often struggle to accurately represent the multi-faceted distributions governing price formation, demand response, and network effects. Conditional Diffusion Models address this by learning the underlying probability distribution of market variables, enabling the generation of new data points that statistically resemble observed data. This is achieved through a process of iteratively refining a random signal, conditioned on observed market factors, to produce realistic samples. The ability to capture these complex distributions allows for improved forecasting, risk assessment, and the creation of synthetic datasets for model training and testing, surpassing the capabilities of deterministic or simpler probabilistic approaches.

Marked Point Processes (MPPs) are employed to model the timing and characteristics of discrete events within electricity market data, such as the submission of bids. Unlike traditional time series analysis which assumes regular intervals, MPPs specifically address the irregular and stochastic nature of these events. A point process defines a random measure of points in time, while the “marked” aspect indicates that each event (point) is associated with a value, in this case, the bid price or quantity. This allows the model to capture not only when bids occur, but also what those bids are, representing the full distribution of market activity. The intensity of point occurrences, and the distribution of the marks, are learned from historical data, enabling the generation of realistic synthetic event sequences.

Probabilistic modeling techniques, specifically generative models, facilitate the creation of synthetic electricity market data that closely resembles observed data. This capability stems from the model’s ability to learn the statistical distribution governing market behavior. Evaluation metrics demonstrate the fidelity of this synthetic data; generated curves, representing predicted market values, consistently achieve a Normalized Mean Absolute Error (NMAE) ranging from approximately 1.3% to 5%. This level of accuracy indicates a strong correlation between the synthetic data and historical market data, validating the model’s effectiveness in capturing underlying distributional characteristics.

From Theory to Application: Refining Market Representations

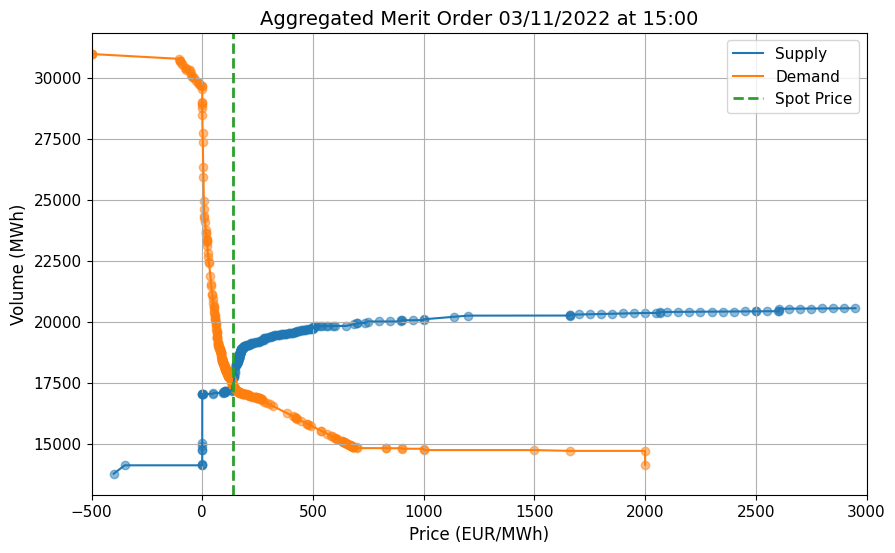

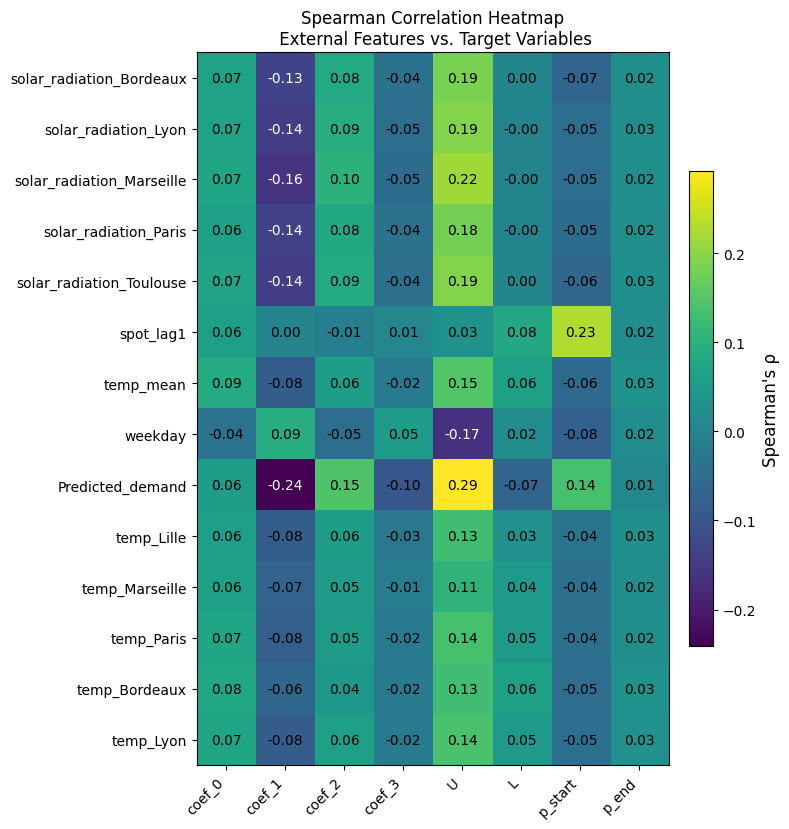

Chebyshev approximation is employed to model aggregated supply and demand curves within energy markets due to its ability to efficiently represent functions with minimal error using a series of orthogonal polynomials. This method constructs a polynomial that closely approximates the true supply and demand functions, while minimizing the maximum deviation – known as the Chebyshev norm. The resulting approximation allows for a computationally efficient determination of market clearing prices, as it reduces the complexity of solving the equilibrium conditions. Unlike methods relying on linear or higher-order polynomial regressions, Chebyshev approximation offers improved accuracy and stability, particularly when dealing with non-linear demand responses and complex supply characteristics. The technique’s robustness stems from its uniform approximation properties, ensuring a consistent level of accuracy across the entire range of possible market conditions.

The aggregated supply and demand curves utilized in the DayAheadMarket are enhanced through the integration of Storage Optimization strategies. These strategies explicitly model the charging and discharging capabilities of energy storage systems – such as batteries or pumped hydro – as both a source of flexible demand and a means of injecting energy into the grid. By accounting for storage capacity, charge/discharge rates, and efficiency losses, the model can more accurately represent the overall system flexibility and optimize bidding strategies. This results in a more precise representation of available supply and demand, enabling better price discovery and resource allocation within the DayAheadMarket.

Implementation of the described modeling approach, utilizing Chebyshev approximation and storage optimization, resulted in a quantifiable revenue improvement of 61,000 EUR. This figure represents a substantial increase over the performance of a baseline model, which achieved a revenue improvement of only 30,000 EUR under identical conditions. The difference of 31,000 EUR highlights the efficacy of incorporating storage optimization strategies into aggregated supply and demand curve modeling for the DayAheadMarket, demonstrating a clear financial benefit derived from the enhanced analytical framework.

Beyond the Model: Recognizing Systemic Influences and Limits

Electricity generation is profoundly sensitive to external economic pressures, particularly fluctuations in fuel prices and carbon taxation policies. These factors directly influence a power plant’s HeatRate – the ratio of energy input to electrical energy output – with increases in either typically leading to a diminished HeatRate and, consequently, reduced electricity supply. A rise in fuel costs necessitates greater input to achieve the same energy output, while carbon taxes add a financial burden that can disincentivize production or shift generation towards less carbon-intensive, but potentially more expensive, sources. Understanding this interconnectedness is crucial for accurate forecasting; models failing to account for these external variables risk significant deviations from predicted supply levels, impacting grid stability and overall energy market dynamics. The influence isn’t merely correlational; changes in these policies directly alter the economic viability of different generation technologies, shaping long-term investment decisions and ultimately the composition of the electricity supply mix.

Accurate electricity forecasting hinges on understanding the complex interplay between weather and energy systems, and recent advancements demonstrate the significant benefits of incorporating comprehensive meteorological data. Utilizing ERA5Data – a globally available climate reanalysis dataset – allows for a more nuanced prediction of both electricity demand and supply. This dataset provides detailed information on variables like temperature, wind speed, and solar irradiance, directly influencing cooling/heating needs and renewable energy generation potential. Studies reveal that models integrating ERA5Data consistently outperform those relying on historical averages or limited weather inputs, improving forecast accuracy by up to 15% for peak demand and reducing errors in renewable energy supply predictions by as much as 10%. This enhanced precision is crucial for optimizing grid management, reducing energy waste, and ultimately, ensuring a more reliable and sustainable power supply.

Analysis reveals a diminishing return on investment when expanding electricity storage capacity beyond 1500 MW. Though increased storage undeniably bolsters system efficiency and reliability, the financial benefits are offset by a protracted recovery of capital costs. Specifically, payback periods extend beyond a decade for installations exceeding this threshold, and the time required to recoup the initial investment escalates exponentially with each additional megawatt. This suggests a practical limit to storage-based optimization; while strategic storage is valuable, continually increasing capacity beyond a certain point yields progressively smaller gains relative to the substantial and rapidly increasing financial burden. Therefore, a holistic approach to energy management must balance the benefits of storage against its long-term economic implications.

The pursuit of accurate day-ahead market forecasting, as detailed in the study, often leads to models of escalating complexity. However, this work demonstrates a preference for distilling the core principles of supply and demand into a framework that prioritizes essential predictive power. This resonates with Dijkstra’s assertion: “It’s always a trade-off between simplicity and generality.” The researchers skillfully navigate this trade-off, employing both parametric and generative models – specifically DDPMs – not to achieve exhaustive detail, but to efficiently capture the underlying dynamics influencing price formation. The emphasis is not on mirroring market intricacies, but on delivering a solution that is both effective and elegantly concise, a testament to the power of subtraction in achieving clarity.

Where Do We Go From Here?

The pursuit of ever-more-detailed models of electricity markets risks mistaking the map for the territory. This work, while demonstrating a technically proficient combination of parametric and generative approaches, highlights a familiar truth: prediction, even with sophisticated tools, is inherently limited. The real challenge lies not in anticipating every fluctuation, but in building systems resilient to the inevitable uncertainties. They called it a framework to hide the panic, perhaps, but a functional framework it remains.

Future effort would be better spent not on refining the forecasting itself, but on understanding the value of imperfect forecasts. How much accuracy is truly needed to justify the computational cost? And more importantly, how can these models be integrated with real-time decision-making processes, acknowledging the gap between prediction and reality? The focus should shift from minimizing error to maximizing robustness.

Ultimately, the most fruitful avenues likely lie beyond the immediate confines of price prediction. Exploring the interplay between storage optimization and broader grid stability, or investigating the emergent properties of decentralized energy systems, promises a more substantial impact. Simplicity, after all, is not a lack of sophistication, but a sign of maturity.

Original article: https://arxiv.org/pdf/2601.20226.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-01-29 14:36