There are afternoons, oppressive with the weight of summer’s monotony, when the pool’s surface glimmers as if to offer relief, but one cannot help noticing the faint, ever-present scent of chlorine—its sharpness an emblem for a world too rigorously maintained. Even beneath the sun, refreshment is at best a fugitive feeling, never quite realized, always mediated by the sense that you have stumbled, unwittingly, into a system whose rules elude all reason. And so, the idle investor, beverage in hand, contemplates Pool Corp (POOL), that rarest of paradoxes: a business which, even in decline, preserves the weary illusion of progress—a machine whose cogs churn methodically, regardless of the fluctuating appetites of mankind for aquatic leisure.

the relentless, unglamorous task of repairing that which refuses to remain whole. Even if the age of new construction slumbers, the labyrinth of malfunction, decay, and replacement ensures the company’s continuation, as if the swimming pool, once summoned into existence, condemned its owner to eternal recurrence of repair invoices.

The recent quarter’s earnings, revealed with the solemnity of a new decree, offered revenue up a meager 1%—hardly the kind of news that would stir the world’s sleeping financiers, but testimony to the absurd durability of Pool’s model. Net income encroached upwards to $194 million, EPS inched to $5.17, and a 30% profit margin was maintained—as predictable as the calendar’s advance, regardless of whether any pools are actually enjoyed.

True, there are complications. The Company, through no volition of its own, will increase prices by 2%, blaming tariffs and inflation—inevitabilities imposed from above, not unlike the vague but binding directives of a distant administration. Guidance, too, is revised with the pain of a mid-level official crossing out and rewriting digits: revenue shall be “flat,” a term almost tragic in its refusal to promise either failure or success; EPS, that oracular number, must be painted within the newly approved range of $10.80 to $11.30.

Why I Remain, Inexplicably, Hopeful for Pool

The connoisseur of stocks, who finds pleasure not in promise but in the ongoing administration of dividends, cannot resist Pool’s appeal. Down 4% this year—the market’s mild censure—yet up 3% post-earnings, the share price reflects the unpredictable logic of a bureaucracy whose memos contradict themselves and whose committees never quite adjourn.

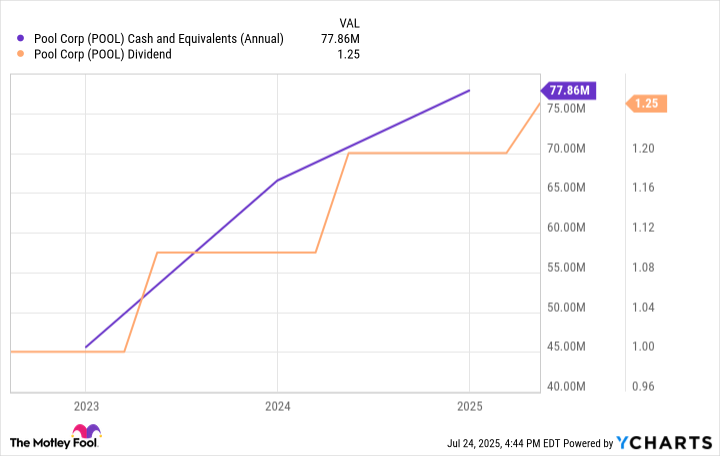

Nevertheless, the company rewards patience and a penchant for papers filed in triplicate. With dividends growing—$92.2 million dispensed in the first half of the year, and $160.6 million worth of buybacks executed in a few artless strokes—Pool entices those who seek comfort in repetition. That Berkshire Hathaway, temple of infinitely patient investment, has staked its claim in Pool, confirms what the observer suspects: the only way to win is to remain, dutifully, on the roster. It is a stock that pays holders for their docility, and, perhaps, for an ability to withstand ennui.

For those whose appetite is not for feverish speculation, but for the slow accretion of benefit, Pool is a study in procedural satisfaction. The short-term trader finds a trickle of income, the long-term observer, the soothing hum of a machine that cannot, by design, be turned off.

The Unfathomable Bottom Line

There is no clear victory here; Pool will not ignite your portfolio, nor will it annihilate what is already in place. Instead, it offers the quiet horror—and relief—of predictability, a stock undervalued enough to suggest an oversight by the faceless market’s clerks, yet already beginning a slow ascent as if summoned by the silent, implacable upward pressure of bureaucracy itself.

Should one wish to enter this cycle, the most prudent process—at once defeating and reassuring—is dollar-cost averaging: dividing one’s investment into four tidy installments, as if seeking reassurance from multiplication tables, soothing oneself with the logic that, by smoothing the absurd lurches of the market, one is at last semi-insulated from the caprice of fate. The pool beckons, but the paperwork, as always, remains.

🪪

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- HSR Fate/stay night — best team comps and bond synergies

2025-07-28 02:47