As a seasoned researcher with years of experience navigating the volatile cryptocurrency market, I must admit that Polkadot’s recent surge has caught my attention. The 178% increase over the past month is impressive and suggests strong bullish momentum. However, looking at technical indicators, I can’t help but feel a sense of déjà vu – I’ve seen this chart pattern before.

In the last day, Polkadot (DOT) has seen a significant increase of more than 10%, and in the past month, its price has skyrocketed by an astounding 178.44%. This surge indicates a robust bullish trend. However, technical signs point to potential slowdown, as both RSI and CMF are hinting at decreasing buying pressure.

As a researcher, I’m observing that the Exponential Moving Averages (EMA) of DOT are maintaining a bullish trend. However, there’s a hint of a waning uptrend which might prompt the price to touch support levels. On the brighter side, if momentum revives, it could catapult DOT towards its upcoming resistance. If this momentum sustains, we might even witness a breakout at its highest level since April 2022.

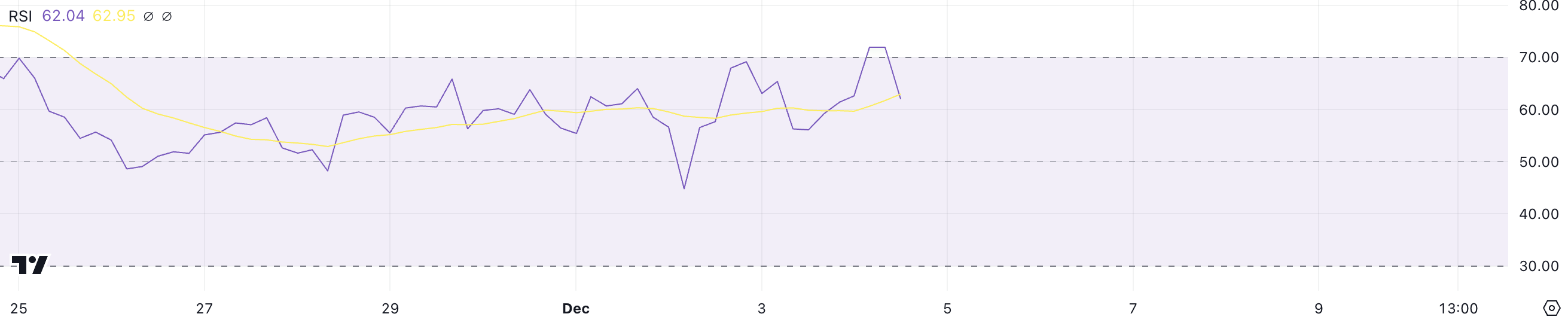

DOT RSI Cooled Down

At present, the Relative Strength Index (RSI) of DOT has dropped to 62, following a brief spike over 70 – a level not seen since November 24. This surge above 70 suggested overbought conditions and robust buying activity, but the subsequent dip down to 62 suggests a momentary decrease in this momentum, indicating a slight letup.

Even though there’s a temporary dip, the Relative Strength Index (RSI) still indicates a bullish trend, hinting at ongoing confidence among purchasers.

The Relative Strength Index (RSI) gauges the rate and intensity of price changes, using values greater than 70 to signal overbought situations and values below 30 suggesting oversold conditions. Currently, DOT’s RSI stands at 62, showing a good pace, but it has moved away from its peak levels.

Should the Relative Strength Index (RSI) hold steady or rebound over 70, Polkadot might experience further upward momentum. However, if the RSI persistently falls beneath 60, this could signal weakening power and potentially trigger price consolidation or a brief correction.

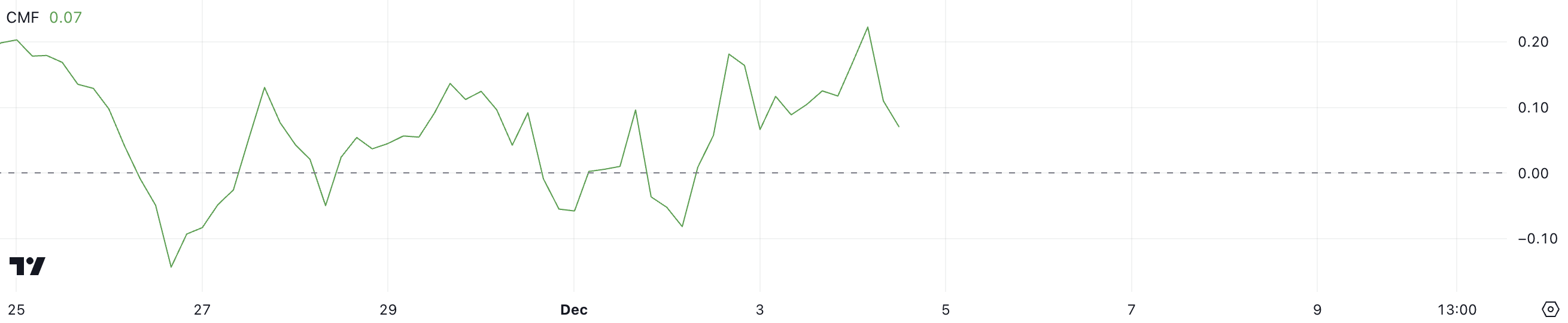

Polkadot CMF Is Still Positive

Currently, DOT’s Chaikin Money Flow (CMF) stands at 0.07, which is a decrease from its recent high of 0.22 – the strongest level since November 23. This drop implies that although buying activity is still present, it has become less forceful compared to its previous strength.

The positive CMF value still indicates net capital inflow into DOT, reflecting overall bullish sentiment, but the decreasing trend signals a potential slowdown.

As an analyst, I observe that the Chaikin Money Flow (CMF) quantifies the ebb and flow of funds into and out of an asset, taking into account both price and volume. A CMF value greater than zero points towards buying pressure, while a value less than zero indicates selling pressure. Currently, the CMF for DOT stands at 0.07, but it’s a significant drop from its previous level of 0.22. This decrease might suggest a diminishing bullish momentum in the asset.

If the Change in Market Functions (CMF) persistently decreases, it could suggest increasing sales activity, which may result in either price stabilization or a decline, known as a correction. Conversely, a resurgence of the CMF towards higher values might rekindle the bullish trend.

DOT Price Prediction: Can Polkadot Reach $12 In December?

The short-term moving averages (EMA) in DOT continue to trend upward, as they sit above the long-term averages, indicating persistent growth. Yet, some additional signals such as RSI and Money Flow Index (CMF) hint that the current upward trend could be losing steam.

If the demand for purchasing Polkadot weakens persistently, its price might reach the possible support threshold of $8.4. Should this support level prove insufficient, there could be an additional decline towards $7.5.

If the upward trend gains momentum again, it’s possible that the DOT price could target a significant resistance point at around $11.6. Overcoming this barrier could potentially propel the price further to a notable level of $12, a figure last reached in April 2022.

Read More

2024-12-04 23:32