In the annals of industrial ambition, few tales are as simultaneously grandiose and precarious as that of Plug Power[1]. Picture, if you will, a troupe of alchemists attempting to transmute base metals into gold while simultaneously constructing the philosopher’s stone from scratch. This is the hydrogen fuel cell industry, where Plug Power (PLUG) has positioned itself as both pioneer and punchline in the grand theater of clean energy.

A Guild of Alchemists in the Age of Steam

The energy sector has always been a tale of infrastructure. Consider the oil barons who built cathedrals of steel and pipelines to ferry black gold across continents. Now imagine replacing that gold with hydrogen-a substance that, while abundant, insists on behaving like a cat in a room full of rocking chairs[2]. Plug Power, bless its circuitry, has spent two decades trying to tame this fickle element, constructing fuel cells and hydrogen stations like a dwarven engineer drunk on ambition.

To date, they’ve deployed 69,000 fuel cells and 250 stations-a feat akin to building a fleet of airships while debating whether air exists. Their current clientele? Forklift operators seeking carbon redemption[3]. The grand vision? A continent-spanning “clean highway” for hydrogen-powered juggernauts. Noble? Perhaps. Practical? As practical as a pocket watch in a black hole.

Financial Gymnastics and the Dilution Waltz

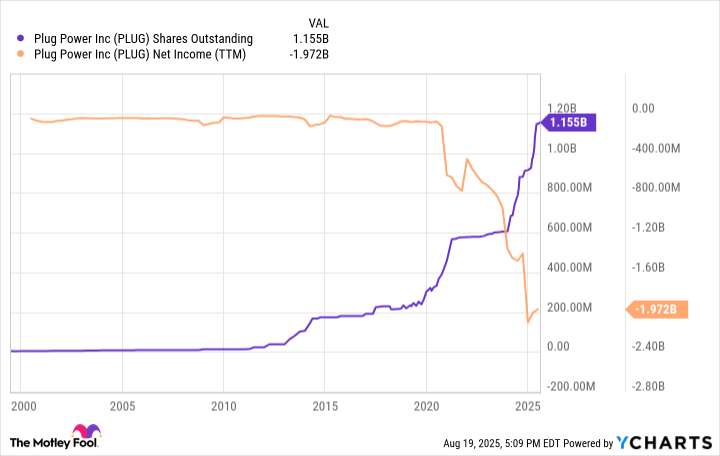

Let us now examine the company’s balance sheet, a document that makes the Discworld’s Luggage[4] look fiscally responsible. Despite $672 million in annual revenue, Plug Power’s losses grow like a particularly aggressive mold. To fund operations, management has issued shares with the enthusiasm of a Mustrum Ridcully hosting a garage sale. Since 2020, shares have quadrupled in number-good news if you’re collecting certificates as art, less so if you own any.

Management promises austerity: $200 million in annual cost cuts, profitability by 2028. This is the financial equivalent of promising to hold your breath until the next ice age. Yet hope springs eternal, much like the hydrogen molecule itself-always there, never quite where you expect.

The Millionaire Maker Mirage

At $1.50 per share, Plug Power trades at the intersection of desperation and daydream. Its $2 billion market cap sits beneath the hydrogen sector’s $225 billion valuation like a mouse beneath a mountain. Could it become a “millionaire maker”? Only if you consider the definition of “millionaire” to include adjusting for inflation post-2050.

The balance sheet reveals $336 million in cash versus $991 million in debt-a delicate dance akin to juggling anvils on a tightrope. With $819 million burned annually, future equity offerings seem inevitable. Investors, already singed by a 97% peak-to-trough drop, might want to consider asbestos-lined wallets.

Plug Power’s story mirrors the tragedy of Icarus, if Icarus had built his own wings from duct tape and dreams. As a business historian, I see echoes of the dot-com bubble’s zaniness and the railroads’ 19th-century excesses. As a disciple of Pratchett, I marvel at the sheer audacity of humans[5] who dare to bet their treasure on a substance that evaporates faster than a librarian’s patience during a fire drill. The future? Perhaps. Fortune? Unlikely. Fun?  🧪

🧪

[2] Hydrogen‘s tendency to leak, combust, and generally misbehave has baffled scientists since 1766. Plug Power’s engineers are still troubleshooting.

[3] Forklifts, it turns out, have excellent carbon footprints but poor taste in fuel.

[4] A magical suitcase that follows its owner everywhere, consuming all nearby objects-including money.

[5] And by “humans,” we naturally mean “the brave souls who call themselves shareholders.”

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-24 12:50