Dear Diary,

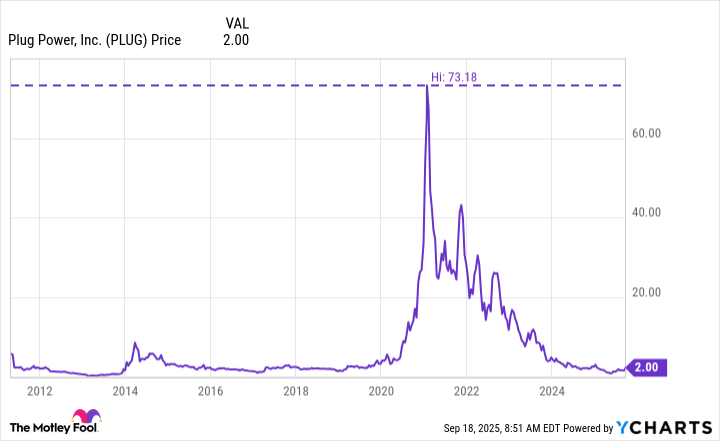

Let me start by confessing I’ve never been great with timelines. Last week, I accidentally scheduled a Zoom meeting for 2023. But today, I’m here to dissect Plug Power (PLUG), a stock that’s fallen so far from its $1,497.50 glory days (adjusted for a 1-for-10 reverse split, of course) that it now trades at roughly $2 per share. For context, that’s less than what I paid for my last coffee-*and* I added extra almond milk.

Plug Power’s story is the financial equivalent of a reality TV show: all hype, no substance. Its mission? To build a “green hydrogen ecosystem.” Sounds noble, until you realize it’s like telling your friend who’s running a lemonade stand that you’re going to disrupt the beverage industry.

Units of PLUG Lost to Panic: 12. Hours Spent Googling “Is Hydrogen the Future?”: 9. Number of Times I Said “This Is a Bubble” Too Late: 24.

What Does Plug Power Do? (Or Rather, Why Shouldn’t I?)

Plug Power’s business model is as simple as my dating profile: “We make hydrogen fuel cells and electrolyzers.” Translating from corporate jargon: they turn water into hydrogen, then turn hydrogen back into energy. The byproducts are heat and water. How very… circular.

On paper, this is clean energy. In practice, it’s like trying to sell a Tesla to a gas station owner who still thinks “EV” stands for “Everyone’s Vain.” The company’s niche markets-forklifts in warehouses, for example-are promising, but let’s not pretend this is about to power the next *Fast & Furious* movie.

Wall Street’s love affair with Plug’s “story” died faster than my gym membership after the holiday season. The stock’s post-IPO peak? A 1-for-10 reverse split away from oblivion. Now it’s a penny stock, which is Wall Street’s way of saying, “This is a bad idea, but we’ll let you try it anyway.”

The Big Problem for Plug Power (And Me, Psychologically)

The issue isn’t the technology-it’s the infrastructure. Oil has pipelines, gas stations, and a 150-year head start. Hydrogen? It’s still waiting for its first “Hello, I’m a filling station.” Plug Power’s customers have to adopt a fuel that’s less accessible and more expensive. It’s like asking your barista to switch to a coffee machine that requires a PhD to operate.

And then there’s the money. Plug Power is a money-losing business. Even their “good news”-a Q2 gross profit improvement from -92% to -31%-feels like a toddler taking one step forward and two back. The company’s future depends on scaling hydrogen infrastructure, which, in turn, depends on companies willing to spend more to be “green.” A noble goal, sure, but not one that pays dividends.

Tread Carefully (Or Don’t-I Won’t Judge)

Plug Power’s story is compelling, like a rom-com where the protagonist is both the hero and the fool. But as a value investor, I’m not here for the plot-I’m here for the numbers. And right now, the numbers scream, “Run while you still can.”

Unless you’re a masochist with a soft spot for hydrogen, this stock is a high-stakes game of chicken. If Plug Power’s vision pans out, you might strike gold. If not, you’ll join the ranks of investors who bought in just to watch their portfolio become a cautionary tale.

Final verdict? Plug Power is a gamble, not an investment. And if there’s one thing I’ve learned from my financial disasters, it’s that seatbelts are for cars, not portfolios. 🚀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-22 16:24