Plug Power (PLUG 2.09%). The name itself suggests a certain… optimism. Or perhaps a desperate need for electrical outlets. The stock, however, has recently been performing a rather dramatic impression of a falling object – down over 16% in the last month, and currently sporting a 59% discount from its 52-week high. Which, in the grand scheme of things, is only slightly less alarming than discovering your socks have achieved sentience and are demanding royalties. (It happens. Trust me.)

Now, sensible investors – those who haven’t yet been abducted by rogue algorithms – understand that a falling price doesn’t necessarily equate to a bad investment. It simply means someone, somewhere, has decided the future is less hydrogen-powered than previously anticipated. Let’s, therefore, wade through the arguments, shall we? It’s a bit like sorting through a box of Schrödinger’s cats – until you open it, you have no idea if it’s a potentially lucrative investment or a feline existential crisis.

Bulls See a Future Powered by… Well, Hydrogen

The bullish contingent, bless their optimistic hearts, believes this recent dip is merely a temporary blip. They point to the potential of hydrogen as the fuel of the future – a future that, admittedly, seems to arrive at a glacial pace. They see Plug Power as a key player in this unfolding drama, a company poised to capitalize on the inevitable shift away from… everything else. (Which, let’s be honest, is a remarkably broad market.)

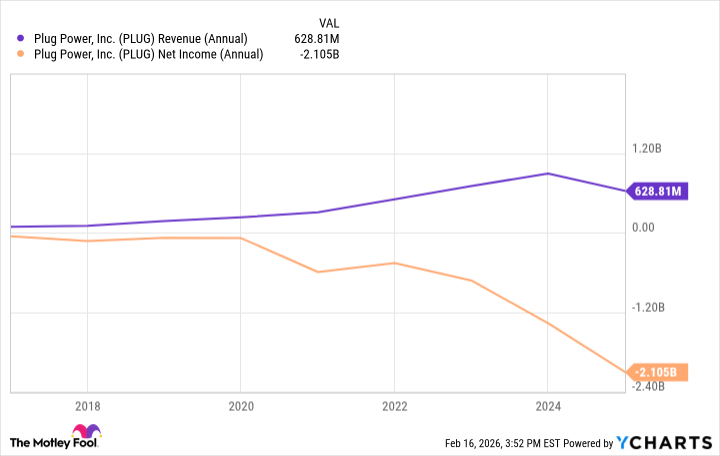

Plug Power has, undeniably, demonstrated a knack for increasing revenue. Over the past decade, they’ve managed an 880% growth in top-line figures. Which is impressive, assuming you don’t consider the sheer improbability of anything growing that much without spontaneously developing tentacles. (And even then, it’s still impressive.)

They’re also making strides – however tentative – towards profitability. Project Quantum Leap, their cost-saving initiative, sounds rather ambitious, doesn’t it? Like a desperate attempt to escape a black hole using only willpower and a slightly dented spreadsheet. Early indications suggest it’s having some effect. Their gross profit margin, currently at a negative 51.1%, is… less negative than it was last year (-89.3%). Which is progress, in the same way that falling slightly slower towards the Earth is progress.

Management, with the unwavering confidence of those who’ve spent years staring at financial projections, predicts breakeven on gross profit by the end of 2025, positive EBITDAS by 2026, and overall profitability by 2028. This timeline, naturally, is subject to the whims of the universe, the price of rare earth minerals, and the occasional rogue asteroid. (One must always account for rogue asteroids.) The current price-to-sales ratio of 2.9, compared to a five-year average of 3.9, further fuels the bullish narrative.

Bears Smell a Hydrogen-Shaped Hole in the Portfolio

But the bears, those pragmatic pessimists, aren’t buying it. They focus on the bottom line, or rather, the lack thereof. While Plug Power’s advocates tout its growth potential, the bears point out that the company has been around for nearly three decades. Twenty-seven years of trying to achieve profitability is starting to look less like a temporary setback and more like a fundamental flaw in the business model. (It’s like trying to build a house of cards in a hurricane.)

And while management has a timeline for achieving profitability, the bears recall a long history of unmet expectations. Promises, promises. It’s a bit like waiting for a bus that never arrives – you start to question the very existence of public transportation.

The contrast with Bloom Energy (BE 7.23%) is particularly stark. Bloom, another hydrogen player, has actually managed to generate consistent profits. In the fourth quarter of 2025, they reported earnings per share of $0.45. Adjusted diluted EPS for 2025 and 2024 were $0.76 and $0.28, respectively. Which, in the world of hydrogen stocks, is practically a financial miracle. The bears suggest there are plenty of other ways to gain exposure to the hydrogen industry, such as investing in Bloom or a hydrogen ETF.

The Verdict: Observe from a Safe Distance

Plug Power deserves credit for its revenue growth and its cost-reduction efforts. But declaring it a ‘buy’ right now feels… premature. It’s like signing up for a space mission before the rocket has been built. For most investors, the prudent course of action is to wait and see if the company can continue to reduce expenses and move closer to profitability, or if it reverts to its historical pattern of disappointment. (And perhaps invest in a good pair of binoculars.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-21 13:52