The matter of Planet Labs (PL +8.66%) has, as of this observation prior to the market’s opening on January 16th, registered a peculiar ascent of 24.5% this week, according to the pronouncements of S&P Global Market Intelligence. The company, engaged in the operation of a satellite constellation, purveys imaging services to governmental entities and commercial interests, and has, it appears, secured another contract with Sweden. A Wall Street analyst has also, in a gesture that feels both arbitrary and inevitable, upgraded the stock. The entire sequence resembles a complex filing system, where the location of any single document remains perpetually uncertain.

The stock itself has experienced an upward trajectory exceeding 600% over the past year. One begins to suspect the numbers themselves are breeding, replicating with an unsettling disregard for underlying value. This week’s increase is, therefore, not an anomaly, but rather a continuation of a process whose ultimate destination remains frustratingly obscured.

The Swedish Accord and the Analyst’s Decree

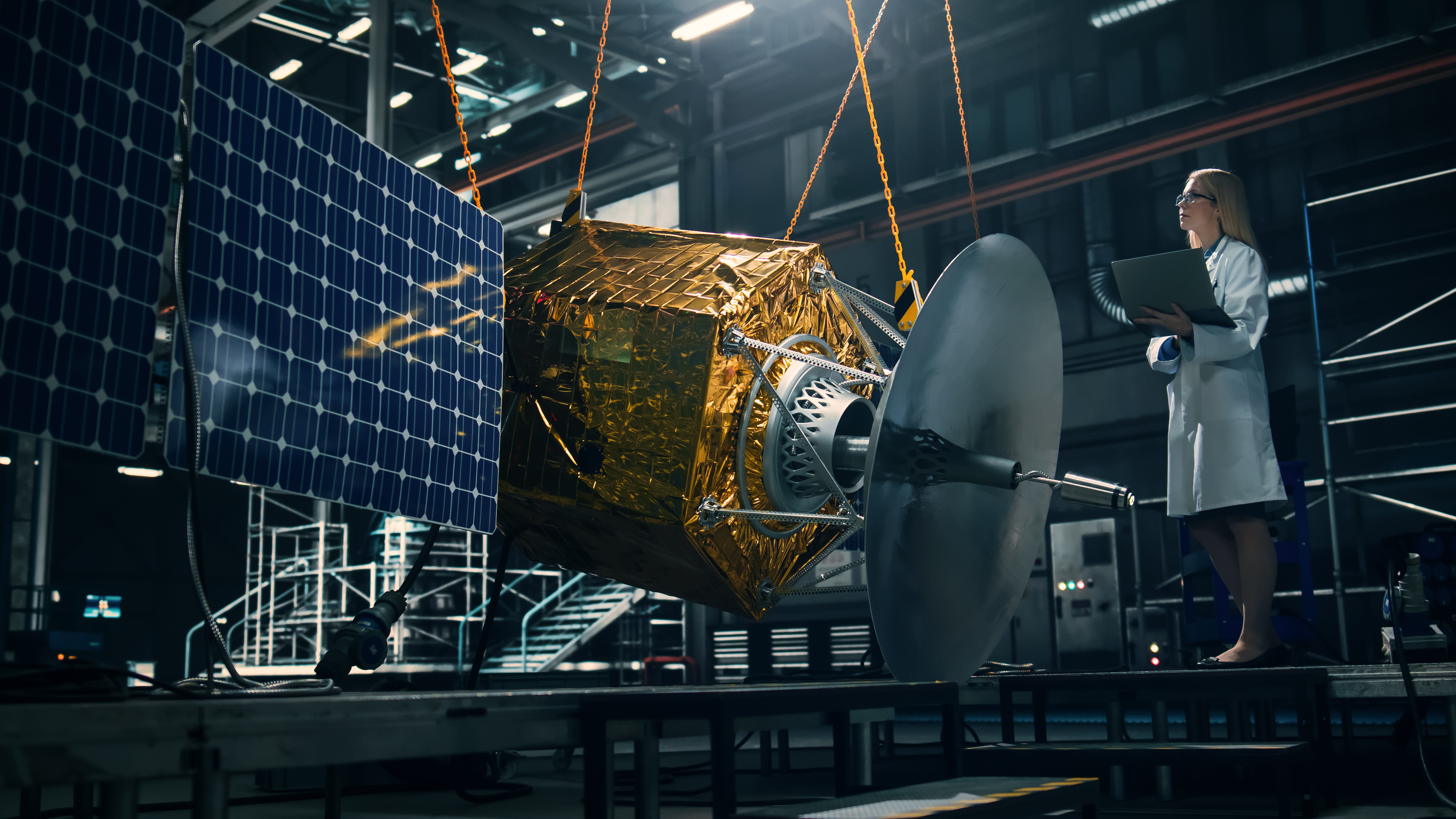

Satellite imaging services, it is understood, are experiencing a period of growth, catering to both military and commercial applications. Planet Labs has constructed a constellation of satellites specifically tailored to these needs, performing daily, high-resolution imaging of the globe to monitor assets such as ports, infrastructure, and, of course, military bases. The sheer volume of data generated is, frankly, overwhelming, and one wonders if anyone is actually interpreting it, or if it simply accumulates in vast, digital archives, a monument to our collective surveillance.

Nations, it seems, are queuing to enter into contracts with the company. This week, Sweden committed to a contract exceeding $100 million for imaging services for its military, payments to be disbursed over multiple years. This signing, predictably, has contributed to a growth of over 200% in Planet Labs’ backlog last quarter, reaching $734 million. Investors, naturally, are anticipating financial returns from these long-term governmental agreements. The process feels circular: contracts beget backlogs, backlogs justify valuations, and valuations… lead to further contracts. A self-perpetuating system, entirely divorced from any discernible reality.

Further complicating matters is a new undertaking with Alphabet, known as Project Suncatcher, which explores the construction of artificial intelligence (AI) data centers in space. The implications of this project are, at best, unclear. The notion of AI operating beyond the reach of terrestrial oversight is… unsettling. Wedbush, responding to these developments, upgraded its Planet Labs price target from $20 to $28, prompting yet another increase in the stock price. The logic of these actions remains opaque.

An Inquiry into Acquisition

Following this week’s surge, Planet Labs possesses a market capitalization of approximately $9 billion. It has, remarkably, achieved cash flow positivity, generating $35 million in free cash flow over the last twelve months. A minor miracle, perhaps, or simply a temporary reprieve from the inevitable.

However, a closer examination of Planet Labs’ revenue reveals a figure significantly smaller than its current market capitalization. Revenue totaled $282 million over the last twelve months, resulting in a trailing price-to-sales ratio of 32. The business may be expanding rapidly, but it is currently valued at a considerable premium. One is left with the distinct impression of a fragile structure, precariously balanced on a foundation of optimistic projections. For the time being, it would be prudent to maintain Planet Labs stock on a watchlist – a holding pattern, indefinitely prolonged. A quiet observation, from a safe distance.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-01-16 17:52