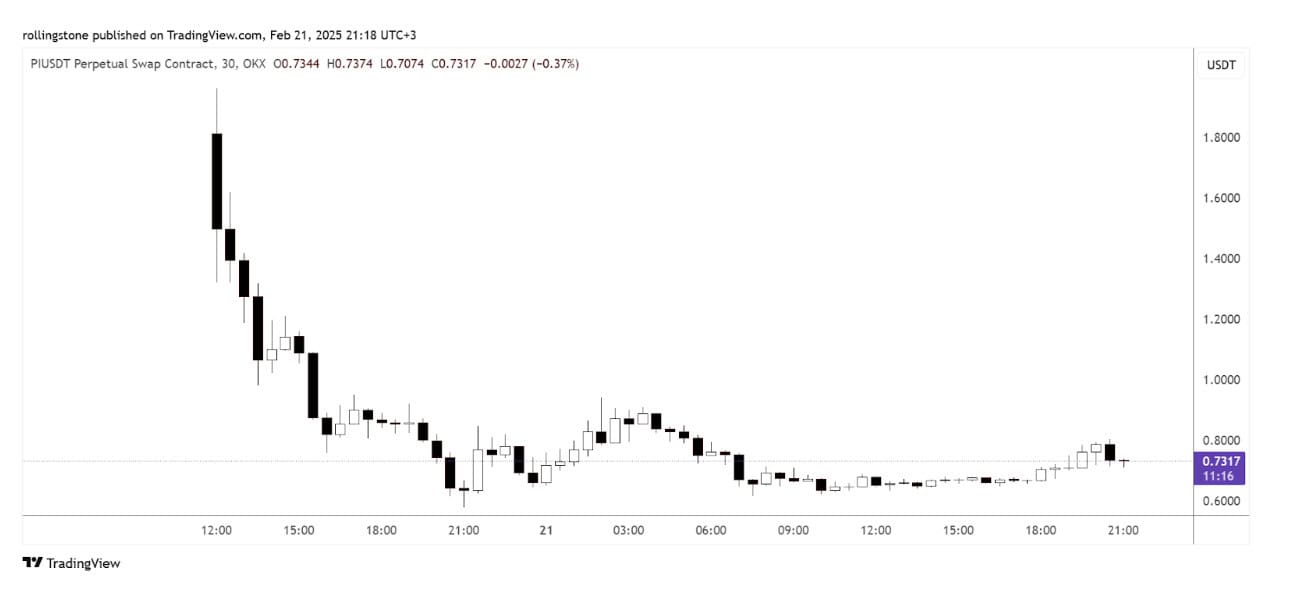

Ah, the Pi token! It opened with all the fanfare of a royal wedding at $1.84, only to crash down to a lowly $0.64 faster than you can say “liquidity crisis.” This dramatic nosedive has left many scratching their heads and wondering if they should have just invested in Beanie Babies instead. 🤔

The mainnet launch was supposed to be the moment Pi Network burst onto the scene like a firework, but instead, it fizzled out like a damp squib. Major exchanges like OKX, Bitget, and MEXC were ready to roll out the red carpet for PI, but instead of a grand parade, we got a stampede of selling pressure that sent the price tumbling. Talk about a party foul! 🎉

Liquidity Issues Raise Red Flags

Despite the initial excitement, PI’s market structure is about as stable as a house of cards in a windstorm. Liquidity has become the elephant in the room, with even the big exchanges struggling to keep up with the trading frenzy. According to OKX, their 2% market depth is a mere $33,000 to $60,000. That means a $100,000 trade could send prices doing the cha-cha! 💃

“The lack of liquidity is making PI’s market highly unstable,” said one analyst, probably while shaking their head in disbelief. “Traders are finding it difficult to execute large transactions without impacting the price, which suggests there may not be enough real demand for the token.” Well, that’s comforting! 😅

This instability has led to skepticism about the project’s long-term prospects, with some comparing it to past crypto disasters that went belly-up faster than you can say “Ponzi scheme.” 🥴

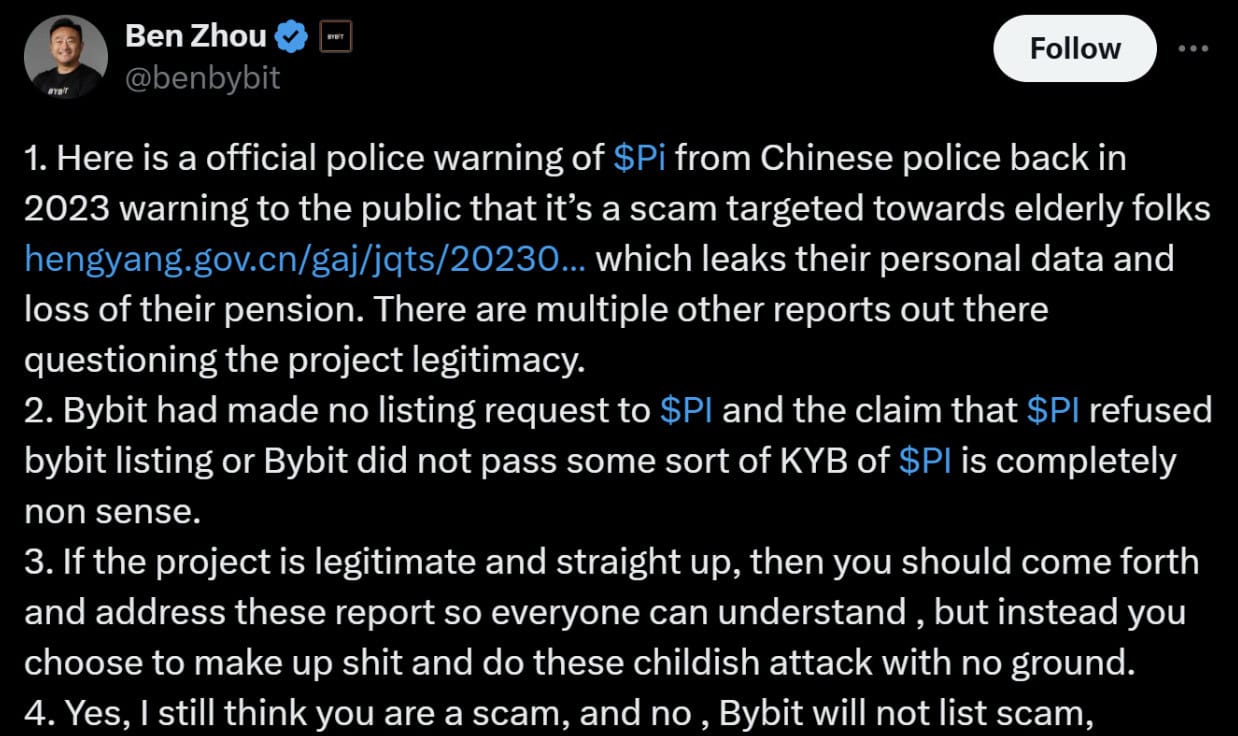

Bybit CEO Slams Pi Network, Calls for Transparency

While some exchanges are rolling out the welcome mat for PI, others are throwing tomatoes. Bybit CEO Ben Zhou has gone on record calling Pi Network a scam, citing a 2023 warning from Chinese authorities that labeled it a fraudulent scheme targeting the elderly. Ouch! That’s a low blow! 😬

“Bybit had made no listing request to $PI, and the claim that $PI refused Bybit listing or that Bybit did not pass some sort of KYB of $PI is completely nonsense,” Zhou tweeted, challenging Pi Network to stop dodging the questions and face the music. 🎶

Despite Pi Network’s claims of decentralization, experts are raising eyebrows. The core team still holds the reins over the network’s validators, with no clear roadmap for independent governance. It’s like saying you’re running a democracy while still being the king! 👑

Community Reactions: Disappointment and Skepticism

Pi Network has managed to gather a whopping 60 million users through its quirky smartphone mining system, which allows folks to earn tokens by tapping a button daily. While this model has built a strong user base, critics are quick to point out that it resembles a multi-level marketing scheme more than a sustainable cryptocurrency. Yikes! 🚩

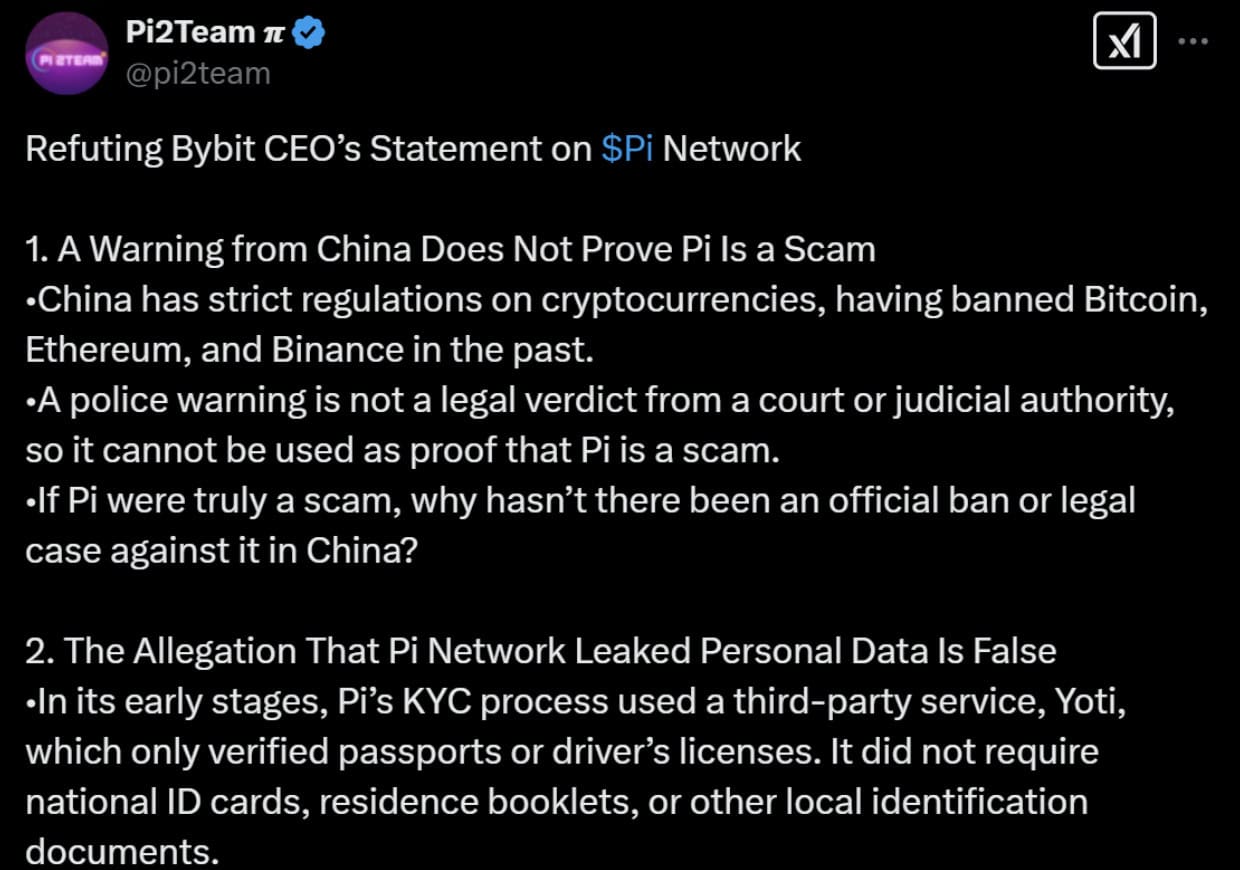

Pi Network refutes Bybit CEO’s scam allegations, citing China’s regulatory stance and denying claims of personal data leaks. Pi2Team 𝝅 via X

After the token’s crash, many long-time supporters were left feeling like they’d just been dumped. Some early adopters, who had been hoarding PI like it was the last slice of pizza, were dismayed to see their precious tokens lose value faster than a bad investment in a 90s tech startup. 🍕

Crypto commentator Kim Wong called the trading debut “disappointing,” citing soft buy orders and a lack of major capital inflows. But hey, Wong is optimistic that the price might bounce back if institutional players decide to join the party. Fingers crossed! 🤞

ByBit Has Problems of its Own after Major Hack

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-21 22:19