Pi Network, that paragon of digital currencies, has experienced a rather unfortunate double-digit decline in the past week, losing nearly 20% of its value. This rather unseemly price dip can be attributed to the market’s newfound love for volatility, a sentiment largely fueled by Donald Trump’s trade war, which has left investors feeling about as cheerful as a wet weekend in Bognor Regis.

With bullish momentum as robust as a jellyfish in a boxing match, Pi Network finds itself in a precarious position, vulnerable to further losses. This analysis aims to explain why, and perhaps offer a few chuckles along the way.

PI’s Decline: A Bearish Ballet of Financial Folly

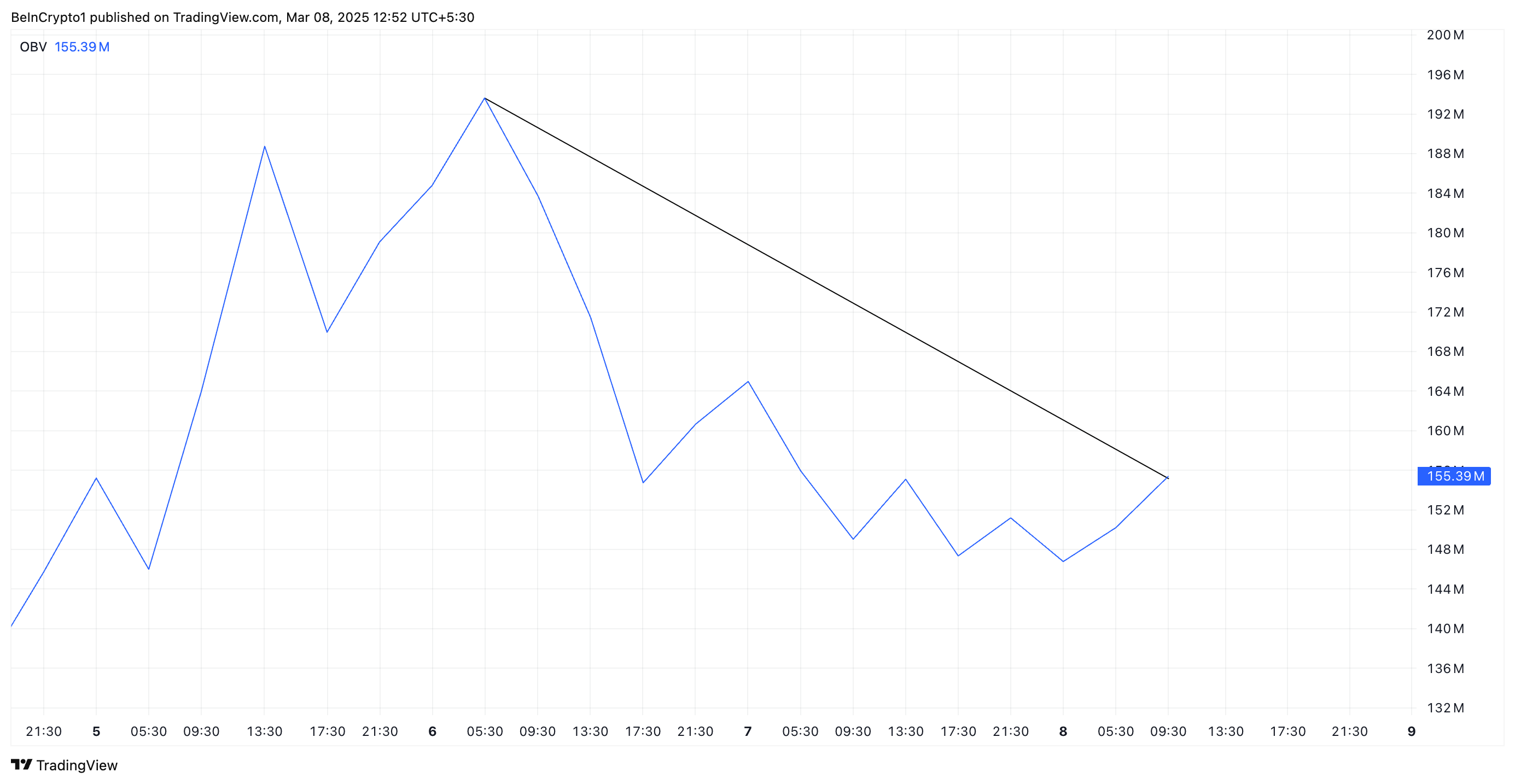

PI’s on-balance volume (OBV) on a four-hour chart has taken a nosedive, confirming the surge in bearish pressure. Since March 6, this momentum indicator, which tracks the flow of money into and out of an asset, has trended downward, falling a rather dramatic 20%.

When an asset’s OBV falls, it’s a bit like watching a sinking ship where the lifeboats are being filled faster than the rats can abandon ship. More volume is associated with price declines than price increases, suggesting weakening momentum in the PI market and hinting at the likelihood of a potential further downside as traders continue to offload their positions.

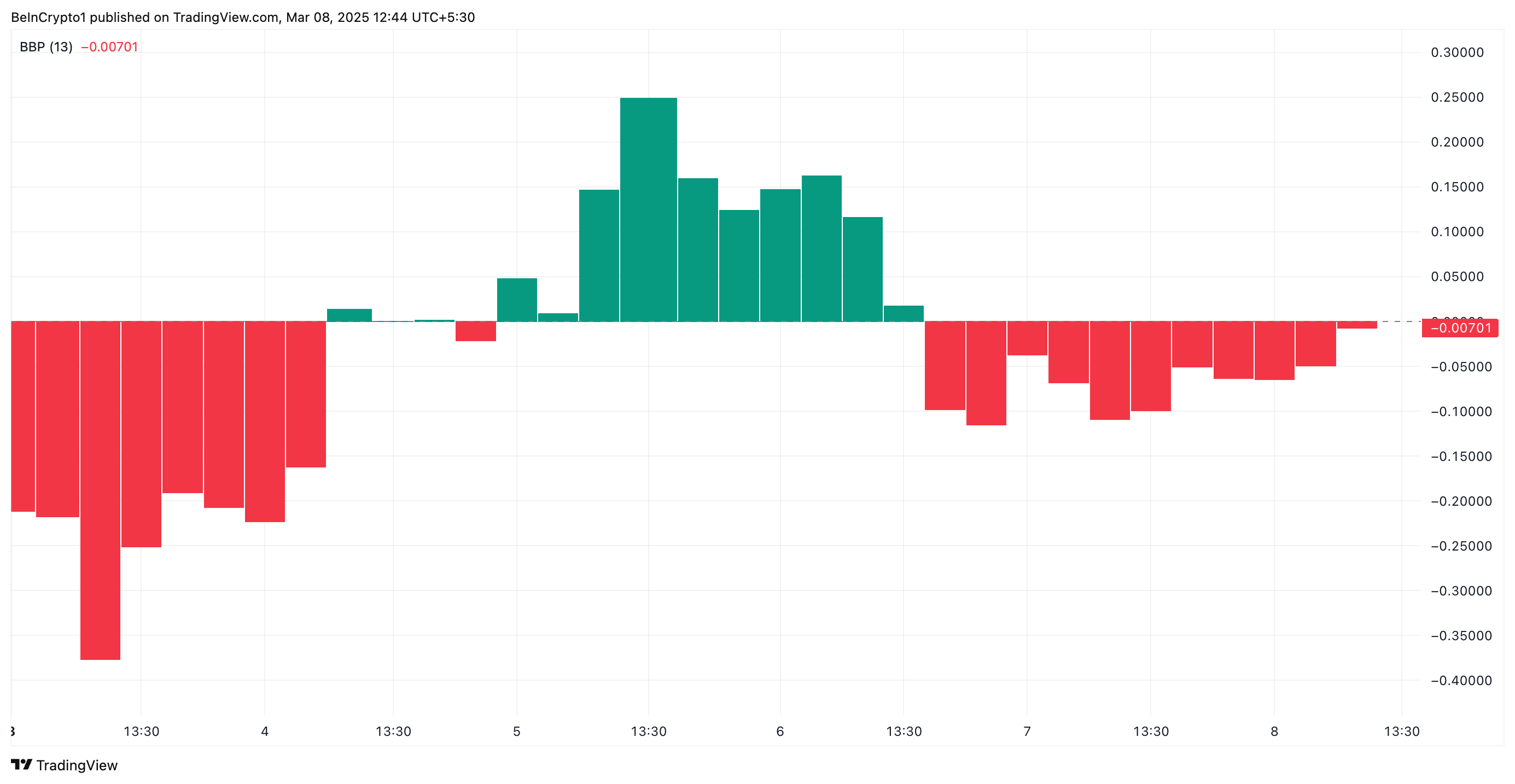

Further, readings from its Elder-Ray Index confirm this bearish outlook. At press time, the indicator posts a negative value of -0.0070, reflecting the high selloffs among market participants. It’s like a game of musical chairs where everyone has decided to sit down at once.

An asset’s Elder-Ray Index compares the strength of its bulls and bears in the market. When the index declines like this, it signals increasing bearish strength, suggesting that sellers are gaining control and downward pressure is intensifying. It’s a bit like a tug-of-war where the bears have suddenly discovered they’re much stronger than they thought.

Bulls vs. Bears: PI’s Critical Battle Between $1.62 and $2.12

Pi Network currently trades at $1.80, resting above the support formed at $1.62. If selloffs strengthen, the bulls may be unable to defend this level. In this scenario, the altcoin’s value could plummet to $1.62, leaving investors feeling as cheerful as a cat in a dog show.

On the other hand, a resurgence in PI demand could invalidate this bearish projection. If the altcoin sees a rise in new demand, its price could rocket above $2 to trade at $2.12. A successful breach of this resistance could propel PI price to revisit its all-time high of $3, much to the delight of those who invested while everyone else was busy watching paint dry.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- DODO PREDICTION. DODO cryptocurrency

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2025-03-08 13:33