2025 finds the crypto community brimming with excitement, as significant coins such as Bitcoin and Solana reach unprecedented peak values. The long-awaited surge past $100,000 for Bitcoin has stoked optimism, paving the way for a potentially prosperous year. Once considered a marginal sector, cryptocurrency is now drawing interest from political figures, governments, and international financial bodies.

Phemex, a prominent cryptocurrency exchange recognized for its expansive trading environment, creative strategies, strong security systems, and user-friendly interface, has unveiled their forecasts for the upcoming years. Emphasizing sectors with the most promise, these projections delve into the factors and stories that might shape the crypto market by 2025.

Phemex is a top-tier cryptocurrency exchange, offering both spot and derivatives trading. It provides over 350 contract trading pairs with up to 100x leverage, all utilizing Hedge Mode, and more than 400 popular spot trading pairs for users of all experience levels. This user-friendly and secure platform makes it simple to instantly buy, sell, or trade cryptocurrencies. Phemex stands out due to its implementation of Merkle-Tree Proof-of-Reserves, allowing users to confirm on the blockchain that their funds are fully collateralized. As the first exchange to publish both proof-of-reserves and proof-of-solvency using a unique self-verifying method, Phemex is recognized as one of the most reliable crypto exchanges in the market.

Intersection of Blockchain with Real World Assets (RWA)

Based on a recent U.S. Treasury report, “tokenization could make it possible for traditional financial assets to access the advantages of flexible, compatible blockchain technology on a broader scale.” Essentially, this means that even the U.S. government recognizes the potential of integrating real-world assets with emerging technologies, given that major players like Blackrock are already part of this movement.

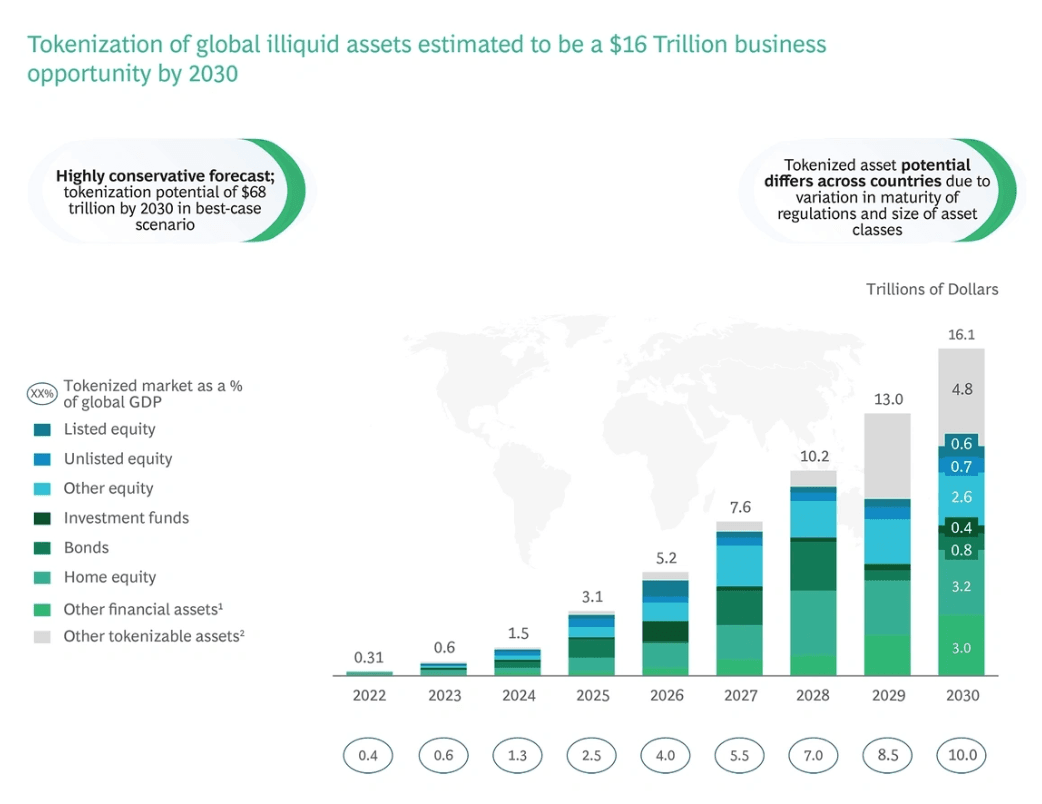

Transforming a tangible asset into a digital form on the blockchain is known as tokenization. This process allows for a wide range of items including real estate, artwork, bonds, and intellectual property to be digitized. Tokenization enhances traceability, enables fractional ownership, and boosts liquidity in illiquid assets like high-end art by making them easier to trade.

In the year 2024, BlackRock debuted its initial fund based on tokenized assets, dubbed BUIDL, which operates on the Ethereum blockchain. Within its inaugural week, it successfully amassed a capital of $240 million. Meanwhile, Citigroup is delving into the realm of tokenizing financial assets through a private blockchain system. The bank asserts that this method will empower clients to transfer assets around the clock, drastically cutting down processing times from days to just minutes.

The prediction indicates that there’s growing enthusiasm for asset tokenization, and it seems this market, currently valued at approximately 2.81 billion dollars in 2023, is expected to expand significantly, potentially reaching around 9.82 billion dollars by 2030. This growth could be achieved with an impressive compound annual rate of nearly 20%.

Intersection of AI and Crypto for DePIN

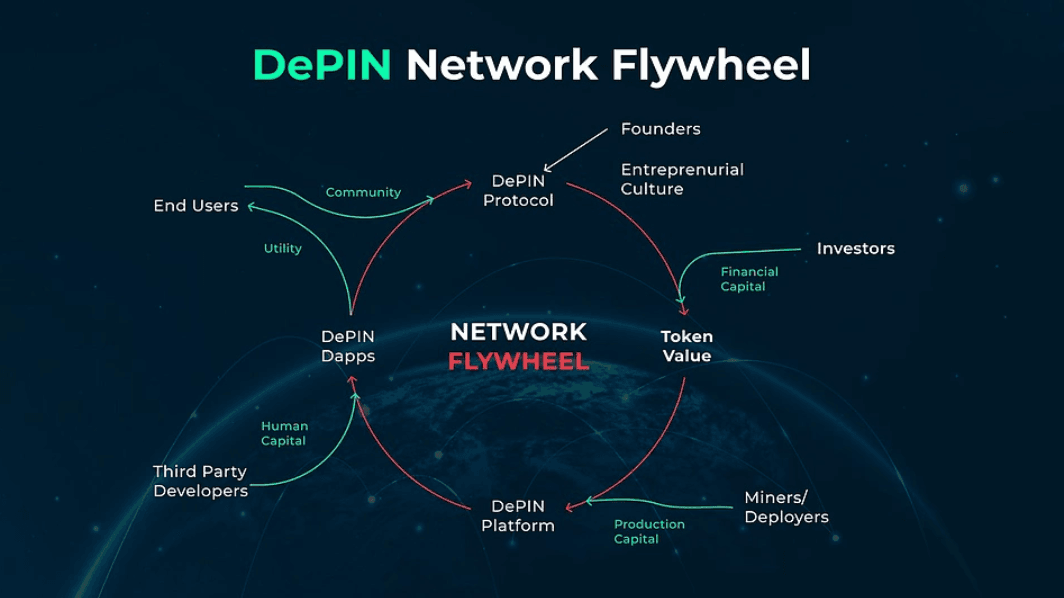

AI is progressively transitioning from being just a tool into a primary catalyst for change in the blockchain sector, taking on roles as self-governing entities. Examples such as Terminal of Truth and AIXBT from ai16z illustrate this evolution, leveraging cryptocurrency to facilitate transactions and opening up a vast array of creative content possibilities. The scope of their potential goes far beyond these uses, as AI agents can act not only on human commands but also independently within the network.

By handling crypto wallets, safeguarding private keys, and managing digital assets, these AI protocols are blazing trails towards unprecedented applications. For example, they could regulate and authenticate nodes in decentralized physical infrastructure networks (DePINs), like supervising distributed energy systems. Furthermore, they are expected to assume crucial positions within gaming environments. In the future, a blockchain network run entirely by AI might materialize, rendering human intervention unnecessary.

The idea of a Decentralized Autonomous Chatbot (DAC) is increasingly popular. These chatbots could attract followers by generating interesting or educational content, all while functioning on decentralized social media networks.

Decentralized Autonomous Corporations (DACs) are revolutionary innovations that allow individuals to earn income from their audience across multiple platforms and independently manage cryptocurrencies. Operating on a decentralized, permissionless network of nodes and governed by a consensus protocol, this technology has the capability to create the world’s first fully autonomous billion-dollar entity.

In the future, as AI-generated deepfakes become more prevalent, there’s an increasing demand for a concept called “proof of identity” or “proof of authenticity.” This could be a developing feature in 2025, since verifying identity makes it harder and costlier for AI to imitate humans or jeopardize network security. Unlike humans who can easily acquire unique identifiers at no cost, it becomes much more challenging and expensive for AI systems to do the same.

Greater Adoption by Enterprise and Governments

In 2025, it’s expected that Decentralized Finance (DeFi) and utility projects will see a resurgence in activity. This revival is partially attributed to the new Trump administration, as both President Trump and Vice President J.D. Vance have shown support for utility crypto tokens in the past. Their backing suggests that the sector might encounter supportive policies going forward.

Stablecoins have successfully adapted to the needs of the cryptocurrency world by providing a swift and affordable method for transferring digital U.S. dollars around the globe. Unlike conventional payment methods, stablecoins facilitate easy transactions without necessitating intermediaries, minimum account balances, or exclusive software development kits (SDKs).

By 2025, there’s a good chance we’ll see a significant increase in the use of stablecoins, particularly among small and medium-sized businesses (SMBs) like restaurants, cafes, and corner stores. These businesses might start moving away from credit cards first due to their appeal. Larger enterprises are likely to follow suit since avoiding credit card companies could potentially add about 2% directly to their profit margins. This trend of experimentation with stablecoins in business transactions is already gaining momentum, and interest from the enterprise sector is on the rise.

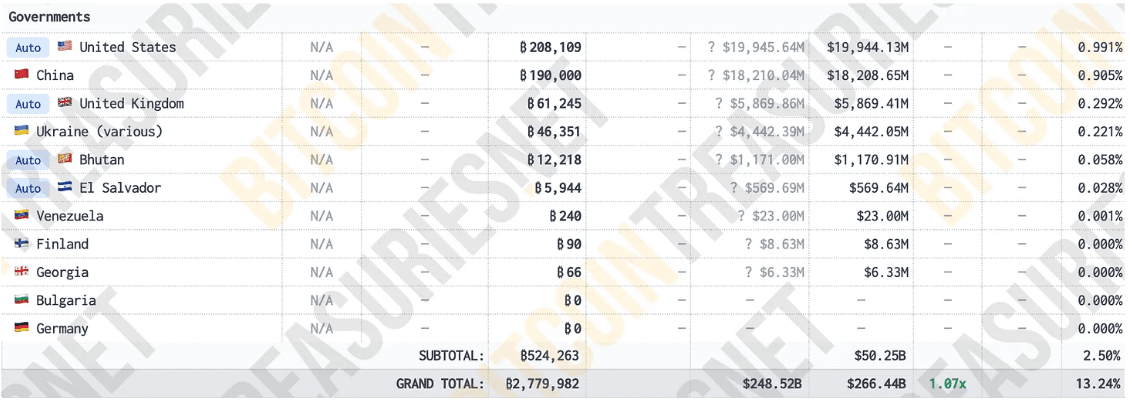

Governments that favor innovation could potentially start exploring the use of blockchain technology for their government bonds. The United Kingdom is taking early steps in this direction, as its Financial Conduct Authority (FCA) is currently experimenting with digital securities within a regulatory test environment.

Furthermore, it has been indicated that HM Treasury and the Exchequer are considering the creation of digital financial tools, such as government-backed digital bonds or “digital gilts.” These endeavors demonstrate an increasing understanding of blockchain’s ability to simplify financial structures and enhance transparency.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

2025-01-08 15:06