So it goes. Five years ago, the world was in the throes of a great unraveling, what they called the COVID-19 pandemic. In that chaos, Pfizer (PFE) found itself at the center of humanity’s greatest hope-a vaccine. With BioNTech as its partner, Pfizer managed to get FDA approval on December 11, 2020. And just three days later, shots were going into arms. Humanity breathed a collective sigh of relief.

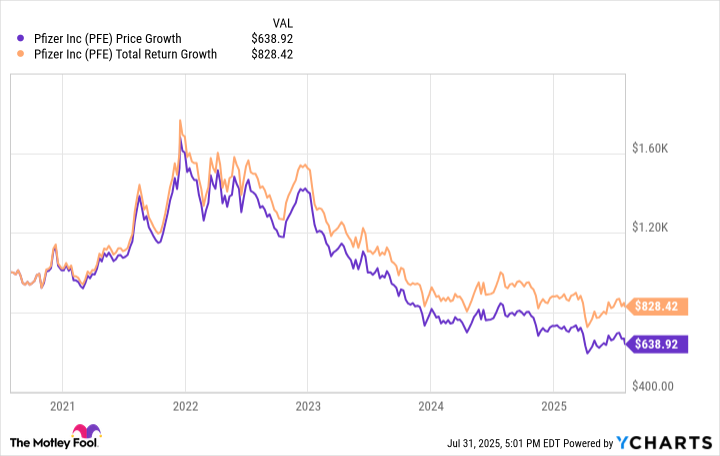

But here’s the thing about hope: it doesn’t always pay dividends. If you’d taken $1,000 and thrown it at Pfizer’s stock back in August 2020, when everyone was desperate for good news, your investment would now be worth around $638. That’s right-less than what you started with. Sure, Pfizer’s dividend offered some comfort, nudging your total up to $828. But let’s face it: that’s still not something you’d write home about.

Why Has Pfizer’s Stock Fallen Flat?

Here’s the cruel joke of capitalism: once the crisis fades, so does the demand. Pfizer’s stock peaked in late 2021, riding high on the wave of vaccines and treatments. But then the tide went out. People stopped lining up for boosters like they used to. Drugs like Ibrance for breast cancer and Eliquis for blood clots are staring down the barrel of patent expirations. And Pfizer’s pipeline? Let’s just say it hasn’t exactly set the world on fire.

But here’s where the macro strategist in me steps in. You see, Pfizer is trading at 7.7 times forward earnings. In the grand scheme of things, that’s cheap. Cheap like a used car with a sputtering engine but good bones. I’m not saying Pfizer will turn things around overnight-nobody can predict that sort of thing-but there’s more upside here than downside. And that dividend yield? It’s sitting pretty at over 7.3%, which is more than five times the S&P 500 average. For income investors, that’s no small potatoes.

So yes, Pfizer has struggled. Yes, the future looks uncertain. But life, as they say, goes on. And sometimes, it even surprises us. So if you’re thinking about Pfizer, don’t think of it as a gamble. Think of it as a bet on human resilience. Because in the end, isn’t that what investing really is? 🌱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-06 15:11