In a world that cannot seem to get enough of cheap thrills and fleeting satisfactions, there lurks a paradox of enduring value. The high-stakes drama of the stock market-always ready to provide the next thrill-seeker with an adrenaline rush-often casts those with a more tempered view in the shadows. Yet, should one care to peer through that darkness, a certain titan of industry persists, as it always has, offering a steady hand amid the fickle squabbles of the market. If you find yourself thirsty for dividends, then perhaps it’s time to take a closer look at PepsiCo (PEP), whose share price may not be the toast of the day but whose dividends continue to serve their purpose.

True, there is much about PepsiCo that invites derision, and no doubt some investors will find solace in the notion that they have better things to do with their time. But for those whose financial appetites are whetted by the promise of regular payouts, a deeper contemplation is warranted.

The stock has had its fair share of bumps, true enough. Yet, if history has taught us anything, it is that such bumps are often temporary-a passing storm in a long, otherwise temperate year.

The Business, For All Its Flaws, Remains Remarkably Resilient

PepsiCo’s operation is a sprawling monument to the charms of the modern industrial world. Its beverage division, led by the iconic Pepsi brand, stands as a force to be reckoned with. But the company is far more than that-its dominance in the salty snack category, via Frito-Lay, and in the packaged food sector, through Quaker Oats, cements its place as one of the most diversified food companies you can purchase.

And yet, no matter how impeccable its infrastructure, even the finest institutions stumble from time to time. At present, PepsiCo is but a shadow of its former self, lagging behind its fiercest competitor, Coca-Cola, in terms of organic sales growth. The 2.1% increase PepsiCo posted in the second quarter of 2025 pales in comparison to Coca-Cola’s more buoyant 5%.

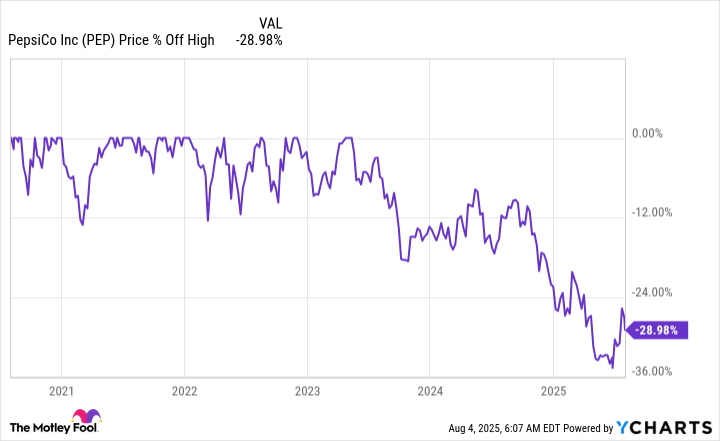

Wall Street, ever the fickle mistress, has responded to these disappointing figures with typical vigor, pushing PepsiCo’s stock price downward. Even with a recent rally, the stock is languishing some 25% below its 2023 highs. In the cruel calculus of the market, this has led to a dividend yield that now hovers at a historically high 4%-an irresistible draw for those whose gaze is fixed on the long term.

Is This a Case of Misfortune or the Opportunity of a Lifetime?

The sudden drop in PepsiCo’s stock price should not be viewed with blind horror but rather with a measured sense of curiosity. Yes, the company currently sits in the murky waters of financial underperformance, but for the discerning investor who is not blinded by the now, this could present an alluring entry point.

Indeed, PepsiCo’s current valuation is suggestive of an opportunity to purchase at a bargain, a rare find in a market addicted to the cult of the immediate. The company’s price-to-sales, price-to-earnings, and price-to-book ratios all languish below their five-year averages. To the casual observer, this may appear as a sign of impending doom. To the seasoned trader, it is nothing more than a temporary blip in the long and storied history of PepsiCo.

It is no accident that the company has earned the distinction of being a Dividend King-its track record of increasing dividends year after year for over five decades speaks volumes about its capacity to weather such storms. This is not a company that wilts under pressure; rather, it adapts, learns, and thrives in the long run.

Moreover, in the face of these difficult times, PepsiCo’s management has chosen to lean into the discomfort, increasing the dividend by 5% in June 2025. Such an increase, particularly in light of the pessimism that has gripped investors, speaks volumes about the internal optimism the company’s leadership holds for the future.

For Long-Term Dividend Seekers, Patience is a Virtue

The best time to invest, as any seasoned trader will tell you, is often when others are running in the opposite direction. PepsiCo, a company renowned for its ability to emerge stronger from difficult periods, has once again found itself in such a position. The recent acquisitions of a Mexican-American food company and a probiotic beverage brand signal that PepsiCo is not resting on its laurels but rather modernizing its portfolio for the future.

It is always difficult to buy when the crowd is selling, but history has shown that PepsiCo’s resilience is not a mere accident. The company has time and time again demonstrated its ability to muddle through dark periods and return to form. For those who are in it for the long haul, PepsiCo remains a consistent and reliable source of dividends-an anchor amidst the ever-changing tides of the market.

So, the next time you find yourself staring at a dividend yield that seems too good to be true, take a moment to consider what’s at stake. In the world of investment, sometimes the most prudent course is to hold your ground when others flee. PepsiCo’s track record is not one to dismiss lightly, and those with the foresight to see beyond the current turmoil may find themselves sipping from the cup of long-term gains. 🍷

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-11 01:27